Bitcoin (BTC) confronted a difficult begin to July, influenced by broader macroeconomic pressures. But, the most important cryptocurrency has demonstrated exceptional resilience. Many market observers stay optimistic, with some speculating that Bitcoin may quickly attain a brand new all-time excessive.

Analysts cite a number of key elements fueling this optimism, together with rising market liquidity, a weakening greenback, historic developments, and optimistic technical indicators.

These Key Drivers Recommend a Potential Bitcoin Worth Surge

BeInCrypto reported yesterday that the renewed feud between Donald Trump and billionaire Elon Musk put downward stress on the broader market. Thus, Bitcoin additionally suffered.

Nevertheless, BTC managed to recuperate its beneficial properties. On the time of writing, it traded at $107,688, up 1.05% over the previous day.

With BTC simply 3.8% from its file excessive, analysts are rising more and more hopeful that this hole will shut quickly. Three key elements help this view.

The primary is the M2 cash provide. Based on the most recent information, the US M2 cash provide has reached a file excessive of $21.94 trillion.

Traditionally, Bitcoin has proven a powerful correlation with M2. If this sample continues, BTC could quickly observe go well with. Furthermore, rising M2 additionally alerts extra money in circulation, which might result in inflationary pressures and a weaker greenback.

In actual fact, current Barchart information exhibits that the US Greenback Index (DXY) has dropped to ranges not seen since February 2022.

“US Greenback Index DXY fell as little as 96.37, its lowest stage since February 2022,” the submit learn.

As soon as once more, Bitcoin has demonstrated an inverse relationship with the DXY. Buyers typically flip to Bitcoin as a hedge towards inflation because the greenback weakens. This pattern may drive costs larger.

Subsequent, along with the M2 cash provide, a number of main indices, together with NVIDIA, S&P 500, and the US100, have reached new all-time highs (ATH). However how does Bitcoin profit from this?

Over the previous 5 years, Bitcoin and the S&P 500 have proven a powerful correlation. Due to this fact, Bitcoin may additionally expertise optimistic momentum.

“Bitcoin is predicted to succeed in a brand new all-time excessive in July, as historical past exhibits sturdy returns for danger belongings this month. BTC has by no means dropped over 10% in July, and the S&P 500 has gained for 10 consecutive years,” an analyst said.

