Prime Tales of The Week

Ripple applies for US banking license, becoming a member of crypto rush for legitimacy

Ripple CEO Brad Garlinghouse confirmed on X on Wednesday that the corporate is making use of for a license with the US Workplace of the Comptroller of the Forex (OCC), following an earlier report by The Wall Road Journal.

“True to our long-standing compliance roots, Ripple is making use of for a nationwide financial institution constitution from the OCC,” he wrote.

Garlinghouse stated if the license is authorised, it could be a “new (and distinctive!) benchmark for belief within the stablecoin market” because the agency could be underneath federal and state oversight — with the New York Division of Monetary Providers already regulating its Ripple USD stablecoin.

Customary Chartered expects Bitcoin to hit new highs of $135K in Q3

International financial institution Customary Chartered is bullish on Bitcoin for the remainder of the 12 months, citing growing company treasury shopping for and robust exchange-traded fund inflows.

Customary Chartered expects Bitcoin to print new highs of $135,000 by the top of the third quarter after which break $200,000 by the top of the 12 months, the financial institution’s digital asset analysis head, Geoff Kendrick, stated in a Wednesday report shared with Cointelegraph.

“Because of elevated investor flows, we imagine BTC has moved past the earlier dynamic whereby costs fell 18 months after a ‘halving’ cycle,” Kendrick stated, including that the frequent halving pattern would have led to cost declines in September or October 2025.

FTX property asks courtroom to freeze payouts in ‘restricted’ nations

FTX’s chapter property has raised issues over payouts to collectors in nations with ambiguous or restrictive cryptocurrency laws.

On Wednesday, the FTX property filed a movement with the US Chapter Court docket for the District of Delaware, searching for authorization for the FTX Restoration Belief to freeze distributions to collectors in “doubtlessly restricted overseas jurisdictions.”

The jurisdictions — 49 nations in complete — have unclear or restrictive crypto legal guidelines, doubtlessly posing dangers as a consequence of complicated cross-border authorized implications.

“Distributions made by or on behalf of the FTX Restoration Belief into jurisdictions in violation of those authorized restrictions could set off fines and penalties, together with private legal responsibility for administrators and officers, and/or legal penalties as much as and together with imprisonment,” the submitting reads.

Solana bot rip-off on GitHub steals crypto from customers

A GitHub repository posing as a reputable Solana buying and selling bot has been uncovered for reportedly hiding crypto-stealing malware.

In response to a Friday report by blockchain safety agency SlowMist, the now-deleted solana-pumpfun-bot repository hosted by account “zldp2002” mimicked an actual open-source software to reap consumer credentials. SlowMist reportedly launched the investigation after a consumer discovered that their funds had been stolen on Thursday.

The malicious GitHub repository in query featured “a comparatively excessive variety of stars and forks,” SlowMist stated. All code commits throughout all its directories had been made about three weeks in the past, with obvious irregularities and a scarcity of constant sample that, based on SlowMist, would point out a reputable mission.

Authorities within the United Arab Emirates (UAE) have reportedly taken Ildar Ilham, the founding father of the decentralized finance protocol WhiteRock Finance, into custody as a part of allegations over a $30-million rip-off by way of ZKasino.

In response to a Thursday X put up from crypto sleuth ZachXBT, UAE authorities arrested Ilham in reference to an investigation into “wide-scale fraud” surrounding ZKasino. ZachXBT’s report recommended that WhiteRock was related to ZKasino’s $30 million fundraising.

Learn additionally

Options

Satoshi Nakamoto saves the world in an NFT-enabled comedian ebook collection

Options

Gen Z and the NFT: Redefining Possession for Digital Natives

The alleged investor rip-off adopted ZKasino’s launch in April 2024, with the platform promising an airdrop of its native token to pick out customers. Nevertheless, experiences point out that greater than a 12 months later, the funds nonetheless haven’t been returned.

