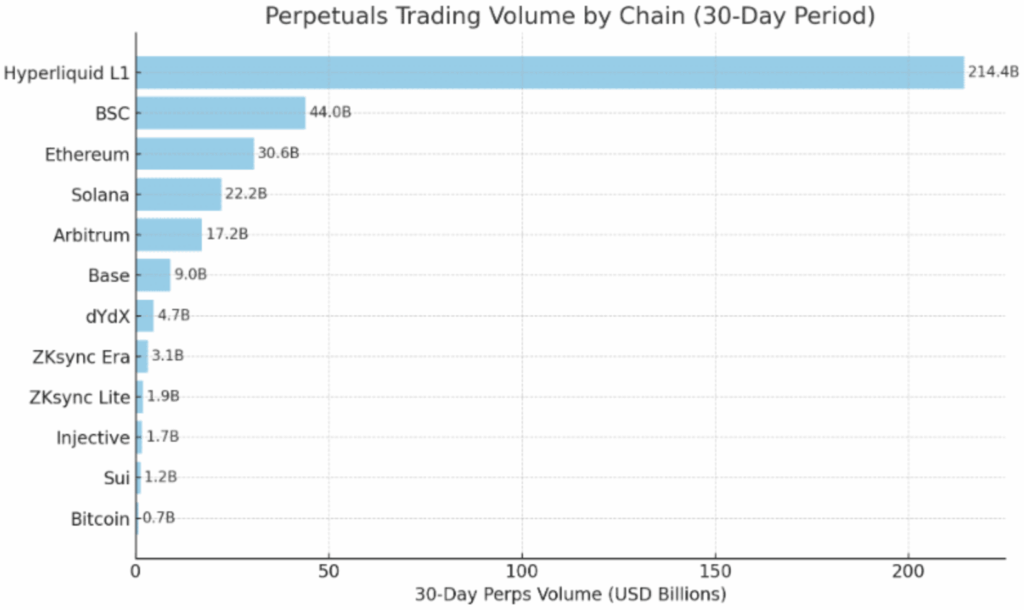

- Hyperliquid topped $214B in month-to-month quantity, outperforming BSC and Ethereum by a mile.

- Analysts imagine HYPE is undervalued, with potential to hit a $100B market cap.

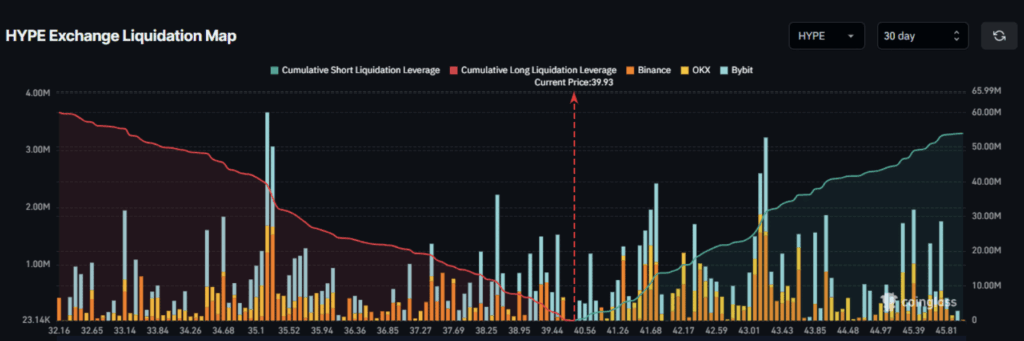

- Key value ranges to look at embrace $35, $43, and $45—with a $16.5M whale lengthy already in play.

Hyperliquid (HYPE) is crushing it proper now. Like, no exaggeration—it simply topped your complete on-chain perps marketplace for the month. In accordance with DeFiLlama, the platform racked up a wild $214 billion in buying and selling quantity over the past 30 days. To place that in perspective? BNB Good Chain (BSC) got here in second with $44B, and Ethereum… a distant third at $30B.

So yeah—HYPE did about 5x what BSC pulled, and 7x greater than ETH. That’s not a typo.

Revenues Up, Eyes On

HYPE’s not simply stacking quantity—it’s making financial institution. It now ranks seventh amongst high crypto apps and chains by income over the previous month. Charges collected? A clear $62.5 million. Cumulative rev? Over $300 million. That alone’s obtained buyers leaning in, curious if this may very well be the commerce of Q3.

Undervalued? Some Suppose So

Crypto analyst Ansem thinks HYPE’s present $10–$15 billion market cap doesn’t even scratch the floor. His take?

“Primary commerce in Q3 needs to be on the lookout for swing longs right here, will simply outperform Bitcoin & there’s nonetheless a ton of ppl sidelined on this commerce.”

He even threw out a $100B market cap goal. If that occurs, we’re speaking a $299 HYPE token. Lofty? Possibly. However the best way this factor’s shifting… who is aware of.

Syncracy Capital’s Ryan Watkins shares that sentiment. He identified HYPE’s deep moat in perps markets—a distinct segment that’s solely rising. And in contrast to different gamers, Hyperliquid skips the KYC. No hoops. No signups. Simply commerce. It’s significantly enticing in areas with, let’s say, much less regulatory wiggle room.

A Leap Buying and selling exec even referred to as it a “significant competitor to Binance.” That’s… saying one thing.

Dangers? Yeah, They’re There

Now, to be honest—it’s not all moon and sunshine. Platforms like Robinhood and Coinbase are rolling out their very own perp merchandise, this time with regulatory guardrails. So Hyperliquid’s no-KYC edge may get examined.

Additionally, value motion these days hasn’t been too wild. Finish-of-Q2 fatigue? May very well be. In accordance with CoinGlass’s 30-day liquidation heatmap, liquidity clusters are constructing at $35.1, $41.6, $43, and $45. Which means if there’s a sweep, value might tag $43–$45 earlier than cooling, or hit $35 first after which rebound.

Enjoyable twist: a whale simply dropped $16.5 million into a protracted place on HYPE. No strain.

Brief-Time period Magnet Zones

All the things now hinges on what Bitcoin does subsequent. However whether or not BTC pumps or chills, these liquidity swimming pools are key ranges to look at. On this market, liquidity is gravity. And HYPE? It’s hovering close to these magnets.