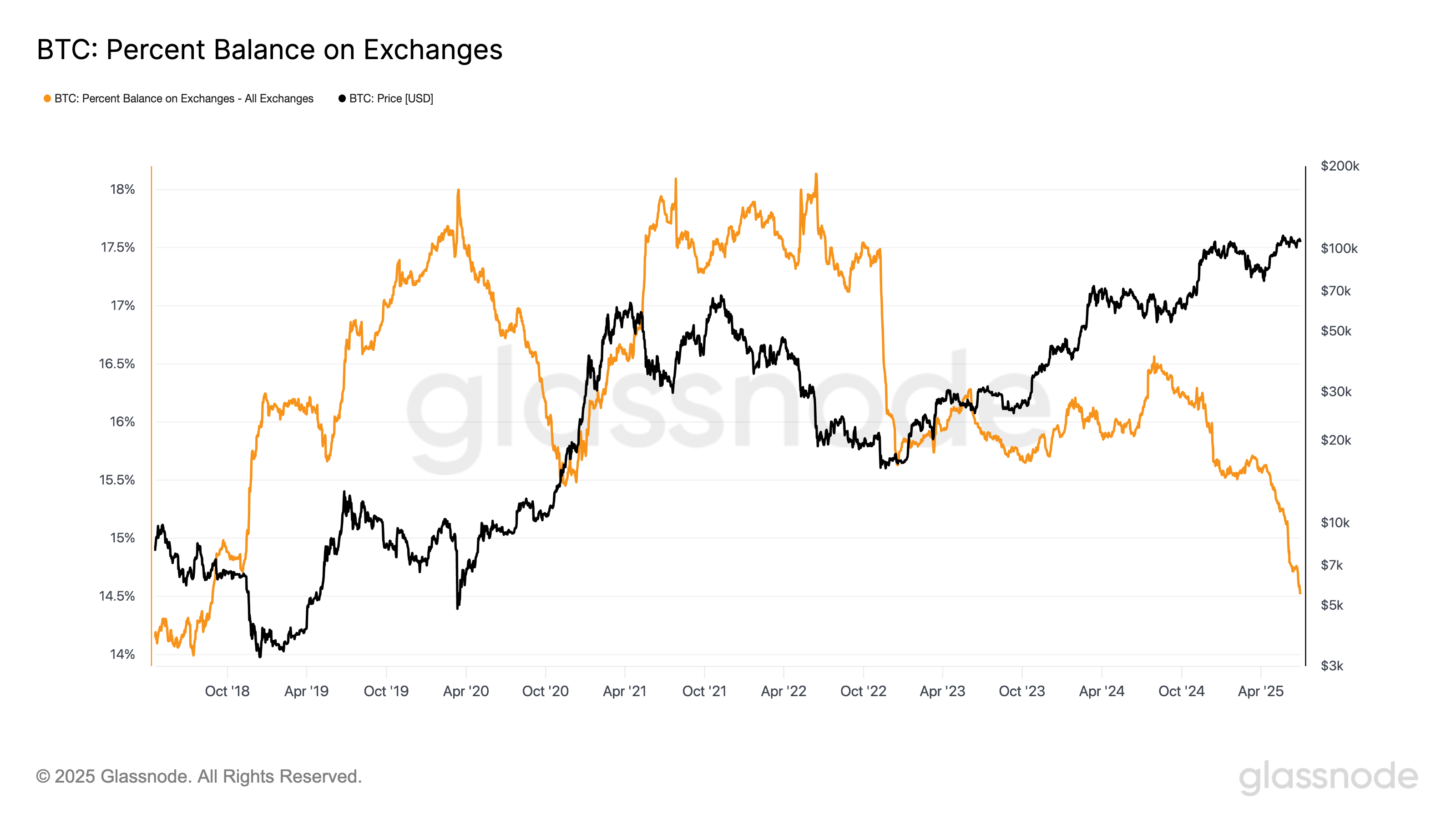

Lastly, a major discount in Bitcoin’s provide on exchanges has emerged as a bullish indicator. Based on information from Glassnode, Bitcoin’s % provide on exchanges has dropped to 14.5%, the bottom since August 2018.

This decline suggests lowered promoting stress as buyers transfer holdings to long-term storage, a traditional precursor to cost rallies.

