Two long-dormant Bitcoin wallets holding a mixed 20,000 BTC—value over $2 billion at present costs—had been reactivated right this moment.

These wallets transferred their balances to new addresses, sparking fears of long-term holder capitulation.

Two Dormant Bitcoin Wallets Transfer $2 Billion in BTC

BeInCrypto reported earlier that on-chain sleuth analytics platform Lookonchain recognized the supply of one of many transfers: a pockets created on April 3, 2011, when BTC was buying and selling at simply $0.78.

On the time, the proprietor acquired 10,000 BTC for below $7,805. The pockets remained inactive for over 14 years till the early hours of July 4, when the complete stability was moved to a brand new handle.

Lookonchain additionally discovered a second pockets from 2011 with the same 10,000 BTC stability, making an an identical transfer. Traditionally, such actions have preceded selloffs from long-term holders, prompting swift and cautious responses from market contributors right this moment.

Bitcoin Market Reacts

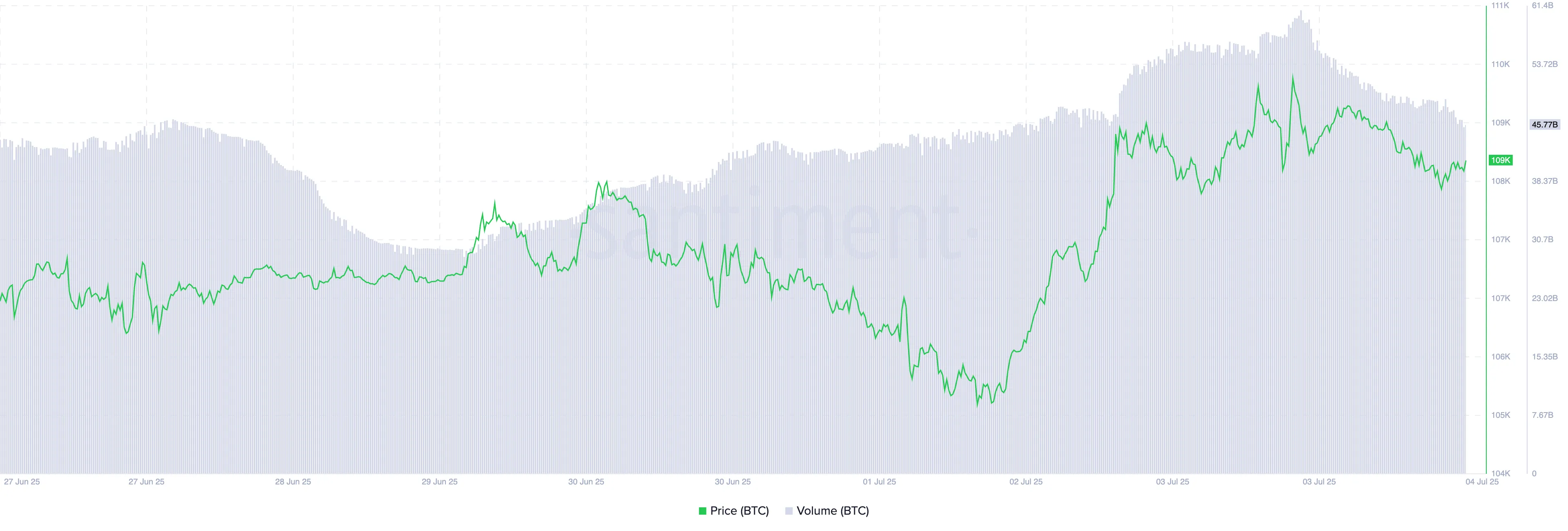

Many merchants have scaled again their actions in anticipation of potential whale liquidations. This rising hesitation is mirrored in BTC’s buying and selling quantity, which has plummeted 15% prior to now 24 hours to $46 billion.

A decline in buying and selling quantity alongside a worth drop signifies weakening market conviction. In such instances, sellers dominate. This dynamic can set the stage for additional BTC declines, as low quantity usually means much less liquidity, making the coin’s worth extra delicate to massive promote orders.

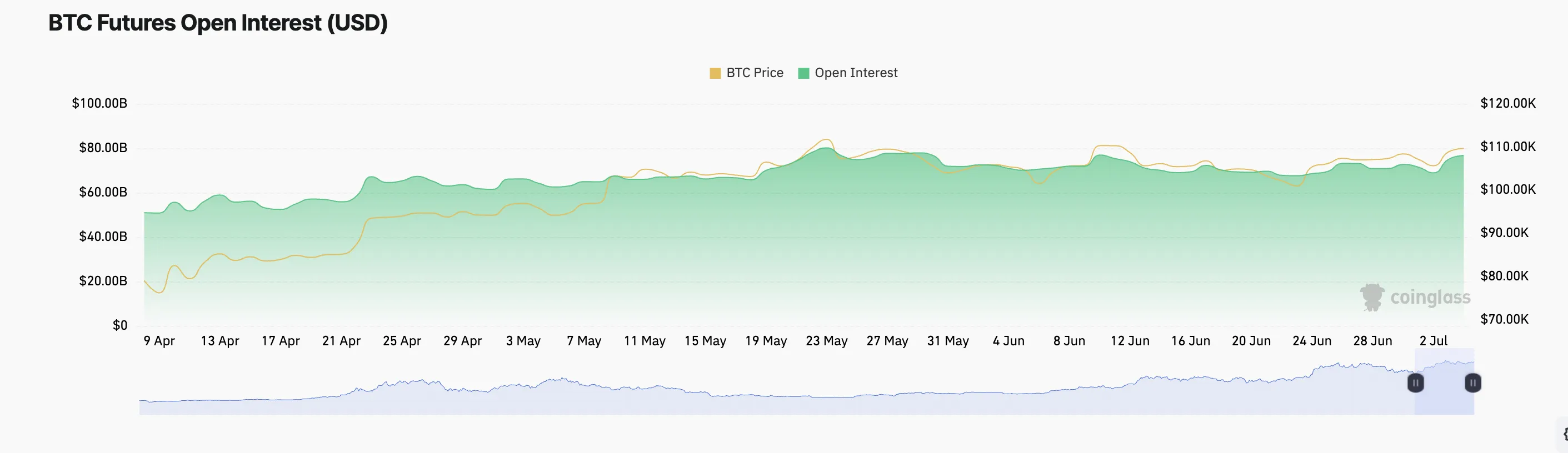

Moreover, BTC’s worth has dipped by roughly 1% amid the drop in buying and selling quantity. However, this decline comes alongside an increase in futures open curiosity (OI), signaling that merchants are nonetheless putting leveraged bets regardless of decreased spot market participation.

At press time, that is at $76 billion, a 1% rise prior to now day.

Rising OI throughout a interval of low quantity and falling costs usually suggests an inflow of speculative positioning, significantly from short-sellers anticipating additional draw back. This setup will increase market fragility, growing the chance of liquidation if worth volatility will increase.

With this setup, even small BTC worth swings can set off vital stop-losses or margin calls, growing the downward strain on the coin’s worth.

Bitcoin Value Hangs within the Steadiness

At press time, BTC trades at $108,978, hovering slightly below its latest highs. Nonetheless, the market stays on edge following right this moment’s motion of 20,000 BTC from the whale wallets.

If a good portion of those cash are deposited onto exchanges and bought, it might intensify bearish strain and push Bitcoin’s worth down towards $106,295.

Conversely, if the whales choose to carry and broader market sentiment turns bullish, the coin might discover recent upward momentum. A decisive break above $109,267 might pave the way in which for a rally towards the $110,422 mark.

Disclaimer

Consistent with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.