Bitcoin (BTC) costs proceed to hover round $108,000 following a minor 0.33% acquire within the final 24 hours. The flagship cryptocurrency continues to carry regular inside a broader consolidation vary between $100,000 and $110,000, reflecting a interval of indecision out there. Amidst the present market standing, well-liked buying and selling knowledgeable with X username Daan Crypto has highlighted key liquidity clusters that might play a big position in shaping Bitcoin’s short-term value motion.

The Imminent Bitcoin Battle Fronts: $107,000 And $110,500

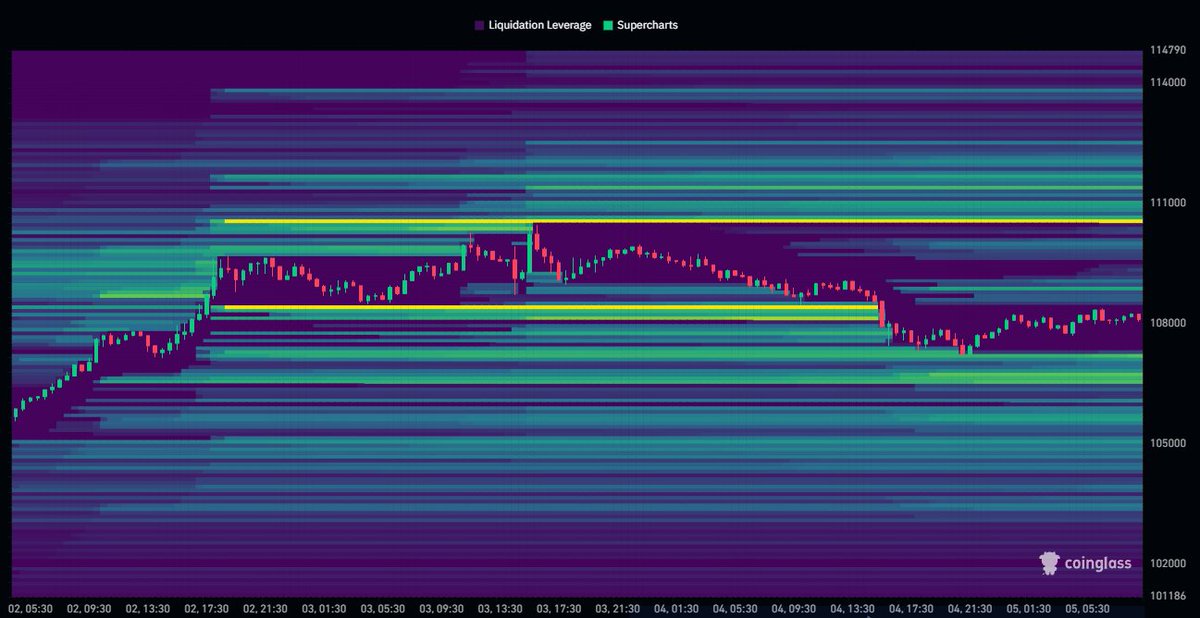

In an X submit on July 5, Daan Crypto shares a important perception on Bitcoin’s potential value motion relative to liquidity ranges. With information from Coinglass, the famend analyst explains that Friday’s value exercise led to a large-scale liquidation of leveraged positions centered across the $108,000 area. Following this growth, buyers’ curiosity is now targeted towards new liquidity zones, forming round $107,000 and $110,500.

Of the highlighted areas, the $107,000 area seems to be serving because the instant assist, with some merchants defending positions that survived the current liquidation. Subsequently, BTC is more likely to expertise a short-term rebound upon retesting this degree. Nonetheless, a value dip under $107,000 would set off giant scale liquidations forcing costs to areas as little as $100,000 consistent with current range-bound motion.

In the meantime, $110,500 is rising as a near-term resistance the place potential promote stress or brief entries may stack up, particularly if Bitcoin makes an attempt one other breakout. A profitable value shut above this degree would remove a number of brief positions inducing a brief squeeze that might end in Bitcoin swiftly transferring previous its present all-time excessive of $111,970 into uncharted value territory.

Total, the BTC market seems to be stabilizing inside the $107,000–$110.5,000 zone following Friday’s sharp liquidation sweep. This sideways value motion usually units the stage for a swift breakout or breakdown.

Bitcoin Trade Leverage Reaches New Excessive

In different developments, CryptoQuant information reveals that Bitcoin merchants are exhibiting excessive market urge for food because the estimated leverage ratio throughout all exchanges has reached a brand new yearly excessive of 0.27. This metric which tracks the quantity of open curiosity relative to alternate BTC reserves reveals an elevated danger conduct as merchants are more and more deploying borrowed capital in anticipation of bigger value actions.

In the meantime, the premier cryptocurrency continues to commerce round $108,232 reflecting market beneficial properties of 0.70% and 6.41% on the weekly and month-to-month chart, respectively. With a market cap of $2.15 trillion, Bitcoin retains a market dominance of 64.6% as the biggest digital asset on the earth.

Featured picture from Pexels, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.