Ethereum has seen an uptick in institutional curiosity in current weeks; nevertheless, the value is consolidating in a good vary.

On-chain knowledge has revealed that promoting stress from US-based whales and establishments has steadily declined over the previous month regardless of the altcoin’s lackluster worth efficiency.

Ethereum Demand Holds Robust Amongst US Buyers

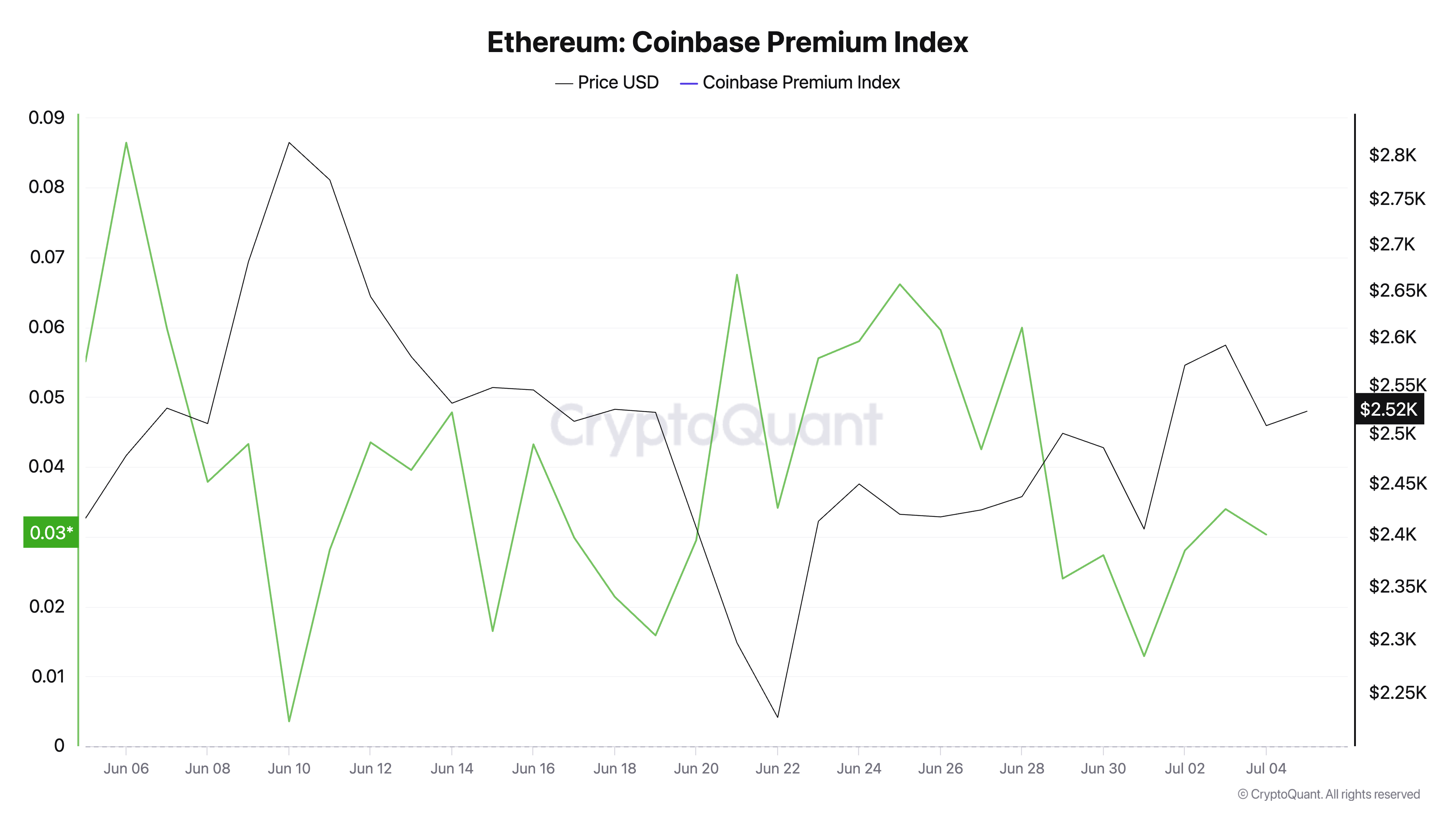

In keeping with knowledge from CryptoQuant, Ethereum’s Coinbase Premium Index (CPI) has remained constantly above the zero mark over the previous month. It is a sign of sustained shopping for curiosity from U.S.-based buyers.

