The Bitcoin market is getting into a fancy part marked by rising realized earnings, diminished whale balances, and traditionally extended sideways value motion.

Whereas institutional curiosity stays regular, the community is exhibiting indicators of redistribution and exhaustion, elevating questions on what may set off the following breakout.

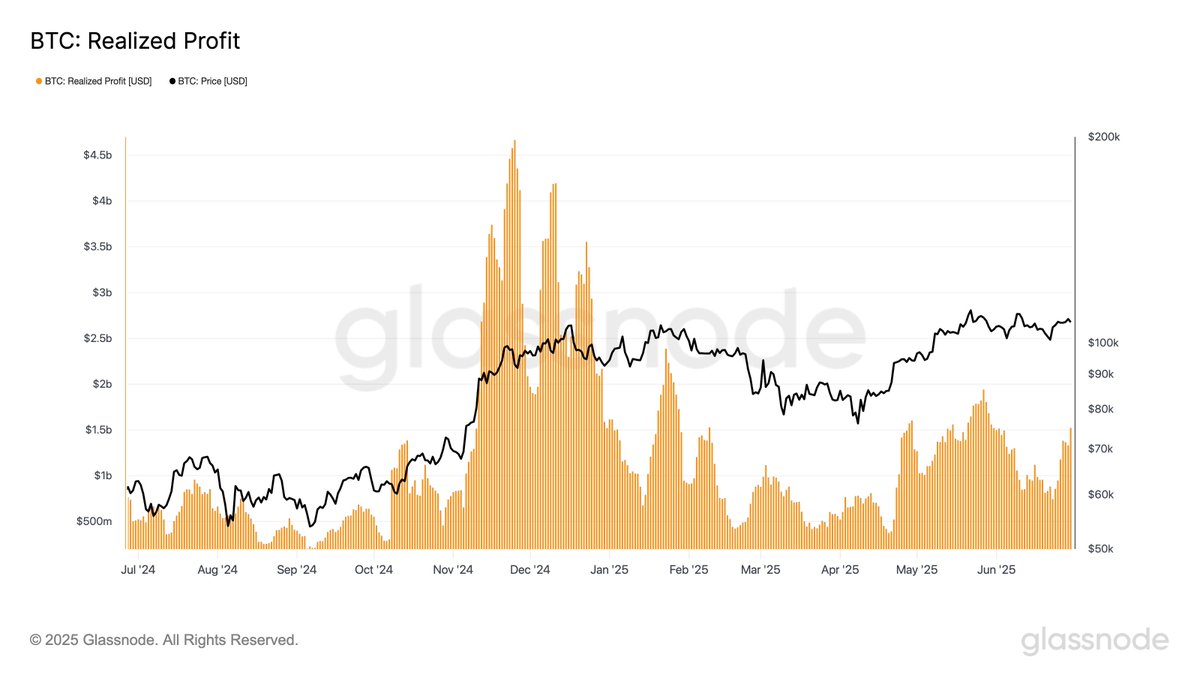

Revenue-Taking Intensifies, However Nonetheless Beneath Earlier Cycle Peaks

In line with on-chain analytics agency Glassnode, profit-taking exercise is rising as soon as once more. On June 30, realized earnings throughout the Bitcoin community surged to $2.46 billion, whereas the 7-day easy shifting common (SMA) rose to $1.52 billion. That determine considerably exceeds the 2025 YTD common of $1.14 billion, signaling rising promote strain.

Nonetheless, Glassnode notes that these revenue ranges stay nicely under the $4–5 billion peaks seen within the November–December 2024 cycle prime. Whereas the market is heating up, it hasn’t but reached the degrees that usually precede main pattern reversals.

Whale Provide Declines Regardless of Institutional Inflows

In the meantime, new information from Sentora (previously IntoTheBlock) reveals that wallets holding over 1,000 BTC have been steadily lowering their balances, at the same time as institutional capital continues flowing into Bitcoin.

