- Ripple has utilized for a U.S. nationwide banking license and Fed grasp account, signaling a serious leap towards conventional monetary integration.

- XRP value predictions now vary as excessive as $50, fueled by institutional demand, ETF hypothesis, and increasing real-world use instances.

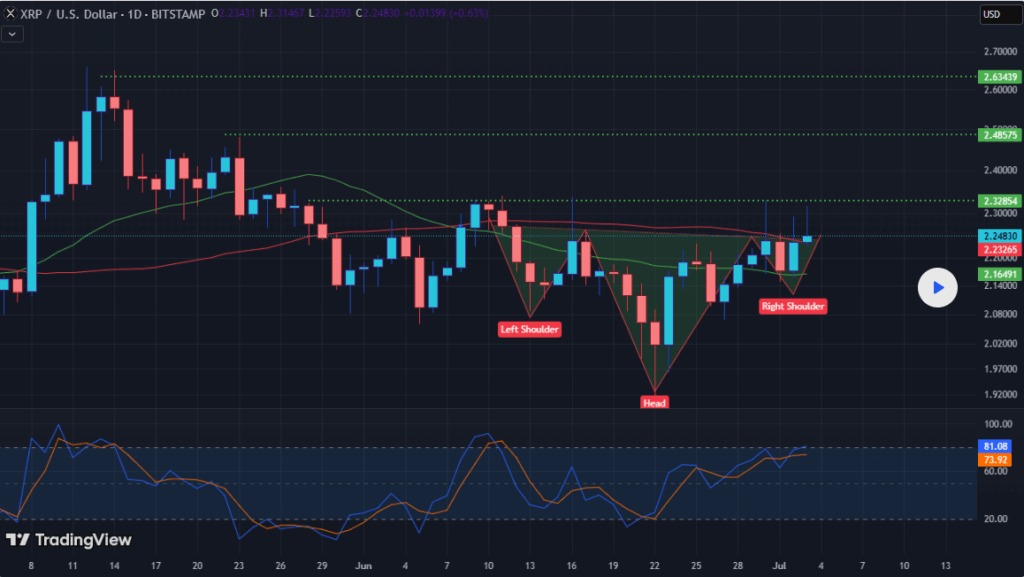

- Technical and on-chain indicators stay bullish, with analysts eyeing a breakout above $2.38 and institutional traders more and more taking discover.

Ripple has shaken up the crypto world with a high-stakes bid to safe a U.S. nationwide banking license—marking one of many boldest strikes by a crypto agency to this point. Coupled with an utility for a Federal Reserve grasp account, this play alerts Ripple’s push to turn out to be a real hybrid between digital property and conventional banking. The announcement has injected new life into XRP, with analysts and advocates pointing to institutional demand, ETF hypothesis, and real-world adoption as gas for a possible value run.

From Crypto Agency to Full-Fledged Financial institution?

On July 2, Ripple confirmed its formal utility for a nationwide financial institution constitution. If permitted, Ripple could be allowed to supply FDIC-insured accounts and direct entry to U.S. cost rails like Fedwire and FedNow. Longtime XRP supporter Vincent Van Code described the transfer as a “watershed second,” forecasting a long-term XRP value goal between $30 and $50. His case hinges on rising use of RippleNet, potential ETF approvals, and XRP’s increasing function in cross-border settlements and CBDC infrastructure.

Technical and Institutional Alerts Align

XRP is at the moment holding above a key ascending trendline, buying and selling close to $2.27 with bullish technical indicators flashing. A golden cross has fashioned, and open curiosity is climbing—hinting at rising confidence amongst leveraged merchants. Analysts are eyeing a breakout above $2.38, which may set the stage for short-term targets round $2.50, and probably $3.50 by year-end. In the meantime, establishments are starting to take discover. Grayscale’s inclusion of XRP in its large-cap ETF portfolio—even amid momentary SEC delays—means that Wall Avenue is warming as much as the asset.

A $50 XRP: Dream or Knowledge-Pushed?

Critics say a $50 XRP would create an unsustainable market cap, however supporters argue the comparability to conventional equities is flawed. In a world the place XRP is embedded in international funds, digital asset custody, and sovereign monetary programs, the value ceiling turns into extra versatile. Van Code notes that with ETF momentum, banking entry, and strategic authorities partnerships (like Ripple’s work with Saudi Arabia), such projections are not fantasy.