- XRP broke out of a bullish pennant sample, pointing to a possible 40% rally towards $3.20 within the brief time period.

- Open curiosity surged to $4.75B, signaling rising institutional demand amid rising confidence in a spot ETF and Ripple’s banking ambitions.

- Technical and elementary indicators align, with whale accumulation, bullish futures positioning, and constructive sentiment boosting XRP’s breakout potential.

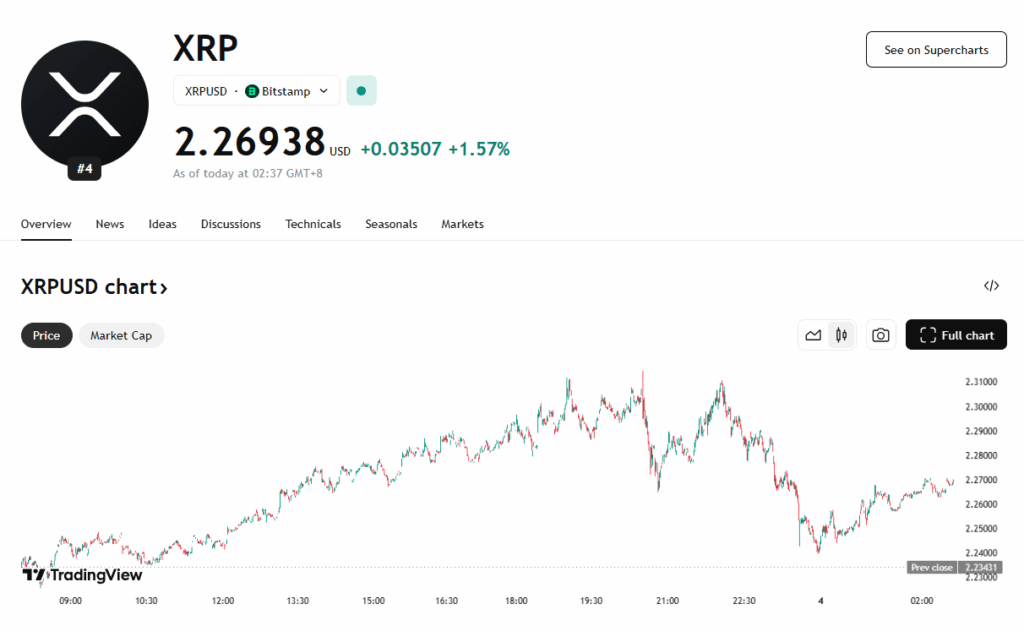

XRP has simply damaged out of a bullish “pennant” sample on the weekly chart, suggesting a continuation of its latest upward momentum. This breakout comes as XRP trades round $2.26, with analysts now eyeing a 40% transfer that might take the token to $3.20 and even increased. The sample’s affirmation follows Ripple’s aggressive enlargement efforts, together with a U.S. banking license software and new strategic partnerships.

Futures Exercise Alerts Institutional Confidence

A pointy uptick in open curiosity (OI) has backed XRP’s latest surge. OI rose by 11% in simply 24 hours and 30% over the previous 10 days, hitting $4.75 billion—ranges that trace at a wave of institutional cash coming into the market. Traditionally, related spikes in OI have preceded robust rallies in XRP. Merchants are drawing comparisons to April 2025, when a surge in OI from $3B to $5.75B accompanied a 65% value rally after a serious Trump commerce coverage announcement.

Key Drivers: Banking Push, ETF Hype, and Whale Motion

XRP’s value climb is being supported by a number of bullish catalysts: Ripple’s push for a U.S. banking license, SEC approval of Grayscale’s GDLC ETF conversion, and its new partnership with OpenPayd. There’s additionally rising hypothesis a few potential XRP spot ETF. All that is occurring whereas whales proceed accumulating XRP and merchants present a transparent bullish bias—evident within the 68% lengthy/brief ratio favoring lengthy positions.

Bullish Chart Sample Factors to 40% Upside

The pennant breakout is critical. XRP traded inside a narrowing construction since December 2024, and eventually broke above the descending trendline close to $2.21 on July 3. This transfer has technically opened the door to a rally towards $3.20, based mostly on the peak of the formation. Some analysts are much more optimistic, predicting a push towards $3.40 as momentum accelerates.