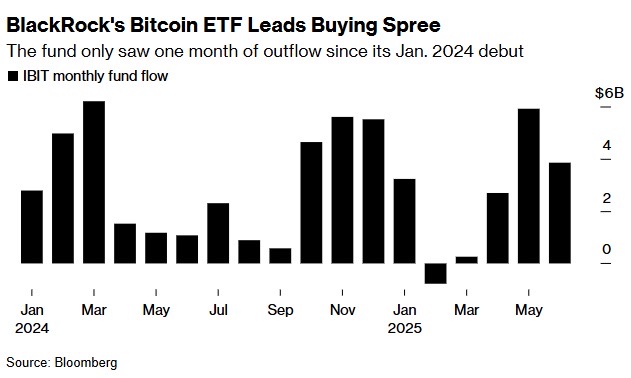

BlackRock’s iShares Bitcoin Belief (IBIT) has quietly surged previous the asset supervisor’s flagship S&P 500 ETF (IVV) in annual charge income, upending lengthy‑standing expectations within the conventional fund world.

This shift issues as a result of it indicators institutional cash is now putting greater bets on digital property than on established fairness benchmarks, reshaping portfolio methods throughout Wall Road. For anybody weighing the perfect crypto to purchase now, this watershed second underscores why regulated Bitcoin publicity is quickly shifting from area of interest to mainstream.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t accountable for the content material, accuracy, high quality, promoting, merchandise, or different supplies on this web page.

How BlackRock’s Tiny Bitcoin ETF Topped Its Big S&P Fund in Charges

BlackRock’s Bitcoin ETF is now incomes more cash for the corporate than its flagship S&P 500 fund, a strikingly symbolic shift as institutional buyers pour cash into crypto throughout this demand surge.

How is that doable when the Bitcoin fund’s property are a lot smaller? It comes right down to charges. BlackRock’s iShares Bitcoin Belief (IBIT) expenses a 0.25% charge, considerably increased than the tiny 0.03% charge on its large iShares Core S&P 500 ETF (IVV).

Bloomberg reported that IBIT pulls in roughly $187.2 million yearly, simply edging out IVV’s $187.1 million. That’s an enormous deal. Since launching in January 2024, IBIT has quickly gathered about $75 billion and dominates the Bitcoin ETF area, holding over half the full market share.

U.S. regulatory approval for spot Bitcoin ETFs was essential, opening the floodgates for hedge funds, pension funds, and banks to take part. This institutional rush explains why IBIT is now among the many high 20 ETFs by buying and selling quantity.

As Nate Geraci of Novadius Wealth Administration famous, IBIT surpassing IVV in charges highlights each the extraordinary demand for Bitcoin and the way fiercely aggressive charges have grow to be for conventional core fairness funds.

Paul Hickey, Bespoke Funding Group co-founder, added that Bitcoin’s fame as a dependable retailer of worth has cemented its lead within the crypto market, assembly pent-up investor demand for straightforward portfolio entry without having separate accounts.

In the meantime, BlackRock CEO Larry Fink has carried out a outstanding reversal, changing into a robust Bitcoin supporter after earlier skepticism. He now calls it “digital gold” – a sensible hedge in opposition to inflation and forex devaluation, particularly given rising nationwide debt and world uncertainty.

Fink even means that if main sovereign wealth funds allotted only a small portion (2%-5%) to Bitcoin, its worth might doubtlessly soar to between $500,000 and $700,000. He believes the transparency and liquidity supplied by ETFs will velocity up Bitcoin’s acceptance as a mainstream asset.

Finest Crypto to Purchase Now

The truth that IBIT now outpaces IVV in charge income highlights a broader conviction: regulated Bitcoin automobiles can rival legacy fairness performs in institutional attraction. As treasury managers and pension funds pivot towards digital property, knowledgeable choice is extra essential than ever, making the seek for the perfect crypto to purchase now extra related than ever.

Bitcoin Hyper

With BlackRock’s ETF success highlighting Bitcoin’s rising monetary significance, Bitcoin Hyper emerges as an answer to Bitcoin’s scalability and transaction velocity challenges. $HYPER’s Layer-2 know-how immediately addresses the demand for sooner, cheaper Bitcoin transactions, making it more and more related as institutional and retail exercise intensifies.

Bitcoin Hyper is rapidly rising as a breakout Layer-2 venture, drawing consideration as Bitcoin adoption surges and early buyers search for the subsequent large alternative. Constructed on the Solana Digital Machine, it gives quick, low-cost transactions whereas tapping into Bitcoin’s safety and long-term credibility.

Transactions settle in below a second, with near-zero charges, making Bitcoin Hyper a sensible match for high-volume DeFi and dApp exercise. Not like previous workarounds, this setup goals to make Bitcoin a real execution layer, not only a retailer of worth.

The $HYPER token drives the community, powering every little thing from governance and staking to transactions and app entry. It additionally unlocks full cross-chain help from day one, together with Ethereum and Solana, key for builders navigating in the present day’s crowded blockchain area.

Early consumers can stake $HYPER throughout the presale, with rewards providing as much as 429% APY, giving backers a transparent incentive to get in early. This staking possibility might add endurance to what’s shaping as much as be considered one of 2025’s most talked-about crypto launches.

