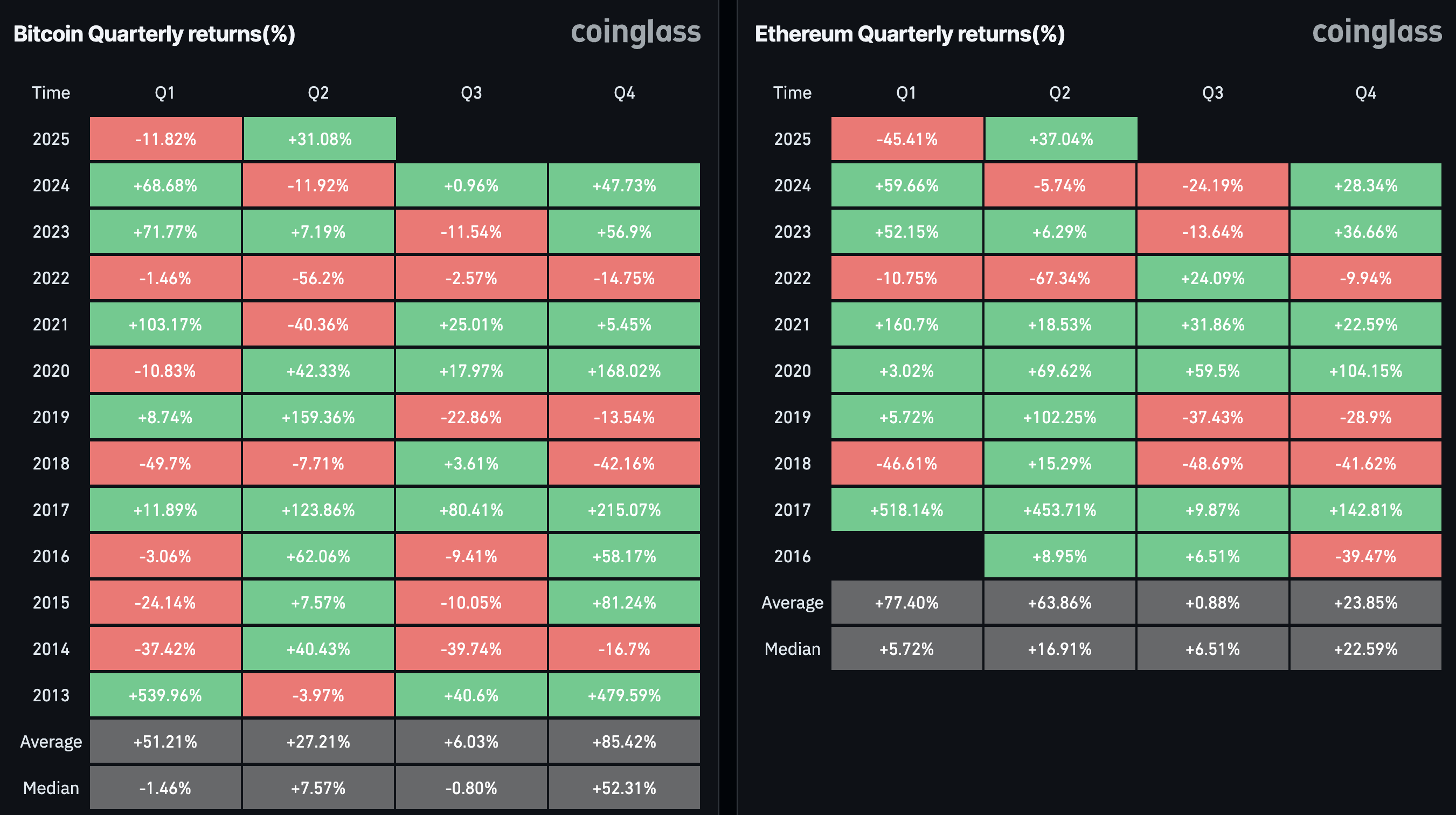

After a unstable begin to the yr, Bitcoin seems to be regaining its footing, surging 31.41% in Q2 after an 11.82% drop in Q1 2025.

This rebound has reignited a urgent query for traders: Is Bitcoin’s bullish cycle nonetheless intact, or are we nearing the tip of the road?

