In what has been described as the biggest each day motion of cash aged ten years or extra in Bitcoin’s historical past, a long-dormant whale pockets transferred 80,000 BTC on Friday.

This historic transaction marks the biggest motion of previous cash in eight years. It despatched ripples by the crypto market and has reignited issues over promoting stress from long-term holders.

Bitcoin Market Shocked as Early Miner Strikes $8.6 Billion in BTC

An extended-dormant BTC whale, believed to be an early miner, shook the crypto market on Friday. The entity moved 80,000 BTC—price roughly $8.6 billion—throughout 4 separate transactions of 10,000 BTC every.

In line with Arkham Intelligence, the cash, which had been untouched for over 14 years, started shifting early Friday morning and have been absolutely despatched to new addresses by 15:00 UTC. This has been dubbed one of many largest single-day actions of decade-old cash in BTC historical past.

This entity managed 161,326 BTC, at the moment valued at over $17.4 billion. With 80,000 BTC moved, 120,326 BTC nonetheless stay untouched within the whale’s pockets.

$110,000 Liquidity Alerts Attainable Rebound

The motion of long-held cash like that is usually considered as a bearish sign. The transfers triggered a wave of sell-offs throughout the BTC market, pushing the king coin to shut across the $107,000 value area on Friday.

Making an attempt to recuperate from the bearish influence, the coin trades at $108,196, nonetheless down a modest 1% over the previous 24 hours.

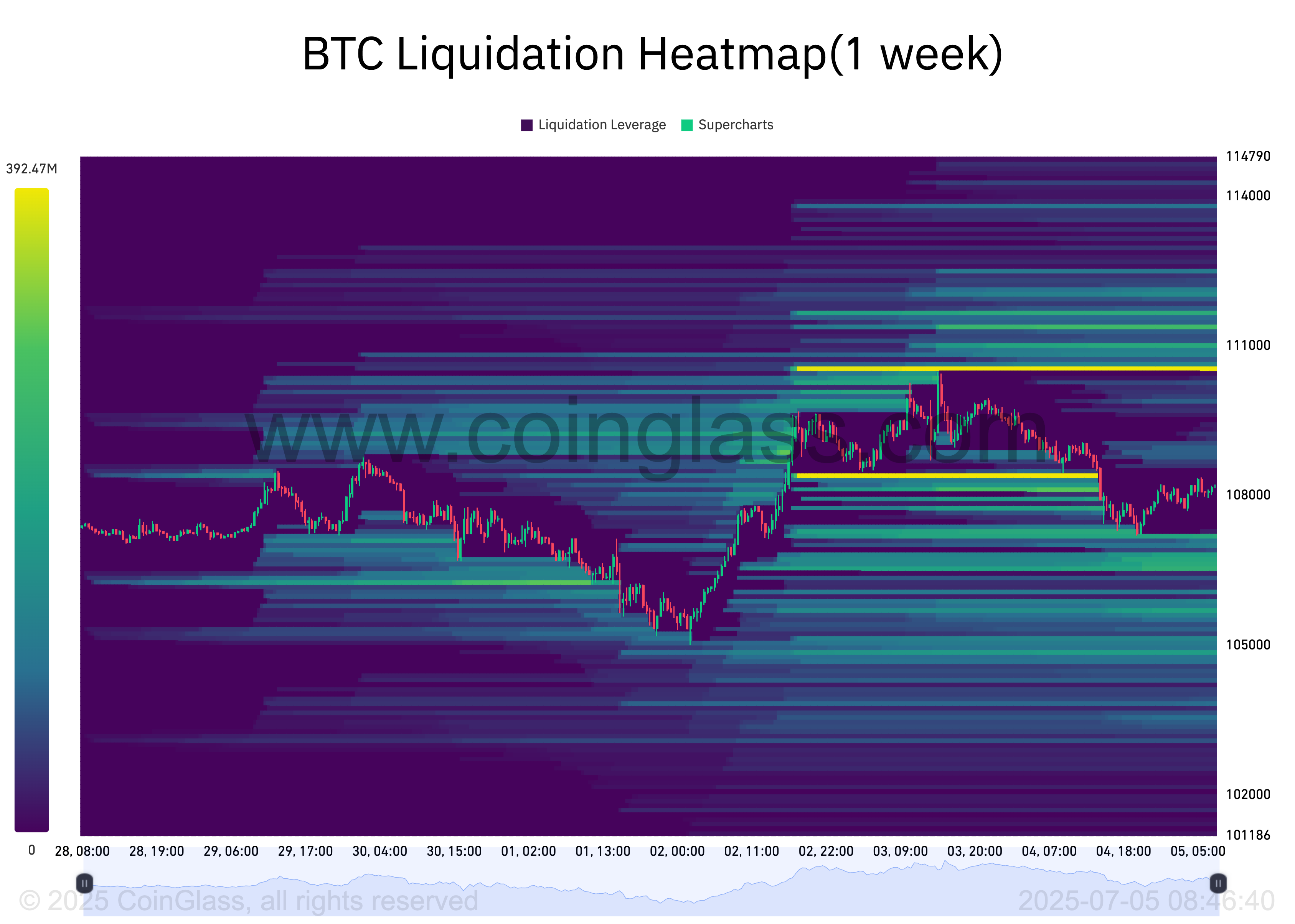

Nevertheless, regardless of the short-term bearish stress, on-chain knowledge suggests bullish energy stays intact. In line with Coinglass, BTC’s liquidation heatmap exhibits a dense liquidity cluster across the $110,567 value mark.