Winners and Losers

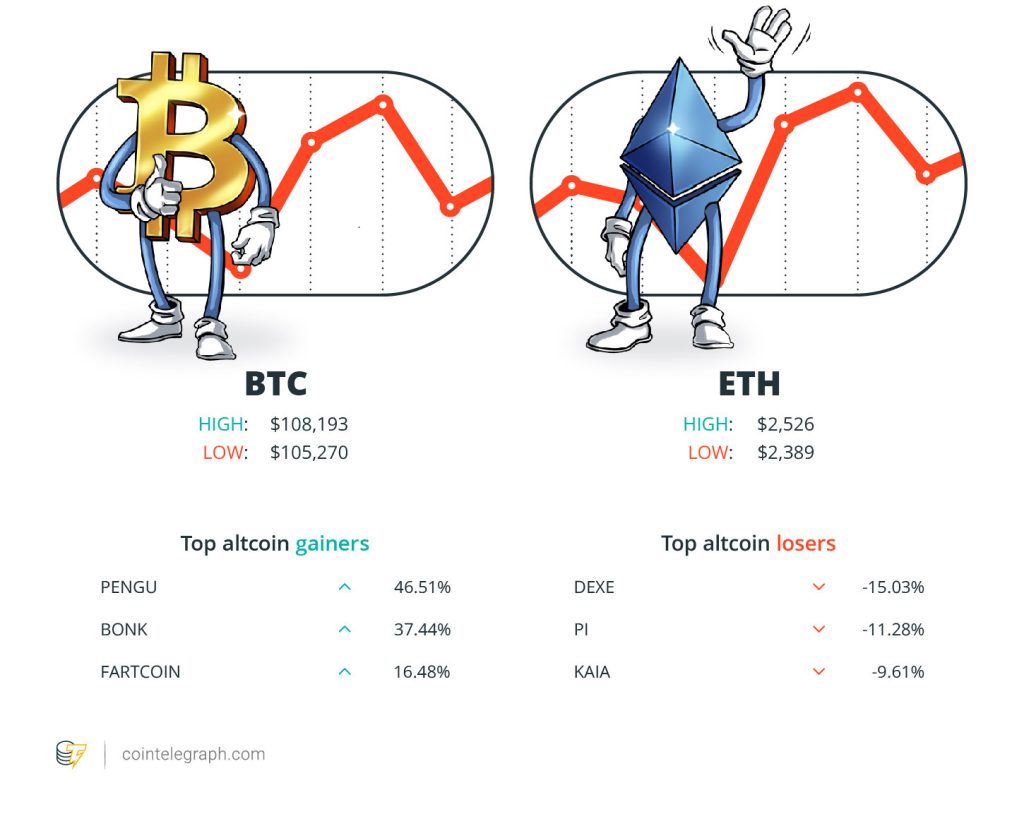

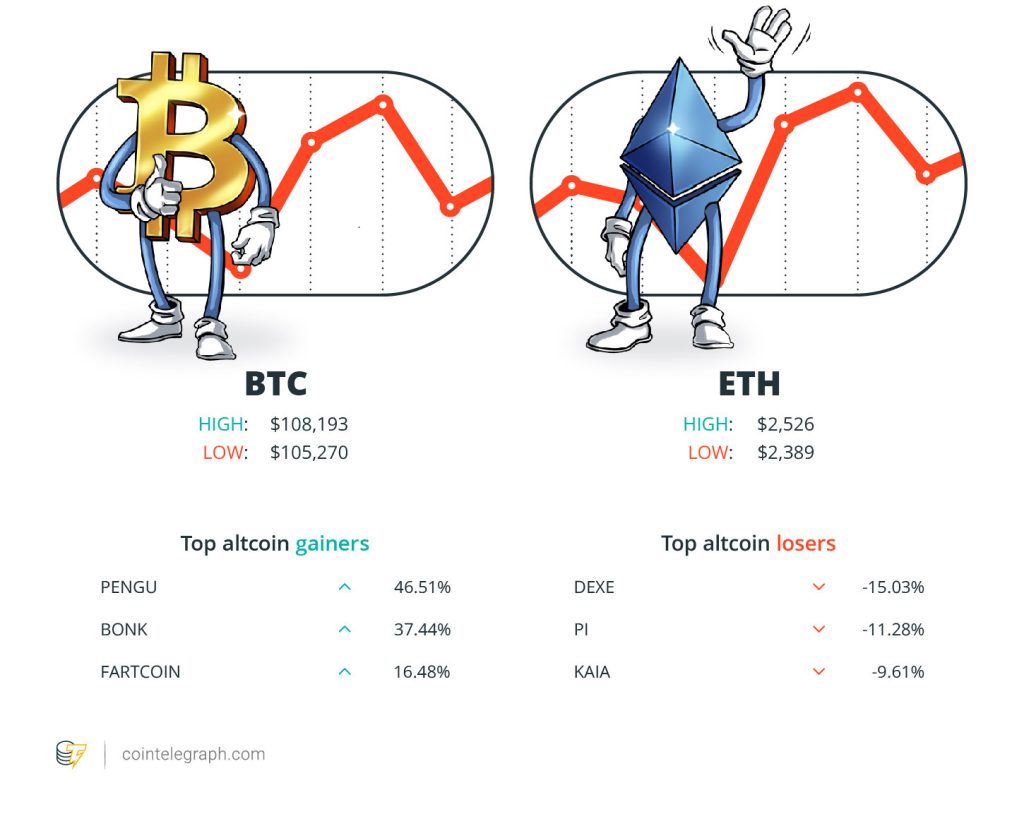

On the finish of the week, Bitcoin (BTC) is at $108,193, Ether (ETH) at $2,526 and XRP at $2.22. The whole market cap is at $3.33 trillion, based on CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Pudgy Penguins (PENGU) at 46.51%, Bonk (BONK) at 37.44% and Fartcoin (FARTCOIN) at 16.48%.