Stablecoins Shaping a New Bullish Cycle

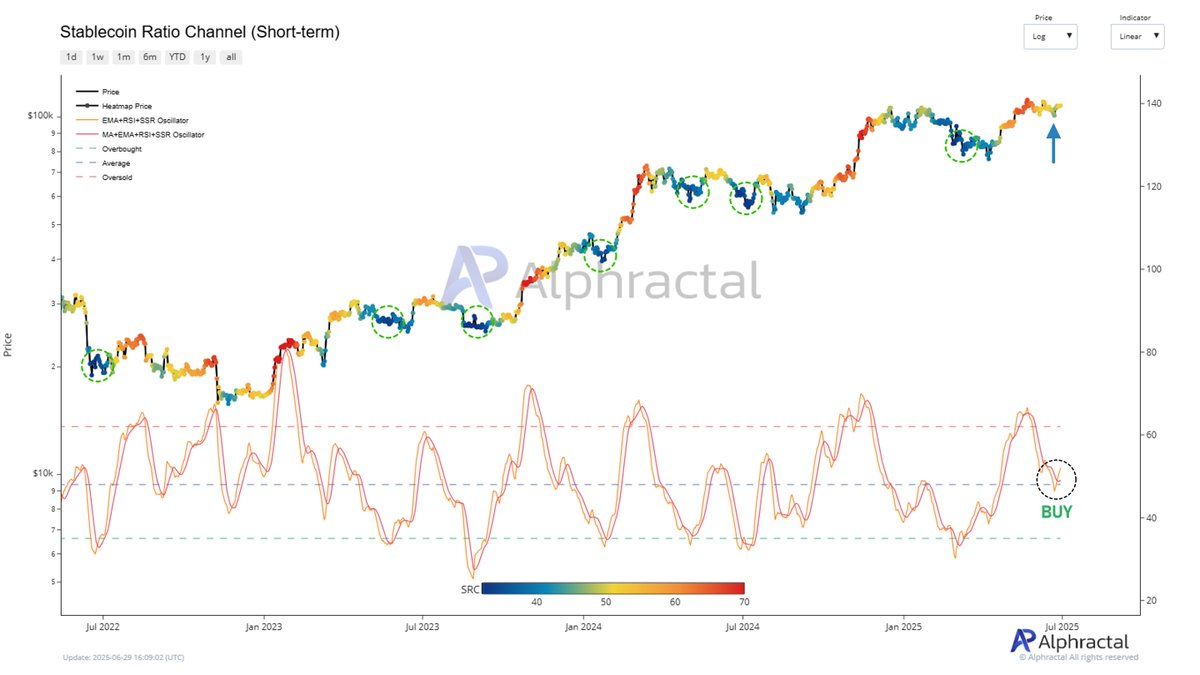

In a current put up on the X platform, Alphractal’s Founder and CEO, Joao Wedson, highlighted three key stablecoin metrics: the Stablecoin Provide Ratio (SSR) Oscillator, the Stablecoin Ratio Channel Lengthy-Time period View, and the Stablecoin Ratio Channel Quick-Time period View. Wedson says these metrics sign optimism, presenting a promising funding alternative.

“None of those metrics at the moment point out overbought circumstances, suggesting that Bitcoin (and different cryptos) might proceed rising for just a few extra months” Wedson shared.

First, the on-chain Stablecoin Provide Ratio (SSR) Oscillator serves as a “compass,” measuring Bitcoin’s market capitalization relative to the entire stablecoin market cap, smoothed by a 200-day transferring common and customary deviation.

This indicator identifies potential shopping for alternatives when Bitcoin is undervalued relative to stablecoin liquidity or warns of overheating markets. Latest Alphractal information exhibits the SSR Oscillator has not but reached a promote sign, suggesting Bitcoin nonetheless has room for progress.

Moreover, the Stablecoin Ratio Channel supplies deeper evaluation in each long-term and short-term views.

The long-term view helps traders determine shopping for alternatives when Bitcoin is fairly priced relative to stablecoin liquidity whereas warning of overvaluation.

In the meantime, with greater oscillation frequency, the short-term view fits swing buying and selling methods, providing momentum alerts for short-term traits. Alphractal’s charts present current “purchase” alerts, notably since early 2025, reinforcing confidence in an ongoing bullish cycle.

In keeping with Coinglass, Bitcoin’s 31.08% restoration in Q2 2025, mixed with Ethereum’s surge (37.04%), displays the power of the crypto ecosystem.

Nevertheless, dangers stay. Stablecoin reliance may very well be impacted by world regulatory volatility, particularly as international locations just like the US and EU tighten oversight. Nonetheless, the outlook stays optimistic with low rates of interest. The US Treasury has additionally predicted that the stablecoin market might attain $2 trillion.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.