Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

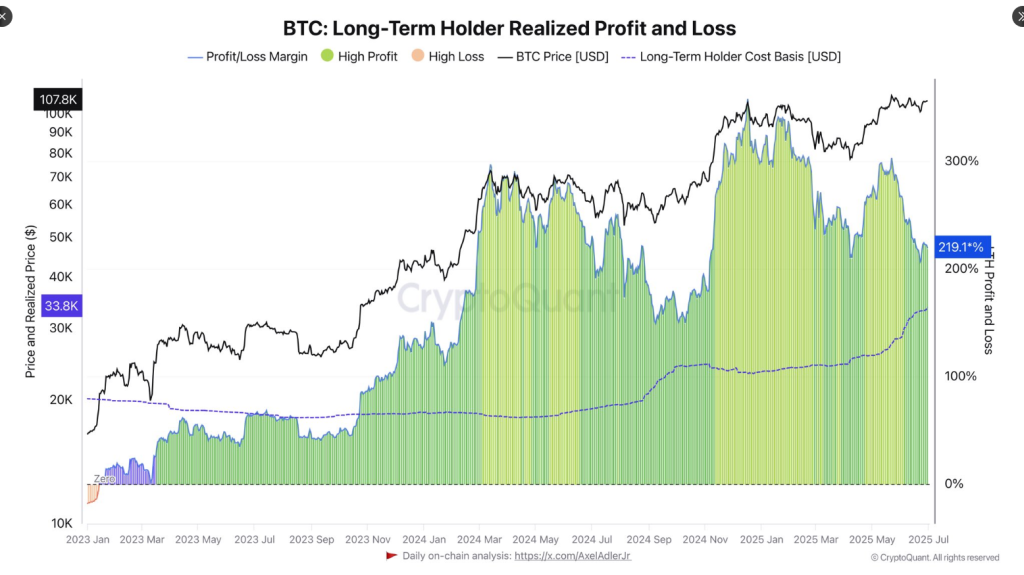

In accordance with CryptoQuant analyst Darkfost, lengthy‑time period Bitcoin holders are sitting on unrealized beneficial properties final seen through the October 2024 market dip. Proper now, these holders present a mean revenue of 220% on cash they purchased and held for the long term. That determine is surprisingly low given Bitcoin’s current surge again above $107,000.

Associated Studying

Decrease Revenue Ranges Than Earlier Peaks

Darkfost used the MVRV ratio — market worth relative to the typical price paid by lengthy‑time period holders — to trace these shifts. In March 2024, when Bitcoin pushed as much as $74,500, MVRV hit 300%. Then in December 2024, on the $108,000 peak, it climbed to 350%. In contrast, right now’s 220% acquire displays the truth that many lengthy‑time period holders purchased in at a lot increased ranges than earlier within the cycle.

Value Wants To Rise To Match Previous Beneficial properties

Based mostly on a mean price foundation of $33,800, Bitcoin would want to climb again to $135,200 simply to revive that 300% revenue degree. If the market aimed to hit the 357% mark once more, costs must attain roughly $154,400. Each figures monitor with what historical past tells us about investor habits — individuals are inclined to promote when income hit large spherical numbers.

📉 Unrealized income of LTH proceed to say no and are actually approaching ranges final seen through the October 2024 correction.

The typical unrealized revenue, primarily based on the MVRV ratio, at the moment stands at round 220%.

That will appear excessive for BTC, however when in comparison with earlier… pic.twitter.com/NeTCmXZVTY

— Darkfost (@Darkfost_Coc) July 1, 2025

Historic Cycle Comparisons

Trying farther again reveals how a lot room stays. In December 2017, on the $19,500 prime, lengthy‑time period holders noticed unrealized income of 4,000%. Then through the 2020/2021 cycle, Bitcoin spiked to $63,000 in April 2021 and MVRV topped out at 1,230%. By November 2021, costs hit about $68,400 however unrealized beneficial properties for lengthy‑time period holders had already fallen to 340%.

An analyst’s current outlook traces up with this math, first pegging a cycle prime at $135,000 in October 2024. After reviewing new information in Could 2025, they revised the goal vary to $120,000–$150,000 and advised a probable peak between August and September 2025. That vary overlaps with the worth ranges wanted to deliver MVRV again to earlier highs.

Room For Extra Upside, However Watch The Dangers

Based mostly on newest figures, Bitcoin is buying and selling at $106,750, roughly flat over the past 24 hours. Decrease revenue margins imply fewer lengthy‑time period holders are itching to promote proper now, which might go away extra gas for increased costs. Nonetheless, on‑chain numbers don’t seize the entire image. Spot-market flows, ETF strikes and wider financial shifts can all set off sharp reversals.

Associated Studying

For now, the proof factors to a market that isn’t overheated. If Bitcoin follows previous cycles, it could have farther to climb earlier than lengthy‑time period holders lock in beneficial properties at ranges seen in March or December 2024. However buyers ought to steadiness these on‑chain metrics with actual‑world indicators — and be prepared for no matter comes subsequent.

Featured picture from Imagen, chart from TradingView