On the time of writing, the CPI stands at 0.03.

This metric measures the distinction between the ETH’s costs on Coinbase and Binance, and it’s a good indicator for monitoring US investor sentiment.

When the CPI rises, ETH trades at a premium on Coinbase in comparison with worldwide exchanges. This displays stronger shopping for stress from US-based buyers.

Conversely, when the CPI falls—or worse, turns destructive—it indicators that demand on Coinbase is lagging behind international markets because of profit-taking or waning curiosity amongst US patrons.

Subsequently, regardless of its lackluster worth efficiency in current weeks, ETH’s regular CPI above the zero line means that US buyers are persevering with to purchase fairly than exit the market. This factors to a measured accumulation pattern fairly than a sell-off.

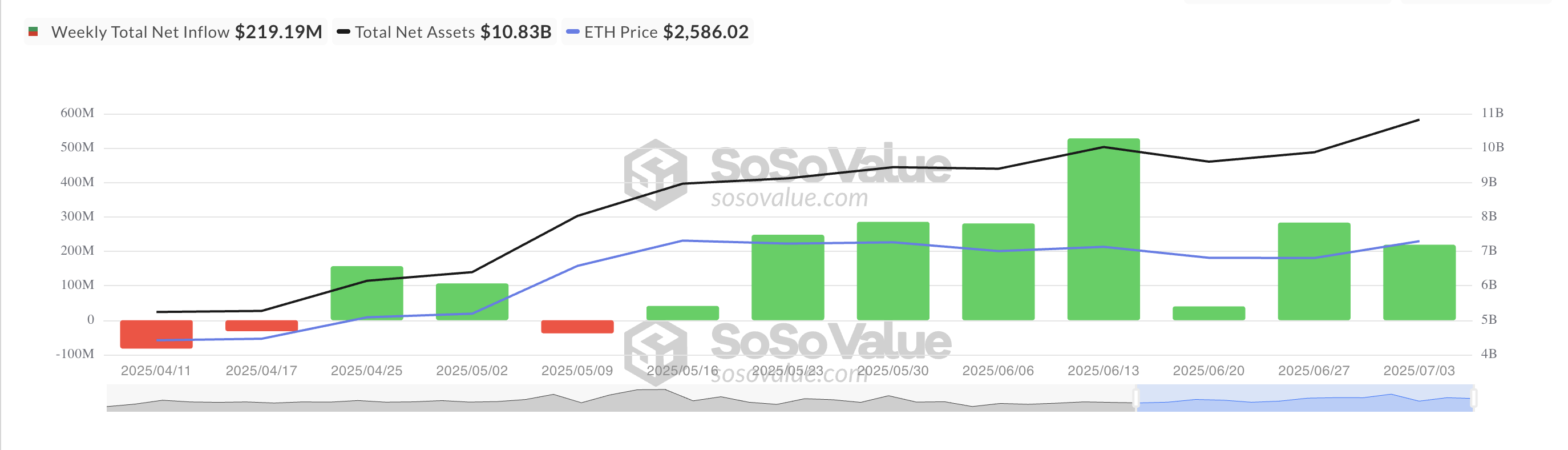

Furthermore, the constant weekly inflows into ETH-backed exchange-traded funds (ETFs) verify the sustained curiosity from key buyers. Per SosoValue, these funds have recorded constant weekly web inflows since Might 9.

This displays a sustained urge for food amongst institutional buyers for publicity to ETH, whilst its worth motion stays comparatively muted.

ETH Trapped in Tight Vary

Readings from the ETH/USD one-day chart verify that ETH has been consolidating throughout the $2,750 to $2,424 worth vary since early Might. If institutional buyers enhance their shopping for stress and broader market sentiment improves, the coin may rally towards the $2,750 resistance stage and doubtlessly try a breakout above it.

If profitable, ETH’s worth may climb additional to round $3,067.

Nevertheless, if buyers’ participation weakens and bearish stress builds, ETH could fall again towards $2,424. It may decline towards $2,185 if that assist fails to carry.

Disclaimer

In keeping with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.