A brand new CryptoQuant report highlights a rising divergence between long-term Ethereum holders and short-term Bitcoin consumers, with vital accumulation habits unfolding in each markets amid growing political and financial rigidity within the U.S.

In line with on-chain knowledge, Ethereum has seen a notable uptick in long-term accumulation exercise all through June. Throughout a interval of worth consolidation, vital shopping for stress emerged from addresses labeled as long-term holders.

The chart shared by CryptoQuant exhibits a transparent divergence: whereas ETH worth moved sideways, accumulation quantity spiked—usually a precursor to a breakout transfer.

This habits displays confidence from skilled traders who have a tendency to purchase during times of uncertainty, when retail exercise is subdued.

Bitcoin: Quick-Time period Holders Leap In

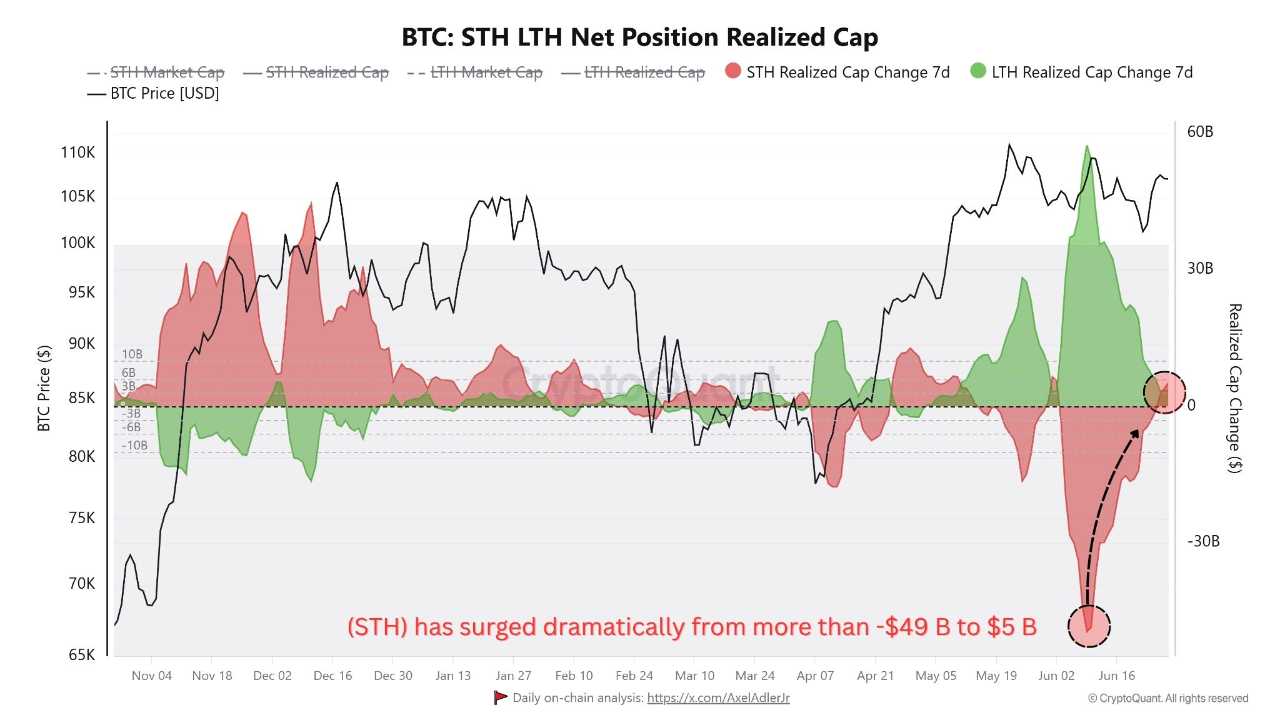

In the meantime, Bitcoin is seeing an reverse development. CryptoQuant’s Quick-Time period Holder (STH) Internet Place Realized Cap jumped from -$49 billion to over $5 billion in current days. This aggressive rise signifies a wave of latest entrants—primarily retail merchants—shopping for Bitcoin at elevated ranges.

Traditionally, such habits has signaled heightened market euphoria, and has usually coincided with native tops. The mix of surging short-term curiosity and long-term ETH accumulation suggests a doable market inflection level forward.