Liquidation heatmaps are instruments for figuring out value ranges at which massive clusters of leveraged positions are more likely to be liquidated. These maps spotlight areas of excessive liquidity, typically color-coded to point out depth, with brighter zones representing bigger liquidation potential.

These liquidity zones act like magnets for value motion, as markets naturally transfer towards them to set off cease orders and open new positions.

In BTC’s case, the liquidity cluster across the $110,567 stage indicators sturdy dealer curiosity in shopping for or masking quick positions at that value. This setup might propel a near-term rally if bullish momentum overpowers the sell-side stress within the BTC spot markets.

Futures Merchants Stay Resilient

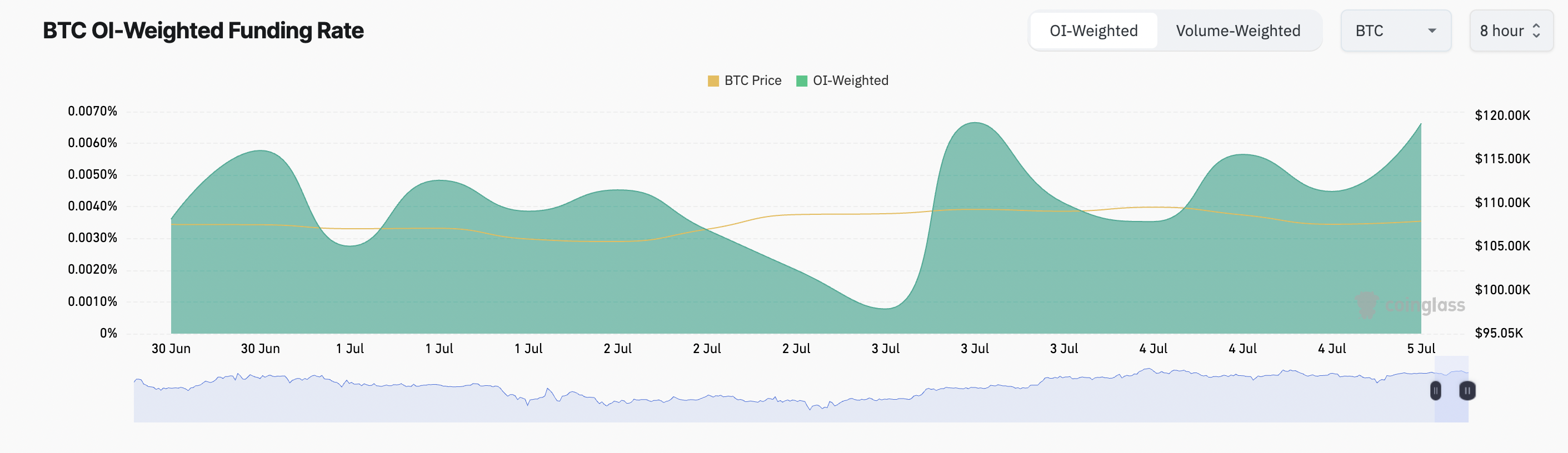

BTC’s funding price has remained constructive regardless of the latest whale exercise. As of press time, it’s 0.006%, indicating that futures merchants are nonetheless bullish and sustaining lengthy positions on the main coin.

A funding price is a periodic fee exchanged between merchants in perpetual futures markets, designed to maintain contract costs aligned with the spot market. When the funding price is constructive, merchants holding lengthy positions pay these holding quick positions, signaling a bullish sentiment available in the market.

Conversely, a unfavourable funding price means quick positions are paying longs, reflecting elevated bearish sentiment and expectations of a value decline.

In BTC’s case, the regular constructive funding price—even after the large motion of long-dormant cash—means that merchants stay assured within the asset’s long-term energy.

BTC Holds Floor After Whale Strikes: Is $110,000 the Subsequent Goal?

Though the awakening of the dormant market spooked some merchants and prompted them to promote, the metrics assessed above nonetheless present that the BTC market is absorbing the bearish stress from the availability spike and not using a full sentiment shift. There was no full sentiment shift, as many merchants are nonetheless positioning for additional upside.

If this bullish sentiment holds, the coin might regain energy and rally towards $109,267. A break above this stage might immediate a run towards $110,442.

Nevertheless, if selloffs spike, Bitcoin’s value might slip to $106,259. If there’s a stronger bearish momentum, the value might additional drop in the direction of $103,952.

Disclaimer

According to the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.