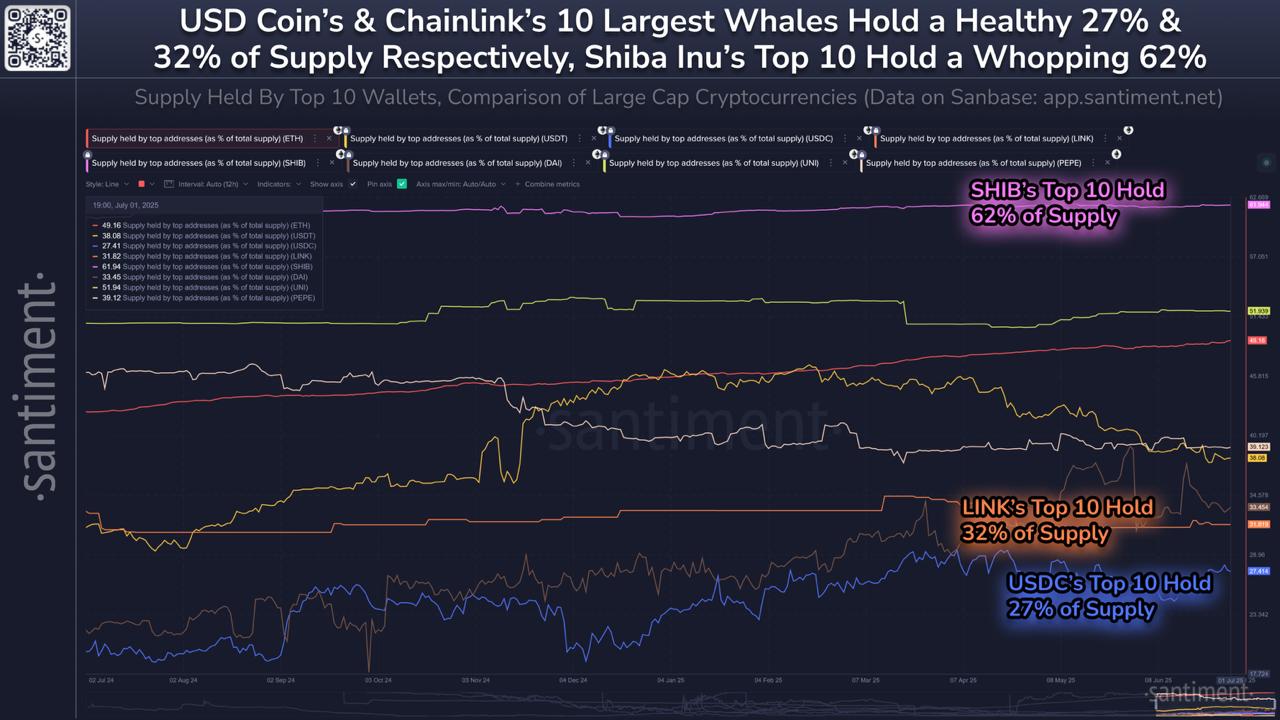

New information from Santiment highlights main variations in token distribution amongst prime cryptocurrencies, revealing essential insights for merchants monitoring whale affect.

The platform in contrast the provision held by the highest 10 largest wallets for varied large-cap belongings, uncovering stark contrasts in decentralization ranges.

Shiba Inu (SHIB) stands out as essentially the most centralized among the many analyzed belongings. A large 62% of SHIB’s complete provide is held by simply 10 wallets, elevating issues about potential worth manipulation or sudden market shocks if a number of whales resolve to promote. Such a excessive stage of focus makes SHIB weak to volatility pushed by a handful of holders.

In distinction, USD Coin (USDC) and Chainlink (LINK) reveal extra balanced provide distributions. USDC, a number one stablecoin, has solely 27% of its provide within the arms of its prime 10 wallets, reflecting a better stage of decentralization and decreased danger of abrupt worth actions. Chainlink’s prime 10 wallets maintain 32% of its complete provide, additionally indicating comparatively wholesome distribution for a large-cap token.

For retail traders and smaller merchants, decrease whale focus usually indicators a safer buying and selling setting. Belongings with decentralized possession constructions are much less more likely to expertise dramatic swings attributable to coordinated whale actions. That is particularly essential throughout instances of heightened market volatility, when giant actions by prime holders can amplify worth instability.

Santiment’s evaluation underscores the significance of monitoring whale pockets exercise, not simply worth tendencies. As on-chain transparency will increase, such information turns into a vital part of due diligence for crypto traders looking for to attenuate publicity to centralized provide dangers.

Finally, whereas meme cash like SHIB might provide fast positive aspects, their whale dynamics demand warning. In the meantime, belongings like USDC and LINK seem extra steady on account of broader provide distribution throughout holders.