Bitcoin noticed a light selloff on the Fourth of July as on-chain information revealed uncommon actions from long-dormant whale wallets and a notable shift in whale accumulation developments.

The flagship cryptocurrency briefly touched $110,000 earlier than retreating to round $107,600 by noon. The intraday decline—round 2%—comes amid unusually excessive on-chain exercise from early Bitcoin holders and weakening whale metrics.

Whale Accumulation Development Turns Unfavourable

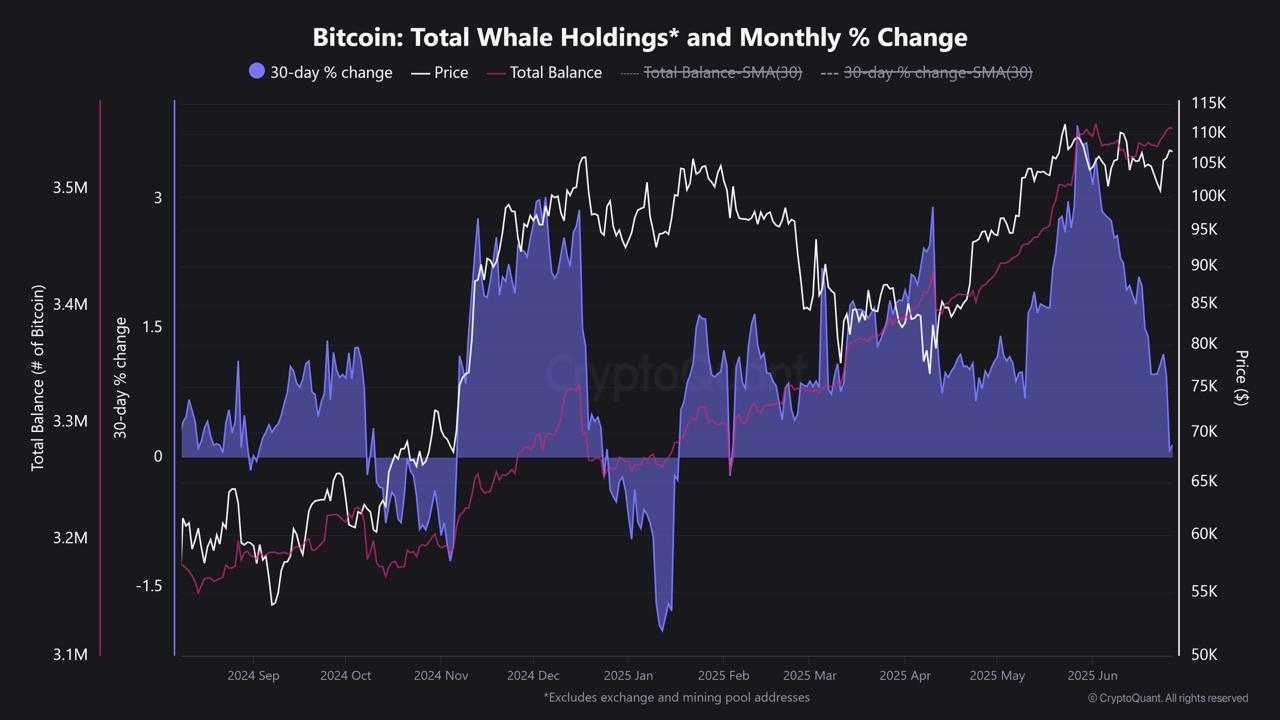

On-chain metrics from CryptoQuant reveal a deeper structural shift. The 30-day proportion change in whole whale holdings has now turned detrimental for the primary time in six months.

Whale holdings steadily elevated from 3.28 million BTC in January to a peak of 3.55 million BTC in June. This accumulation section helped help Bitcoin’s value restoration by way of Q1 and Q2.

Nonetheless, this upward pattern has now reversed. The decline in internet whale holdings indicators the beginning of a distribution section, when massive holders start offloading or reallocating capital.

Traditionally, detrimental shifts on this metric have coincided with short- to mid-term corrections. Institutional and long-term holders usually cut back publicity or put together for liquidity occasions.

If extra of those dormant cash begin shifting—or promoting strain mounts—we might even see a short-term retest of help zones close to $105,000.

Dormant Bitcoin Whales Wake Up After 14 Years

Seven dormant Bitcoin wallets relationship again to April and Might 2011 transferred a mixed 70,000 BTC, valued at $7.6 billion, previously 24 hours.

Blockchain information reveals these addresses had been inactive for over 14 years. On the time of receipt, BTC traded beneath $4.

At this time, the identical holdings are value billions.

The coordinated nature of those strikes suggests they belong to a single entity—presumably an early miner or institutional custodian.

At the least 12 transactions have been logged at the moment, every shifting 10,000 BTC, flagged by analysts as originating from a whale cluster labeled “BTC Whale 4th July.”

These funds have been despatched to contemporary addresses, however no alternate deposits have been confirmed but.

In the meantime, one transaction traced again to a consolidation of 180 block rewards—every 50 BTC—right into a single output of 9,000 BTC.

These rewards have been earned throughout Bitcoin’s first reward period, indicating the cash got here from early solo mining operations.

The timing—on US Independence Day—has additionally drawn consideration. Some analysts interpret the symbolic date as deliberate, echoing previous situations the place whale exercise aligned with main calendar occasions.

Whereas not one of the transferred cash have been bought but, the market usually reacts preemptively to such actions.

Disclaimer

Consistent with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.