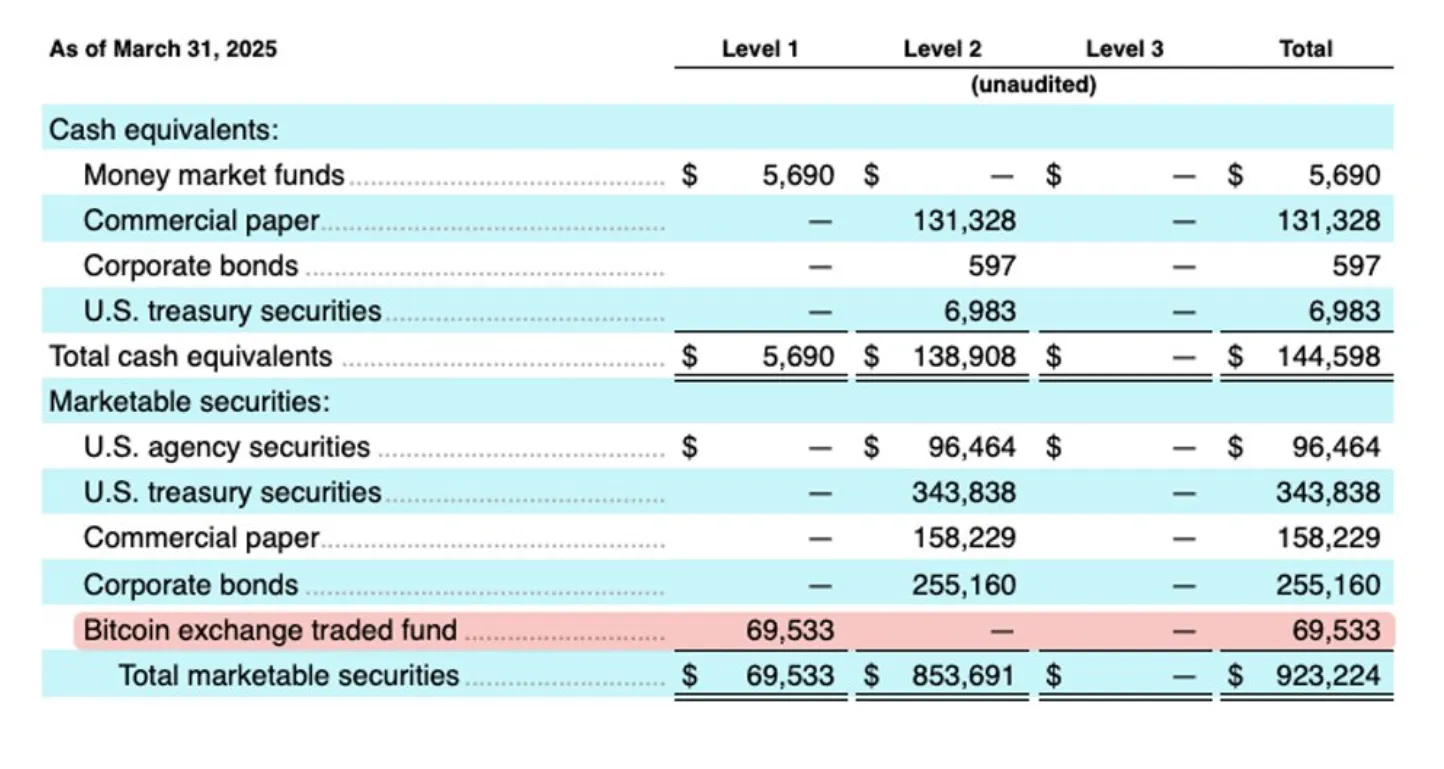

Figma has submitted paperwork to the SEC to go public. The San Francisco-based design software program agency disclosed it held $69.5 million in spot bitcoin ETFs as of March 31.

On Could 8, the corporate’s board accredited a $30 million bitcoin funding plan. As a part of this transfer, Figma bought an equal quantity of USDC for conversion into bitcoin.

One other Company Bitcoin Holder Desires to Go Public within the US

Based in 2016, Figma supplies browser-based instruments for real-time design collaboration. It’s extensively used throughout the tech business for interface and product design.

The corporate expanded quickly over the previous few years. In 2022, Adobe deliberate to amass Figma for $20 billion.

Nonetheless, regulators within the US and Europe opposed the deal, and each events dropped the plan in late 2023.

In the meantime, Figma’s public submitting provides to a broader development of crypto-aligned companies coming into public markets.

Corporations like Coinbase, Circle, and Robinhood have just lately outpaced most altcoins in year-to-date efficiency.

Final week, Coinbase inventory surged to an all-time excessive of $380, marking a 53% improve since January. Circle shares gained 10% as buyers proceed to guess on its development after its public itemizing.

MicroStrategy, recognized for its giant Bitcoin reserves, has additionally rallied. Its shares are up 25% this yr.

Analysts now estimate a 91% likelihood it may very well be added to the S&P 500, based mostly on projected earnings and Bitcoin’s help stage holding at $95,240.

Figma’s submitting displays a wider shift the place public firms see Bitcoin as a strategic reserve asset. As extra companies disclose crypto positions, buyers are responding with sturdy curiosity.

Total, it’s turning into an attention-grabbing development that US publicly listed firms are more and more shifting to spend money on Bitcoin and maintain it as a treasury asset.

Whereas there are considerations about centralization and huge company holders driving value actions, that is one other clear sign of institutional acceptance.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.