- Chainlink is caught in a $12.50–$15.00 vary, with no clear breakout but.

- Derivatives information exhibits fading curiosity, as merchants wait on route.

- A break above $15.30 may launch LINK towards $18–$22; failing help dangers a fall to $10.

Chainlink (LINK) is kinda caught in limbo proper now. It’s floating round $13.26—barely moved the needle with a 0.76% achieve on the day. Quantity’s hovering at $157 million, which isn’t a lot to shout about. And actually? The value motion’s been caught in a sideways chop between $12.50 and $15.00 for weeks now, ever since June kicked off.

Yeah, we had that candy run as much as $22 again in December 2024, however since then? Decrease highs… and extra hesitation. Bulls simply haven’t proven up in power. Not but, anyway.

LINK’s Taking part in Ping-Pong Between $12.50 and $15.00

To be honest, help round $12.50 has held up like a champ—examined time and again in Q2. Each dip down there’s been purchased up. However on the flip aspect, $15.00? It’s like working right into a brick wall. Rejected. Once more. And once more. Ali Martinez, one of many extra tuned-in voices on X, identified $15.30 as the true line within the sand. If LINK can punch by that? Completely different story.

Till then, it’s simply ping-ponging on this tight little channel.

Derivatives Say: “Meh”

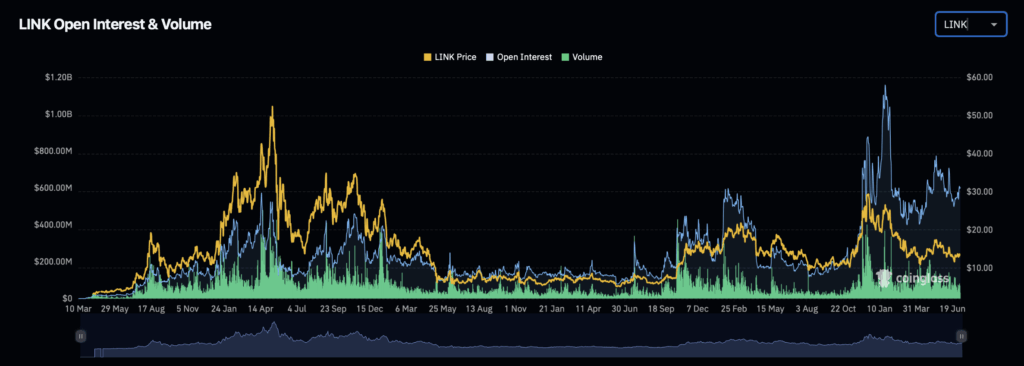

So right here’s the factor—LINK’s derivatives market is exhibiting indicators of chilly ft. Open curiosity hit over $1.1B earlier this yr, however now? It’s cooled off to about $590 million. That’s an enormous drop. Mainly, merchants are taking part in it protected. Nobody’s making huge leveraged bets proper now.

Trying on the historic chart, it’s clear that main worth strikes have all the time adopted huge quantity spikes—suppose April ‘21, October ‘21, and early ‘24. However currently? Quantity’s been snoozing. So until we see a giant bounce in exercise, don’t anticipate fireworks.

Might $18 Be Subsequent?

Right here’s the place issues get fascinating. If LINK one way or the other claws above $15.30—and that’s a giant if—it may kick off a run towards $18. Possibly even again to $20 or $22 if issues actually warmth up. However till that degree will get cleared with quantity backing it? That is simply chop.

Now if the underside falls out and we lose $12.50, be careful. A drop towards $10 isn’t outta the query. That’s a psychological degree, plus a stable ground from the previous.

Chainlink’s nonetheless laying down good fundamentals—rising oracle integrations and stable dev work—however worth wants a purpose to maneuver. A convincing breakout above $15.30 could possibly be that purpose. In any other case? Extra ready.