- BNB is forming a bullish cup-and-handle sample with a possible breakout goal close to $1,135.

- Token burns and rising DEX + stablecoin exercise are including sturdy basic help.

- BNB Sensible Chain now rivals Solana and Ethereum in quantity and ranks 4th in blockchain profitability.

Binance Coin (BNB) has kinda been drifting sideways all yr. Not thrilling, not dramatic… simply floating. However that may not be a foul factor. In truth, if the charts are proper, this boring stretch could possibly be the calm earlier than a $655-to-$1,000 breakout wave earlier than 2025 closes.

The Calm Appears to be like Like a Cup—With a Deal with

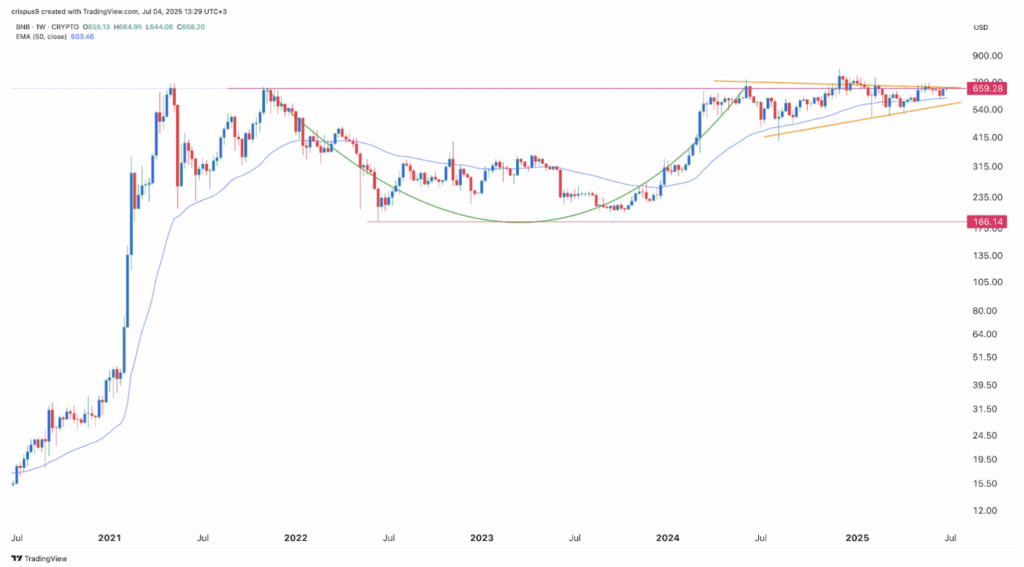

So let’s discuss patterns. In keeping with technical nerds, BNB’s present value motion could be a part of an excellent ol’ “cup-and-handle” setup. Feels like kitchenware, however merchants find it irresistible. The form features a huge U-curve (the cup) adopted by a tighter consolidation part (that’s the deal with).

Proper now, BNB’s higher resistance sits at round $660, and the rounded backside dropped all the way in which to $185—giving that cup some severe depth at $475. Now we’re within the deal with half, which is forming a triangle form. If this performs out like typical setups do, the strains of that triangle will quickly meet—and that’s when breakouts normally occur.

If the breakout comes and pushes previous the $1,000 mark, the complete transfer may goal for $1,135. That’s primarily based on simply including the cup depth to the breakout level. Simple arithmetic. Wild outcomes.

Billion-Greenback Burn Incoming?

Right here’s the place it will get spicier. BNB has a deflationary angle. Yep, it burns its personal tokens, which is crypto-speak for “makes them disappear ceaselessly.” There’s a real-time fee-based burn and a quarterly one primarily based on what number of blocks the chain spits out.

To date, over $174 million value of BNB has been burned. However developing? A burn value greater than $1 billion. That’s an enormous dent in circulating provide—and provide drops have a tendency to spice up costs, particularly in bullish situations.

Additionally, long run, the objective is to shrink the circulating provide from 140 million to only 100 million tokens. That’s tight.

BSC Is Quietly Crushing the DEX Recreation

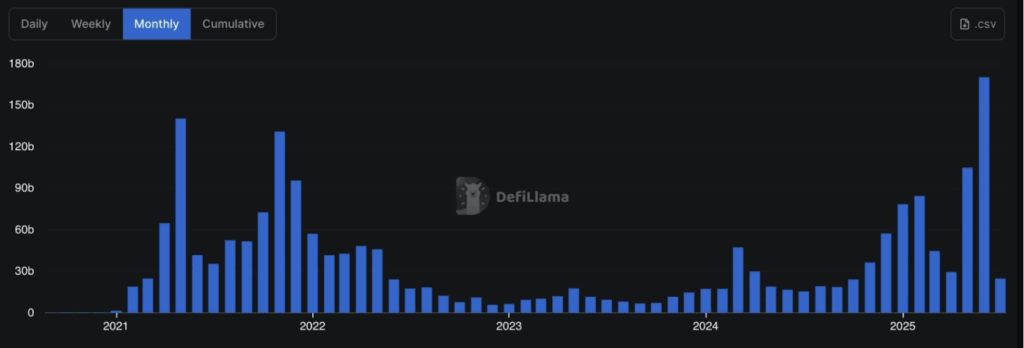

BNB Sensible Chain (BSC) isn’t simply vibing—it’s dominating. When it comes to decentralized change (DEX) quantity, it’s beating some huge names. On a single Friday, BSC noticed $6 billion in DEX quantity. Solana? $2 billion. Ethereum? $1.79 billion. Base? Not even shut.

Over the past 30 days, BSC hit $179 billion in quantity. That’s miles forward of Solana ($61B) and Ethereum ($56B). PancakeSwap’s nonetheless the massive canine right here, by the way in which.

Stablecoins, Too? Yep

There’s extra. The stablecoin motion on BNB Chain is choosing up quick. Artemis information reveals stablecoin provide on BNB Chain simply handed $10 billion. And in simply 30 days, stablecoin tackle depend spiked 75% to hit 12.6 million.

Adjusted transaction quantity hit a large $334 billion. That’s not small. BNB Chain is now the fourth most worthwhileblockchain on the market—raking in $20 million in charges over the previous yr.

So yeah, BNB could be snoozing proper now, however this consolidation? It’s a part of the larger cup-and-handle sport. Add in rising token burns, insane DEX dominance, and a booming stablecoin ecosystem—and also you’ve received a coin that could be quietly prepping for a serious breakout.