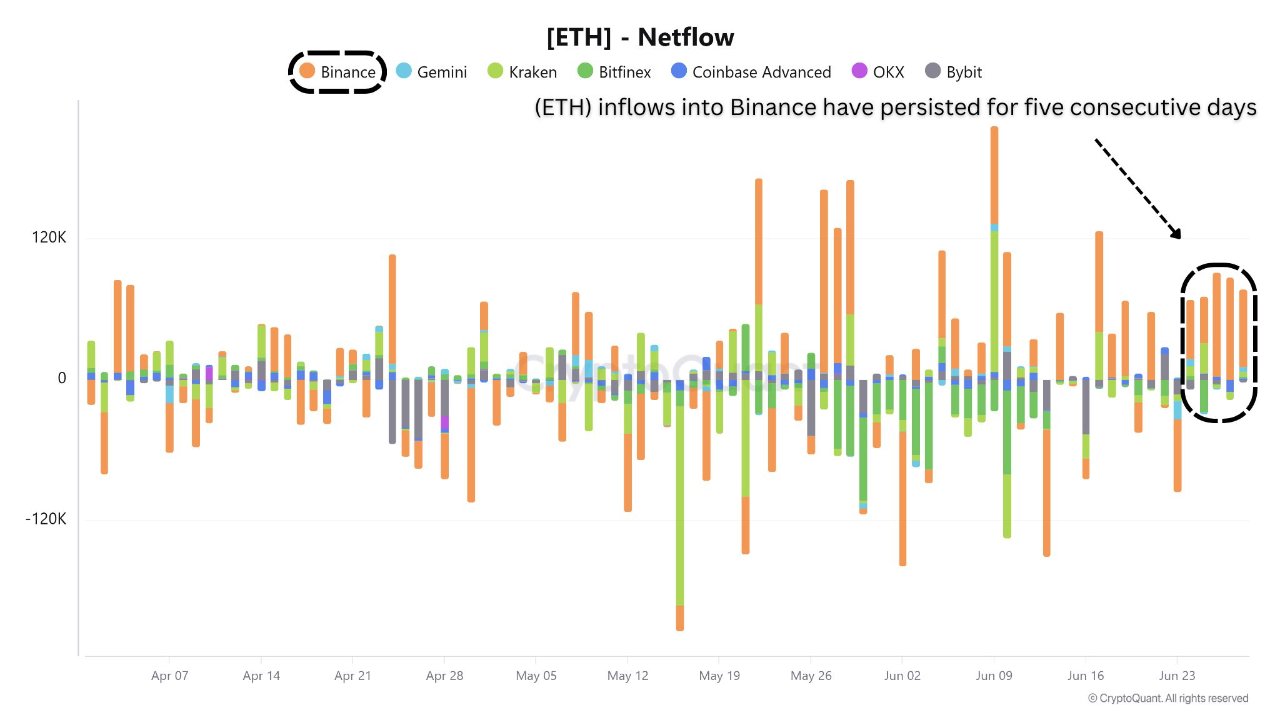

Binance ETH Inflows Increase Warning

Including to the complexity, Ethereum inflows to Binance have continued for 5 consecutive days, a sample that usually indicators rising sell-side stress. Merchants shifting ETH to centralized exchanges could also be getting ready to take income or rebalance portfolios—particularly after weeks of sideways worth motion.

U.S. Politics Might Drive Volatility Forward

The on-chain indicators emerge simply as political developments warmth up in america. President Trump just lately urged the Senate to move the “One Huge Stunning Invoice,” a sweeping package deal of tax cuts and army spending proposals. The laws consists of main tax reduction for seniors and staff and is positioned as a patriotic win forward of the July 4 vacation.

Nevertheless, Elon Musk voiced concern concerning the invoice’s long-term implications. He warned that unfunded tax cuts might swell the U.S. deficit and pose structural dangers to strategic industries. Economists echo related considerations, noting that with out matching spending cuts, the invoice might gas debt accumulation and future inflationary stress.

Market Outlook: Divergence Might Resolve Quickly

Within the face of political crosswinds and combined on-chain indicators, traders seem divided. Ethereum’s long-term holders are displaying conviction, whereas Bitcoin’s retail surge suggests concern of lacking out is returning. Coupled with inflows to Binance and macroeconomic uncertainty, the following few weeks might carry vital worth motion throughout crypto markets.