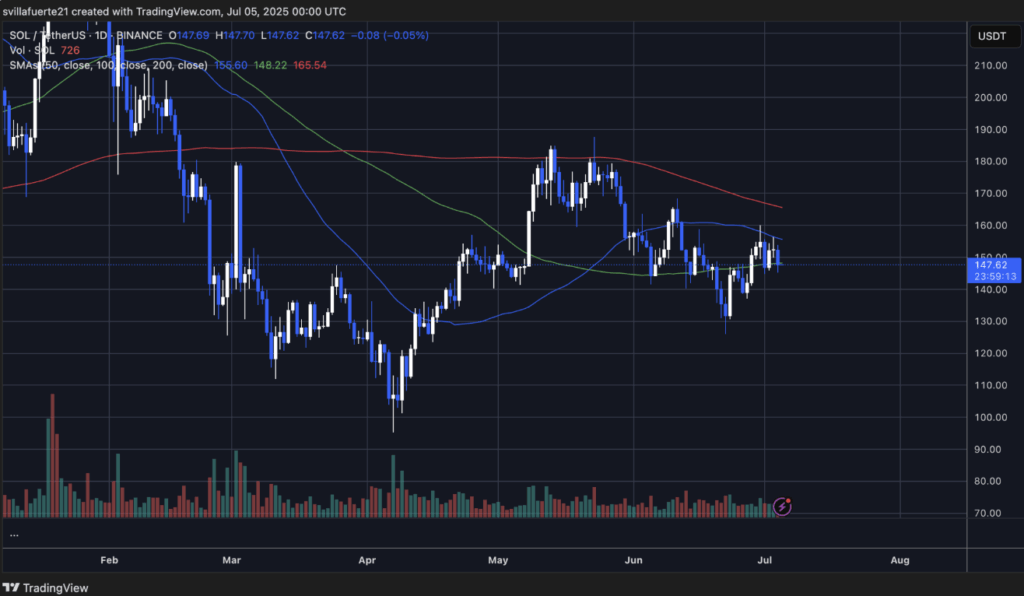

- Solana is caught between $145–$160, consolidating inside a rising channel whereas bulls wrestle to interrupt resistance.

- A break above $160 may push SOL towards $170, however a drop under $145 dangers a fall to $128.50.

- Quantity is fading and indecision guidelines, making the following few classes key to figuring out course.

Solana’s had a bizarre week—buying and selling tight, caught between $145 and $160 since Monday. Worth is holding regular, which exhibits there’s nonetheless purchaser curiosity… but in addition, like, hesitation. Bulls can’t fairly break by means of, and that’s elevating some eyebrows. If it may possibly’t get previous resistance quickly, this complete consolidation may tip the opposite method.

Analyst Carl Runefelt identified one thing necessary—Solana’s trapped inside this rising channel. Seems to be bullish at first look, positive, however patterns like these? They’ve bought a behavior of breaking down laborious if assist doesn’t maintain. So yeah, the following couple of days is likely to be form of a giant deal.

Now, macro’s wanting higher general. Bitcoin’s flirting with new highs and normally SOL likes to observe BTC’s lead. However technicals are flashing warning indicators. If SOL loses grip and dips beneath that decrease trendline, it would head towards $128.50. On the flip aspect, a clear break above $160? That might push it proper again to problem its Could highs.

Bulls Maintain the Line—for Now

As of now, SOL is floating beneath $150—down about 20% from the place it peaked in Could. Nonetheless, it hasn’t collapsed, which says consumers aren’t backing off fully. It’s simply kinda…ready. That sideways motion is an indication of indecision, typical when everybody’s not sure whether or not to load up or get out.

Analysts assume a breakout above the $150–$160 zone may kickstart a contemporary run. However nobody’s pretending it’s assured. That rising channel Carl talked about? It’s holding, but when it snaps, $128.50 is the following place to observe. That space acted like a trampoline final time worth dipped there.

The entire thing actually relies on what occurs subsequent. Merchants are hanging again, watching, not speeding. If SOL jumps again above $150 and sticks the touchdown, sentiment may flip actual quick—and $170 isn’t removed from there. But when it breaks under $145 and slips out of the sample? It may get messy.

SOL Rangebound, Quantity Fades

Proper now, SOL’s buying and selling at $147.62. Worth has been just about caught, shifting sideways, caught in a slim band. The each day chart exhibits rejection after rejection close to that $155–$160 stage—traditional resistance. The 100-day shifting common is including stress, hovering simply above at $155.60, and the 200-day MA is even greater at $165.54.

Quantity’s additionally method down in comparison with these early June spikes. That’s a giant pink flag—no quantity means no conviction. If SOL does break $160, the bulls may get up, and you could possibly see it purpose for $170. However once more, that decrease trendline of the rising channel? If it fails, we’re $128.50 over again.

So yeah—subsequent few classes may set the tone for weeks. Bulls must step up or threat watching this factor unwind.