In a primary for the Bitcoin community, 20,000 BTC dormant since 14 years has abruptly moved. Right here’s how a lot revenue was concerned within the transaction.

A Important Quantity Of Historical Bitcoin Has Simply Been Transferred

As defined by CryptoQuant group analyst Maartunn in a brand new submit on X, there have been a few unprecedented transactions on the Bitcoin blockchain.

The transfers in query concerned the motion of 20,000 BTC in two batches (that’s, 10,000 tokens in every transfer) sitting dormant since 14.3 years in the past. “That is by no means earlier than witnessed in Bitcoin’s total historical past,” notes Maartunn.

The info of the transfers older than 10 years | Supply: @JA_Maartun on X

When the tokens concerned in these strikes had been final transacted in April 2011, they had been value a complete of $15,586. Right now, they’re value upwards of $2.1 billion.

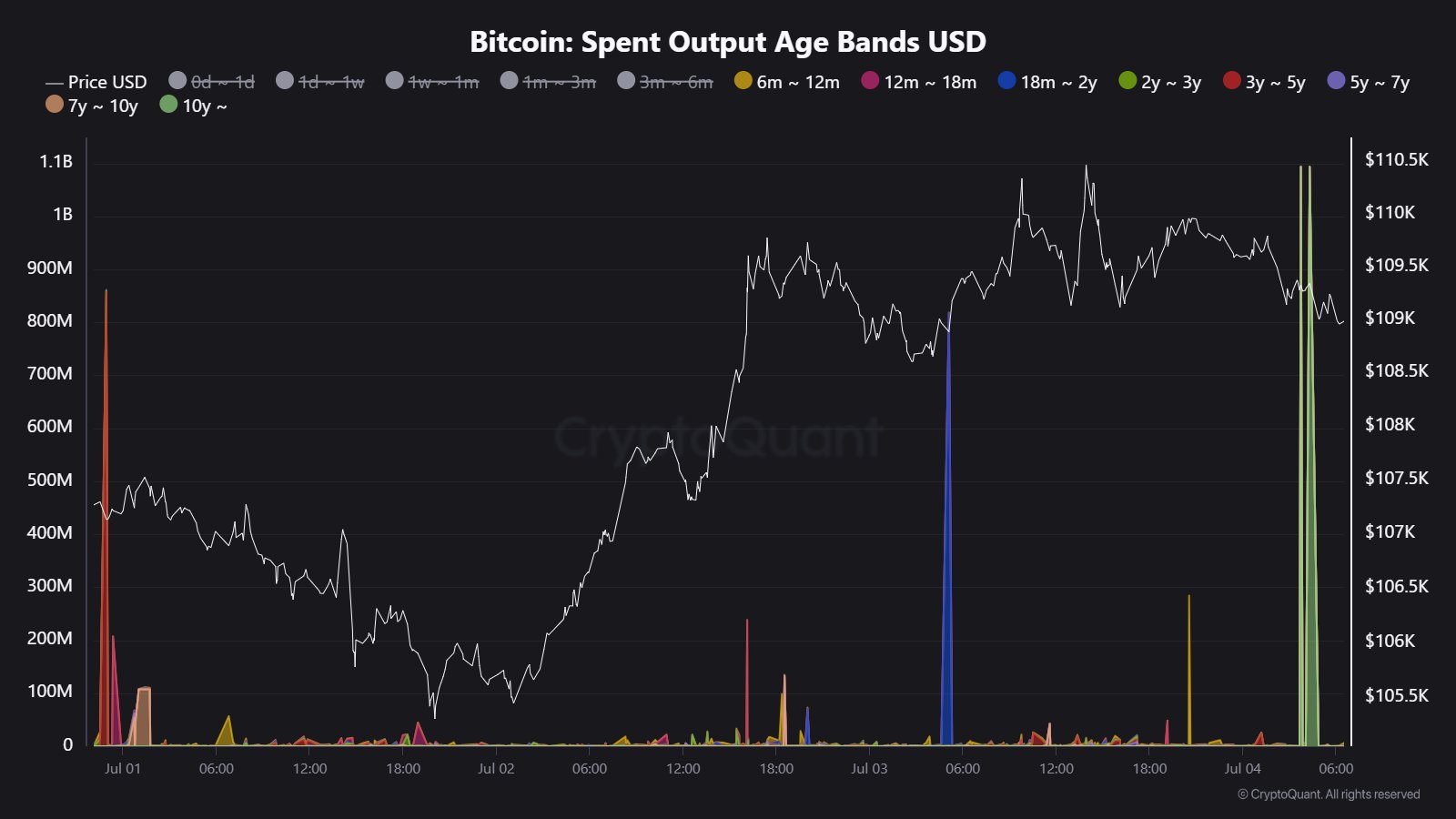

The dimensions of the transfers in USD phrases | Supply: @JA_Maartun on X

This naturally means that with the transfer, the proprietor of the tokens has harvested a unprecedented quantity of revenue. Extra particularly, the transfer has realized a acquire of just about 13.8 million p.c.

An indicator that has registered a notable spike due to the dormancy-breaking transactions is the Bitcoin Coin Days Destroyed (CDD). A ‘coin day’ is a amount that one token of the asset accumulates after being nonetheless on the blockchain for someday.

When a coin that has been dormant for some variety of days is moved, its coin days counter resets again to zero and the coin days that it had been carrying are mentioned to be ‘destroyed.’ The CDD measures the full variety of coin days being reset on this method throughout the community.

Naturally, the CDD is especially delicate to strikes from the diamond fingers of the Bitcoin market, as their tokens have a tendency to hold numerous coin days. The 20,000 BTC transactions from as we speak are fairly historical, so it’s to be anticipated that they might register on the indicator.

Seems like the worth of the metric has shot up throughout the previous day | Supply: @JA_Maartun on X

And certainly, because the chart for the metric shows, every of the 2 10,000 BTC transfers concerned the destruction of greater than 52 million coin days. Thus, collectively, the strikes have brought about the CDD to succeed in over 104 million coin days.

Now, what may these strikes imply for the Bitcoin market? Usually, when such historical cash transfer, the motive is prone to be promoting. On this explicit case, nonetheless, the investor concerned is probably not a high-conviction holder. It’s because cash that attain such an previous age often get there by changing into misplaced, both resulting from their existence being forgotten or having their keys misplaced.

As such, it’s possible that the tokens have solely just lately been rediscovered. Promoting from holders carrying cash from just a few years in the past generally is a signal of conviction breaking within the sector, however this explicit transfer is probably not it.

BTC Value

Bitcoin has retraced a few of its newest restoration as its value has pulled again right down to $107,900.

The worth of the coin has general moved sideways over the past 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.