Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

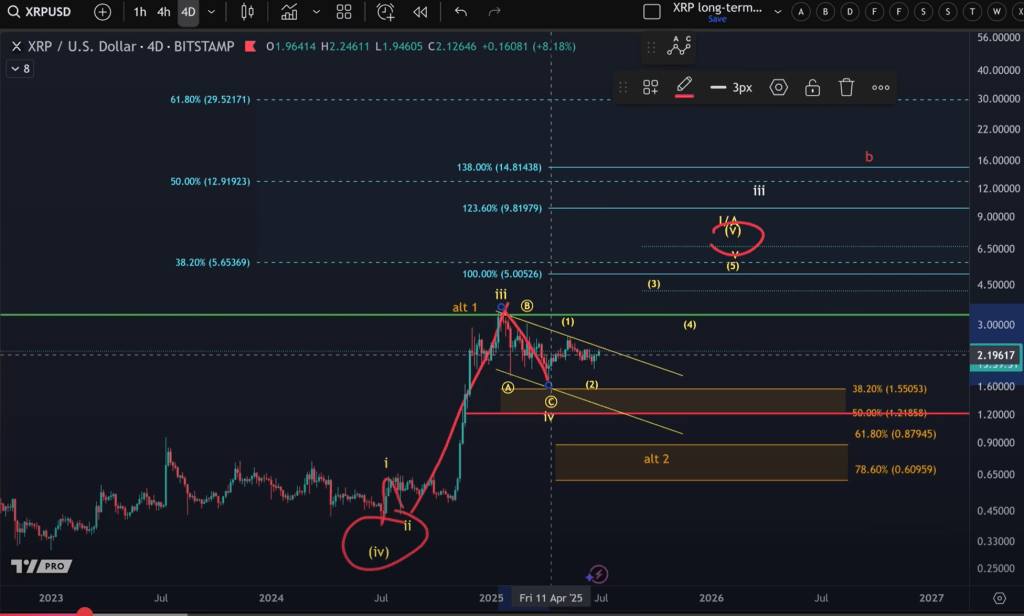

XRP is inching towards what might be its most consequential technical inflection in additional than a 12 months, based on the June 3 video evaluation from the YouTube channel Extra Crypto On-line (MCO). Using classical Elliott-wave mapping, the analyst argues that XRP has been constructing a five-wave advance ever because the market reset in July 2023 and is now trying to ignite the terminal “fifth” wave—a rally that, if it unfolds below euphoric circumstances, might lengthen so far as $9.

How The Roadmap Is Constructed For XRP

“We is likely to be in a strategy of upside reversal… It’s like a now-or-never second,” the commentator instructed viewers, stressing that breakouts are normally apparent solely after giant parts of the transfer are already spent. In Elliott wave terminology the market is claimed to be making ready for a smaller-degree third wave contained in the bigger fifth, “usually probably the most aggressive one,” he famous, pointing to the explosive impulse that adopted the same set-up final 12 months.

Associated Studying

On MCO’s major chart the July 2023 trough serves because the wave-four low of an excellent bigger advance. From there, a collection of lower-degree one-two formations seems to have carried XRP into wave three and, extra not too long ago, right into a sideways, three-legged correction that accomplished in April. “We’ve got a wave 1, a wave 2, a wave 3, the wave 4, and possibly that is now the fifth wave that’s unfolding,” he defined, including that wave 4’s depth and length have been textbook for a counter-trend pause.

To translate wave counts into value goals the analyst measured waves 1 via 3 and projected the basic 61.8 p.c Fibonacci extension from the underside of wave 4. That calculation yields $6.20 as a “simple” fifth-wave goal. The identical measurement’s 78.6 p.c extension sits at roughly $9.00, a stage the commentator mentioned “generally materialises in a really euphoric fifth wave.”

Earlier than any dialogue of $5-plus costs turns into actionable, XRP should clear a cluster of near-term hurdles. The analyst identifies the $2.30–$2.40 vary as the primary structural ceiling; it coincides with a descending trend-line that has capped each rally since March and with the 100-day exponential shifting common.

Associated Studying

The shorter-time-frame wave rely exhibits why this band issues. From the 7 April swing low the market printed a transparent five-wave micro-structure, implying {that a} contemporary up-trend could already be underway. But, because the analyst cautioned, “We nonetheless should clear all these earlier swing highs… We’ve acquired resistance on this space round $2.30, structurally $2.40.” A decisive break above that shelf would validate a sub-wave (iii) goal round $3.30–$3.50, the January swing-high zone the video calls “the subsequent stage.”

Bearish Situation For XRP

Each Elliott-wave blueprint comes with an invalidation stage. Within the MCO mannequin your complete fifth-wave situation survives provided that value holds above the April nadir—the beginning of wave 1 within the present one-two set-up. On the micro stage the bulls should additionally defend what the video labels “the $1.99 help space.” A deeper retracement to $1.60 (the “pink dotted line”) might be tolerated inside an prolonged wave 2, however any sustained commerce beneath that mark would most likely imply wave 4 continues to be creating, pushing again the timetable for a breakout.

“So long as we’re holding above the April low, this pathway greater stays legitimate and believable,” the analyst reiterated. Conversely, a failure there would power a re-evaluation of your complete rely.

Though the headline $9 print grabs consideration, the analyst is obvious that such an extension presupposes an excessive sentiment shift. Traditionally XRP’s rallies have typically stalled close to the 61.8 p.c projection, and the channel’s host reminds viewers that “market sentiment” finally decides whether or not the 78.6 p.c extension is reachable.

For now the main target is squarely on securing an impulsive shut above $2.40 after which on difficult the mid-$3 area. Solely as soon as that marketing campaign succeeds will the dialogue transfer significantly towards $5.65, $6.20 and, in a parabolic climax, the high-single-digit zone.

At press time, XRP traded at $2.23.

Featured picture created with DALL.E, chart from TradingView.com