Reasonably than decoding this as weak spot, analysts view it as an indication of market maturation. Older “whale” cash are being redistributed throughout smaller holders and newer entrants, reflecting broader adoption and lowering centralized provide threat. This shift, Sentora argues, might strengthen Bitcoin’s long-term decentralization and liquidity profile.

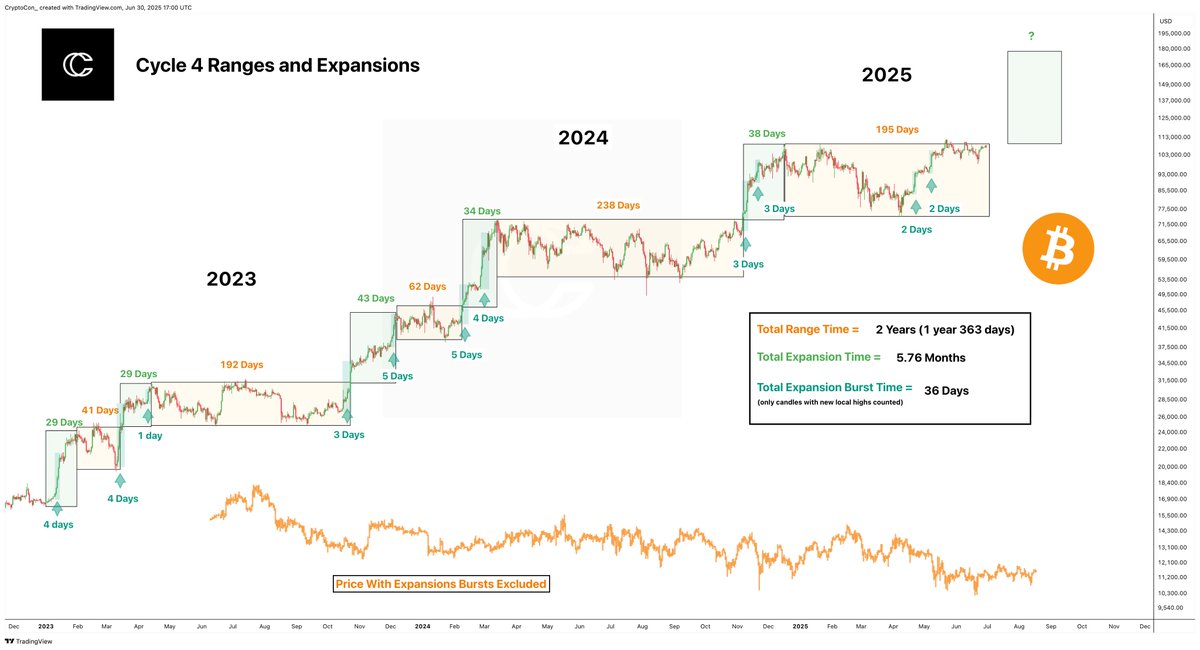

Sideways Motion Hits 195 Days: The Slowest Cycle But?

Including to the stagnation narrative, CryptoCon studies that Bitcoin has now spent 195 consecutive days in sideways value motion, courting again to December 18, 2024. Whereas quick bursts of upside have occurred—solely 36 days in complete—practically 2 full years have been dominated by grinding, non-trending habits.

“Take away the enlargement bursts,” CryptoCon writes, “and also you’re left with a brutal sideways cycle and new lows for your complete part.”

Their cycle chart reveals solely temporary enlargement rallies throughout 2023 to 2025, with the longest stretches of consolidation in Bitcoin’s historical past. The present cycle is now the slowest on file, although it stays structurally intact.

Conclusion

Bitcoin’s present part displays a maturing but indecisive market. Rising profit-taking, whale coin redistribution, and record-long sideways motion counsel a buildup slightly than a breakdown. Whereas volatility stays subdued, structural shifts in possession and regular institutional inflows could also be laying the groundwork for the following main transfer. Till a transparent catalyst emerges, the market seems poised in quiet anticipation of a breakout—or a reset.

If historic patterns maintain, this prolonged consolidation might act as the muse for a future breakout. However for now, Bitcoin seems caught between exhausted bullish momentum and powerful fingers ready for the following macro catalyst.