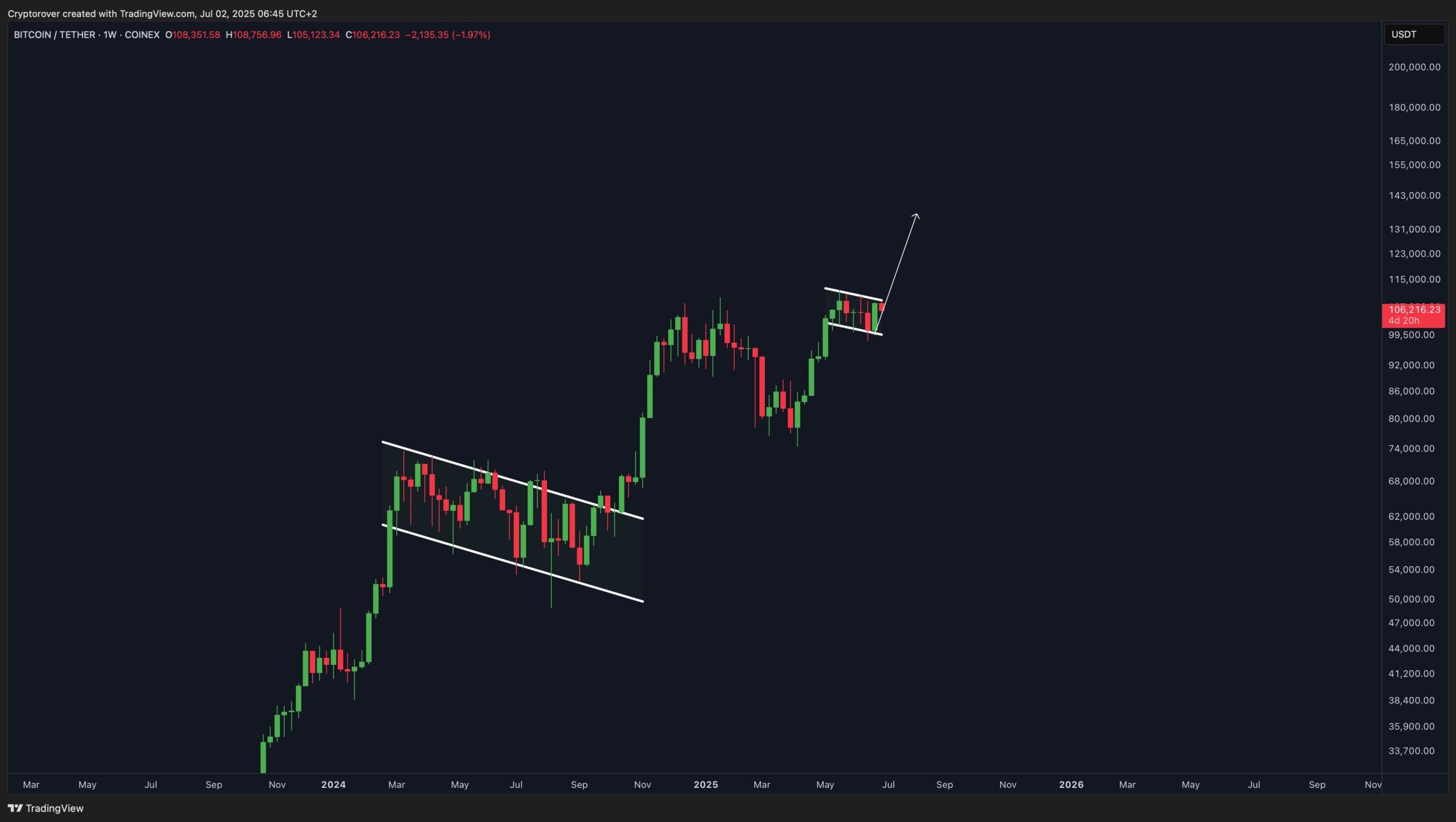

Furthermore, analyst Crypto Rover highlighted a bull flag sample on the BTC value chart. A bull flag is a chart sample indicating a continuation of an uptrend, so Bitcoin may proceed transferring north.

“This bull flag will ship Bitcoin to $120,000!” Rover added.

BTC Market Construction Favors Upside, However Challenges Stay

Whereas all these elements create a compelling case for Bitcoin’s subsequent rally, Ray Youssef, CEO of NoOnes, stays cautiously optimistic.

“BTC value motion has remained range-bound between $106,000 and $108,700 for 7 consecutive days, with market momentum stalling and no decisive breakout in sight. BTC has repeatedly failed to interrupt and maintain above $108,500 regardless of the resilient institutional urge for food,” Youssef advised BeInCrypto.

He acknowledged that conventional shares’ efficiency and the macroeconomic circumstances, like a falling greenback, help a bullish outlook.

Nevertheless, the chief believes that Bitcoin nonetheless wants a transparent macro catalyst to emerge. Within the absence of this, the market seems cautious and reluctant to interrupt larger.

“A clear break above $108,800 may open the door to retest the earlier all-time vary at $111,980, doubtlessly $130,000 by the top of Q3 and $150,000 by EOY, offered institutional demand stays resilient and macro circumstances create a positive backdrop. Sellers are actively defending the $108,500 resistance zone, however the market construction favours upside continuation if bulls can regain management with quantity,” he said.

Youssef careworn that if the worth fails to remain above $107,000, the short-term outlook may shift, with potential targets of $105,000 and even $102,000 coming into play.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.