Finest Pockets is the go-to for buying, with a clear interface and $HYPER already featured in its ‘Upcoming Tokens’ record. It additionally offers customers a smoother shopping for expertise, early entry to presales, and straightforward token administration from one dashboard.

SUBBD

As BlackRock’s Bitcoin ETF indicators surging institutional curiosity and mainstream adoption of digital property, tokens like SUBBD are capitalizing on this momentum by remodeling content material monetization and creator economies. SUBBD leverages blockchain’s transparency and effectivity, providing creators and followers new methods to work together and transact within the present crypto area.

SUBBD ($SUBBD) is a crypto token powering a brand new platform for creators and followers, with each transaction constructed round it. It goals to grow to be the monetary spine for on-line leisure, providing utility throughout all the ecosystem.

The platform lets followers pay for numerous digital subscriptions, like Netflix or productiveness apps, utilizing only one token. If extensively adopted, SUBBD might reshape how folks pay for web providers throughout a number of platforms.

Creators can subject their very own subscription tokens, unlocking unique content material, stay streams, and perks for followers who stake. It’s a direct problem to platforms like Patreon and OnlyFans, pushing for a decentralized mannequin in creator monetization.

With backing from influencers and area of interest communities, SUBBD is making crypto really feel extra mainstream and creator-friendly. Tipping, subscribing, and even partial content material possession are all enabled via the $SUBBD token.

Token holders get 20% fastened staking rewards, plus entry to premium platform options and creator engagement instruments. This creates stronger connections between followers and influencers, including actual worth to the token past hypothesis.

The venture has additionally launched AI instruments, together with monetizable digital influencers and human-like video or voice replies. These options give creators new methods to scale, have interaction audiences, and supply personalised experiences at a low value.

Over 250 million followers are already onboarded, exhibiting robust early traction for SUBBD’s decentralized creator economic system. With presales underway, the venture is positioning itself as a daring contender within the crypto and content material panorama.

TOKEN6900

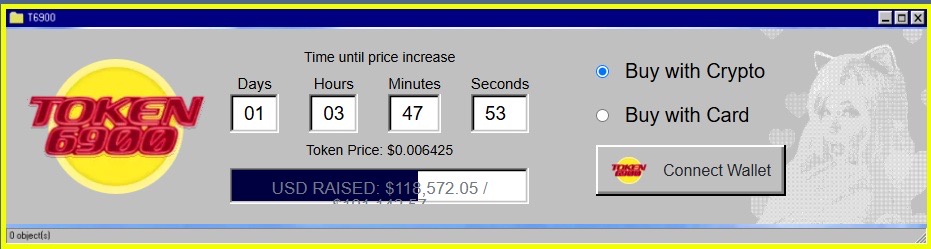

The record-breaking efficiency of BlackRock’s Bitcoin ETF underscores how crypto has entered the mainstream, sparking curiosity not solely in utility tokens but additionally in meme cash like TOKEN6900. T6900 rides this wave of mass adoption, reflecting the playful and speculative facet of the market that thrives alongside institutional improvements.

TOKEN6900 is popping heads in 2025 with its zero-utility philosophy. Launched as $T6900, the venture leans into chaos, satire, and community-driven momentum over conventional options.

The venture’s whitepaper reads extra like efficiency artwork than a roadmap, calling the coin “a lobotomy, not a token.” It guarantees nothing, providing a uncommon sort of honesty in an area crowded with inflated claims and empty hype.

Described as a Non-Corrupt Token (NCT), the venture rejects AI instruments, metaverse plans, and personal investor rounds. As a substitute, 80% of its provide was launched to the general public, with no insider offers or early entry lists.

The remainder of the token allocation is as unusual as its branding, with 40% for meme advertising and marketing and 10% for liquidity. One thriller stays: a 24.9993% “Dolphin Allocation” that the crew refuses to clarify.

TOKEN6900 is absolutely capped, no new cash will ever be minted, setting it aside in a market flooded with inflationary provide. This fastened mannequin stands as a transparent swipe at authorities cash printing and token overproduction throughout crypto.

Whereas others promise utility and partnerships, TOKEN6900 strips all of it again. No pitch decks. No guarantees. Simply memes and code. It’s a deliberate counter to overengineered tasks that always fail to ship.

As famous by one of many well-known crypto YouTubers, 99Bitcoins, Token 6900 has the potential to ship a 100x return.

The venture’s launch section included staking, audits, and a nostalgic 90s-themed website, all accomplished on time. With the presale now stay, the token has constructed early credibility by truly following via.

In an trade typically constructed on smoke and mirrors, TOKEN6900’s uncooked transparency is placing a chord. It’s half joke, half protest, and presumably probably the most sincere launches on this 12 months’s meme coin wave.

Conclusion

BlackRock’s landmark feat, with its Bitcoin ETF eclipsing a $624 billion S&P 500 staple in charges, underscores a turning level in asset administration. What started as a distinct segment experiment has grow to be a mainstream possibility, proving that institutional demand can drive digital‑asset merchandise to outperform legacy funds.

As regulatory readability and company allocations proceed to agency up, buyers searching for the perfect crypto to purchase now should stability confirmed tokens with rising performs that seize this institutional momentum.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t accountable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, immediately or not directly, for any harm or loss induced or alleged to be attributable to or in reference to use of or reliance on any content material, items or providers talked about.