Bitcoin’s climb previous $110,000 this week has reignited a recent spherical of bullish calls. Costs hit $110,150 on July 3 and traded a bit previous $108,000 stage eventually verify, exhibiting a small 0.41% dip in 24 hours however a 1.20% rise over seven days.

Associated Studying

This regular transfer greater has drawn voices from social media, stirring debate on whether or not Bitcoin is actually underpriced or at risk of slipping again beneath key ranges.

Undervalued At $110K

In accordance with Altcoin Each day, Bitcoin at $110,000 is “undervalued,” with the analysts arguing there’s loads of room to run. That daring declare has followers cheering, and a few even dream of $1,000,000 down the highway.

Bitcoin at $110k is undervalued! [screenshot this]

— Altcoin Each day (@AltcoinDaily) July 3, 2025

Different customers have pushed again, asking what on‑chain information or metrics again up this view. They level out that till Bitcoin clears resistance at $110,500, an actual breakout isn’t confirmed.

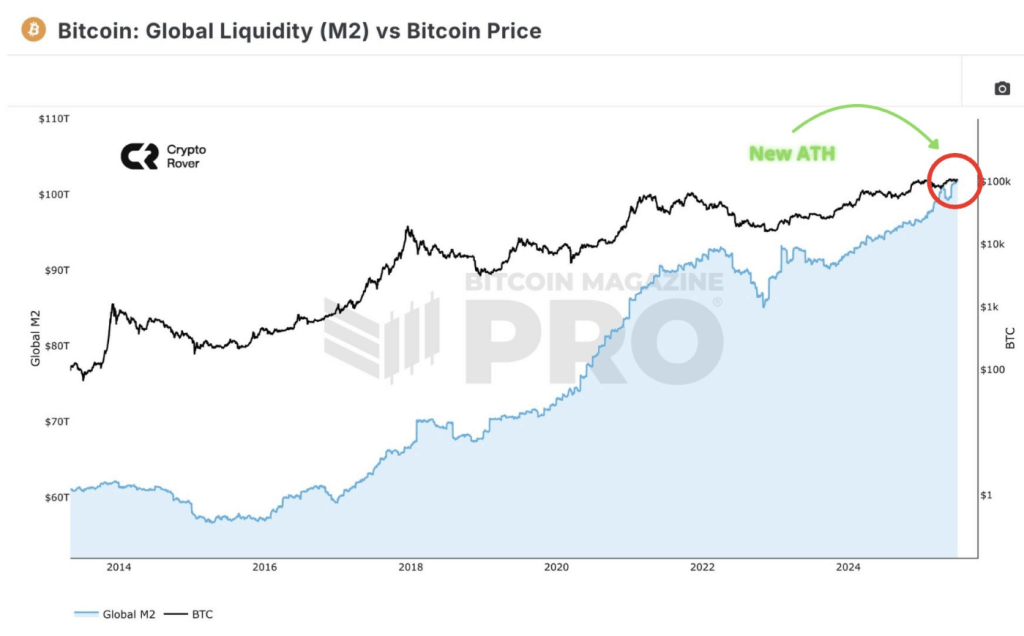

Based mostly on studies from market trackers, world liquidity is on the rise. Market observers picked up on that, saying more money floating round can push Bitcoin greater.

Rising liquidity typically fuels massive strikes in threat belongings. Nonetheless, merchants control futures funding charges and miner promote‑strain, on the lookout for clues if a pullback is brewing.

International Liquidity simply hit a brand new ATH.

Bitcoin will comply with! pic.twitter.com/gH1Kl2D1Zw

— Crypto Rover (@rovercrc) July 3, 2025

Combined Views On-line

Some followers argue that inflation and new tariffs may dampen Bitcoin’s rally. Others word that central banks are nonetheless shopping for time earlier than any charge hikes, which can give crypto one other increase.

The again‑and‑forth on social media reads like a mini warfare room, with brief feedback and deep threads floating round. Loads of voices, however few laborious solutions.

Previous Bull Runs

Altcoin Each day wasn’t shy about previous calls both. Simply days earlier, they stated that after Bitcoin tops $150,000, traders would want they’d purchased extra at decrease costs. That form of hindsight discuss will be stirring, nevertheless it doesn’t change the right here‑and‑now charts or the macro calendar.

Exec Calls For Hedge

Based mostly on remarks by Matt Hougan, Chief Funding Officer at Bitwise, now may very well be a great time to purchase Bitcoin. Hougan pointed to Ray Dalio’s warnings about US debt, which has swelled previous $7 trillion in annual spending in opposition to $5 trillion in income.

With every family on the hook for roughly $230,000, Dalio says holding Bitcoin can act as a hedge in opposition to future cash‑print dangers.

Associated Studying

Value Motion On Crosshair

Buyers can be watching each value motion and massive‑image occasions. A stable break above $110,500 would possibly pull in additional consumers. But when inflation surprises on the upside or tariffs hit tougher, odds may shift shortly.

For now, Bitcoin’s story remains to be unfolding—and the following few days may inform us lots about the place it’s headed.

Featured picture from Meta, chart from TradingView