- AVAX is displaying indicators of an impending breakout from a long-term falling wedge sample.

- On-chain metrics are hitting all-time highs, hinting at robust underlying demand.

- A breakout above $18.50 might result in $28, with $50 nonetheless in play if momentum holds.

Avalanche (AVAX) has been sitting actual quiet recently—however typically quiet isn’t a nasty factor. With the value floating round $17.88 right this moment (a tiny 0.5% transfer), it’s been slowly tightening up above key help. And actually? It’s beginning to appear to be a breakout’s brewing. That falling wedge sample on the weekly chart? Yeah, it’s trying textbook.

Wedge Stress Is Constructing—And $20’s Proper There

Should you zoom out a bit, AVAX has been caught inside a falling wedge for what appears like endlessly. Decrease highs, increased lows, traditional compression. However right here’s the place it will get spicy: momentum’s flatlining, quantity’s cooling… and that’s normallythe calm earlier than one thing breaks. Value is hovering simply above $18 proper now, and if it will probably punch via $18.50 and shut above that on the weekly? That’s if you begin speaking $28, possibly even $48 if momentum sticks round.

Not everybody sees it but. However Ty, a kind of chart-watchers on X, says $20 might come as quickly as this month. And actually? He won’t be flawed.

On-Chain Exercise’s Exploding

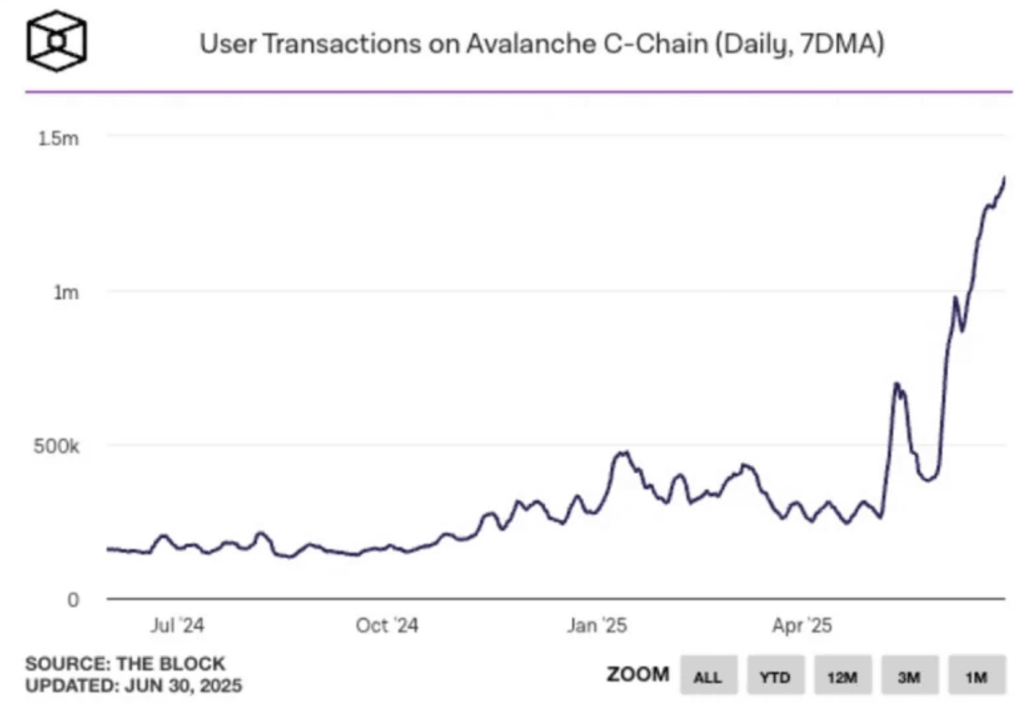

Whereas value motion’s been dragging its toes, Avalanche’s community has been on a tear. Day by day C-Chain transactions simply blew previous 1.5 million—that’s not just a few month-to-month spike, it’s an all-time excessive. And get this: that quantity doesn’t even embody Avalanche’s subnets or different chains. Simply C-Chain alone.

When on-chain use begins heating up earlier than value strikes, it’s normally a very good signal. That sort of community demand tends to pull the value up with it will definitely. It’s occurred earlier than… and we is likely to be seeing it occur once more.

The Actual Take a look at? $50 Resistance—and It’s Nonetheless in Sight

Let’s not get forward of ourselves, although. $50’s nonetheless a stretch—however it’s not off the desk. Analyst BullSignal factors out that $50 marks a breakdown degree from previous cycles. It’s a sticky zone, yeah, but additionally a magnet. First, although, AVAX must deal with enterprise at $20, then grind previous $24–$28. Solely then do the bulls get an actual shot at retesting $50.

Oh, and on the BTC pair? AVAX/BTC is hanging round an enormous trendline help that’s held for greater than a yr. If that degree bounces, and AVAX positive aspects power versus Bitcoin, it might give the USD pair the additional gasoline it wants.

Last Ideas

AVAX isn’t making headlines—but. However between the wedge setup, the rising on-chain demand, and help ranges holding agency, the items are positively falling into place. If it clears resistance quickly, don’t be shocked to see AVAX again within the $28 zone… and even making a transfer on $50 someday this yr.