Vanadi Espresso’s shareholders authorised its Bitcoin accumulation plan, opening with a $6.8 million buy of 54 BTC. It plans to take a position $1.17 billion in whole, which might make it Spain’s largest Bitcoin holder.

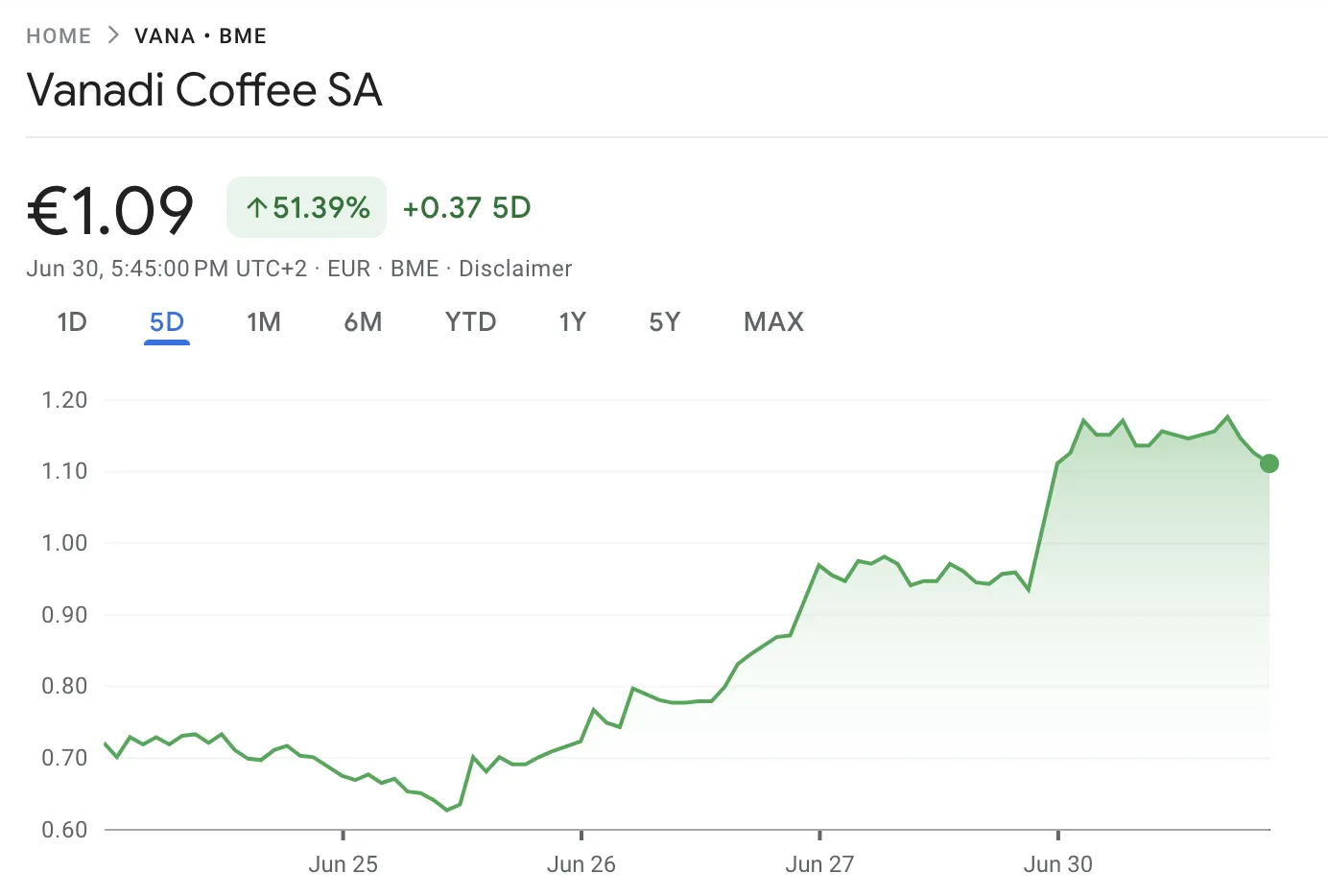

To date, Vanadi’s plan appears to be working, with spectacular inventory value good points in the previous couple of days. Nonetheless, economists warn of a company Bitcoin bubble that the agency may not have the ability to face up to.

Vanadi Commits to Bitcoin

Firms all over the world are turning to the Bitcoin treasury technique, following in MicroStrategy’s footsteps to make radical enterprise pivots.

Earlier this month, Vanadi Espresso did the identical, proposing to spend over $1 billion on Bitcoin to switch a flailing core enterprise. At a board assembly yesterday, shareholders unanimously authorised the proposal:

Since then, issues have been transferring fairly quick. Vanadi has already bought a major amount of Bitcoin, additional exhibiting its dedication to finishing up the plan.

Its inventory valuation rose round 20% at present, constructing on a number of days of momentum. Hype constructed because the board assembly approached, persevering with all through its affirmative determination and these early purchases.

At first look, this technique is paying off rapid dividends. If Vanadi manages to spend $1.17 on BTC acquisitions, it’ll develop into the largest Bitcoin holder in Spain.

Final 12 months, the agency misplaced $3.7 million, elevating questions on its sustainability within the espresso enterprise. Utilizing its assets for a Web3 pivot may very well be its finest probability of survival.

Nonetheless, this may not be a sound funding, at the least at scale. Now that so many firms are shopping for Bitcoin, economists fear about an impending bubble.

If main holders liquidate their holdings, it may ship a cascade of volatility by the worldwide markets. Since Vanadi’s core enterprise is underwater, it’s issuing debt to purchase Bitcoin, making this the core focus.

MicroStrategy, the “business chief” for company Bitcoin holdings, already holds billions in unrealized losses. Rumors of a pressured liquidation have dogged the corporate, however Michael Saylor has stored recent funding flowing.

Not everybody can handle this feat. If Vanadi will get squeezed by crypto volatility, a number of Bitcoin liquidations may spin uncontrolled.

All that’s to say, there are lots of combined indicators out there. Vanadi is committing onerous to Bitcoin, and it’s already reaping vital rewards.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.