- AVAX leads all chains with $32.92M in 24-hour web inflows, signaling rising investor demand because it nears a vital technical breakout zone.

- Worth is testing the $18.60–$19 resistance vary, with analysts looking forward to affirmation of a transfer towards the $25–$30 degree.

- ETF hypothesis for 2025 is constructing, doubtlessly setting the stage for main institutional adoption and long-term value progress.

Avalanche (AVAX) is making critical noise in a cautious crypto market, logging the best web inflows throughout all chains over the previous 24 hours. With $32.92 million flowing into its ecosystem, Avalanche is displaying clear indicators of renewed curiosity—simply because it approaches a key technical resistance zone. Whereas many tokens stay flat or declining, AVAX is quietly constructing momentum that would set it up for a significant breakout.

On-Chain Knowledge Exhibits Sturdy Accumulation

The $32.92M in web inflows isn’t only a statistical bump—it locations AVAX on the high of the leaderboard amongst all tracked chains. That degree of exercise, particularly in a low-volatility market, hints that traders are positioning early for a possible transfer. Traditionally, AVAX has seen comparable surges throughout market uncertainty, however the scale and timing of this spherical counsel one thing larger could also be in play.

Worth Motion Targets $19 Breakout

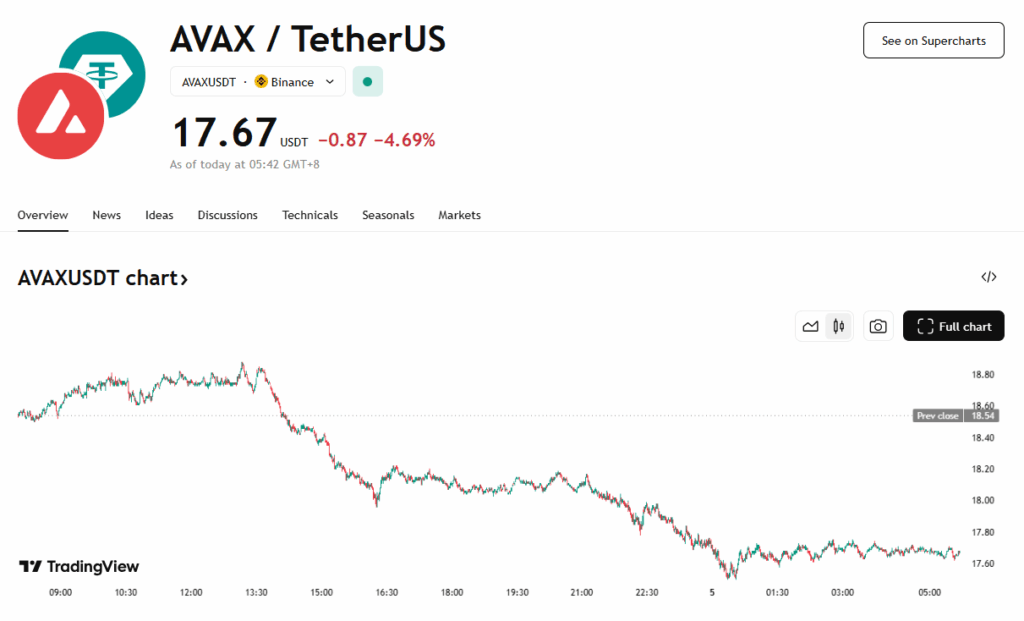

Technically, AVAX remains to be buying and selling inside a falling channel, with a significant resistance band between $18.60 and $19. This zone has rejected value a number of occasions over the previous few weeks, making it the important thing degree to flip. Analysts level to a short-term double-bottom forming close to $17 and rising buying and selling quantity—each indicators of bullish energy. If AVAX clears the $19 mark, it may get away of the present downtrend and head towards $25 and even $30.

AVAX ETF Hypothesis Builds Steam

Fueling much more buzz is theory round a possible spot AVAX ETF. Whereas unconfirmed, crypto commentators like Steven9000 counsel {that a} 2025 launch isn’t out of the query. The impression of a spot ETF can be enormous: legitimizing AVAX for institutional traders and decreasing value volatility by way of extra structured capital flows. As seen with Bitcoin and Ethereum, ETF inclusion tends to be a significant catalyst for sustained value appreciation.

Remaining Ideas

Avalanche is displaying all of the early substances of a significant bullish setup—high inflows, a stable technical base, and a story that’s heating up quick. If AVAX clears the $19 resistance, it gained’t simply be a chart transfer—it may very well be the start of a bigger shift fueled by ETF hypothesis and actual capital inflows. The items are aligning; now it’s a matter of execution.

Ask ChatGPT