The highest three altcoin losers of the week are DeXe (DEXE) at 15.03%, Pi (PI) at 11.28% and Kaia (KAIA) at 9.61%. For more information on crypto costs, be certain that to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“Overseas stablecoin issuers want to significantly contemplate a license underneath MiCA as latest supervisory actions in Germany level to a strict enforcement of the foundations.”

Peter Märkl, group basic counsel at Bitcoin Suisse

“People who find themselves engaged on cryptography really want to extra actively consider cryptography as one thing that has social and ethical implications.”

Vitalik Buterin, co-founder of Ethereum

“My complete purpose is to make issues clear from the regulatory facet and provides individuals a agency basis upon which to innovate and are available out with new merchandise.”

Paul Atkins, chair of the US Securities and Change Fee

“Spot quantity has cooled, taker purchase strain has weakened, and profit-taking has intensified — particularly amongst short-term holders who rode the transfer from sub-$80,000 ranges.”

Bitfinex analysts

“Provided that stablecoin issuers basically operate as banks, they need to be topic to the identical laws as banks with the intention to cut back systemic danger.”

Letitia James, lawyer basic of New York

“With a brand new month and quarter, we frequently see a uneven begin after which worth chooses a path afterward. Give it a while to play out and look ahead to confirmations.”

Daan Crypto Trades, pseudonymous crypto dealer

Prediction of The Week

DOGE double-bottom sample hints at worth rebound to $0.25

Dogecoin is buying and selling close to $0.17, staging a modest rebound after fluctuating between $0.13 and $0.25 since February. Regardless of its sideways motion, DOGE stays the seventh most traded crypto by 24-hour buying and selling quantity. Traders proceed to watch whether or not the memecoin can reclaim the important thing psychological stage of $0.25.

The every day chart reveals DOGE tracing a double backside sample, a traditional reversal sign, with a help base at $0.15 established over latest weeks. This long-term setup hints at a possible climb to $0.25, a goal that would materialize earlier than anticipated.

Over the previous two months, DOGE has been confined inside a descending channel, a sample indicating indicators of a possible uptrend breakout. Pseudonymous crypto analyst Dealer Tardigrade posted an evaluation on X, highlighting a decisive transfer above the 50-day trendline, adopted by a profitable retest and an uptrend continuation.

FUD of The Week

$20M crypto rip-off sufferer who sued Citibank says 2 extra banks liable

The self-claimed sufferer of a crypto romance rip-off who not too long ago sued Citibank for failing to catch purple flags has simply filed a second lawsuit concentrating on two different banks.

Michael Zidell sued East West Financial institution and Cathay Financial institution in a California federal courtroom on Tuesday, accusing the banks of turning “a blind eye to their statutory duties and obligations.”

He claimed he despatched 18 transfers totalling practically $7 million to the alleged scammers’ account at East West Financial institution, and made 13 transfers totalling over $9.7 million to an account at Cathay Financial institution.

Twister Money co-founder retains testimony plans unclear forward of trial

Roman Storm, one of many co-founders and builders behind the cryptocurrency mixing service Twister Money, appeared in a video interview as his US legal trial is anticipated to start in lower than two weeks.

In an interview launched Wednesday by Crypto In America, Storm stated his authorized staff supposed to deal with at trial the allegations that he had personally profited from illicit funds by way of his function at Twister Money.

Learn additionally

Options

12 minutes of nail-biting pressure when Ethereum’s Pectra fork goes dwell

Options

Decade after Ethereum ICO: Blockchain forensics finish double-spending debate

Nevertheless, he declined to say whether or not he would testify in his personal protection over costs of cash laundering, conspiracy to function an unlicensed cash transmitter, and conspiracy to violate US sanctions.

“That is the choice that we are going to make,” stated Storm on taking the stand in courtroom. “I don’t have a 100% reply proper now. I could or could not.”

IRS division failed to satisfy requirements for seizing crypto, says watchdog

A US authorities watchdog has really useful reforms to the Inside Income Service (IRS) legal investigation division’s dealing with of digital belongings, citing repeated failures to observe established protocols.

In a Tuesday report, the US Treasury Inspector Normal for Tax Administration stated its analysis of the IRS legal investigation division revealed shortcomings across the seizure and safeguarding of digital belongings.

In response to the federal government watchdog, the IRS did not observe all pointers between December 2023 and January 2025 for seizure memorandums round confiscated crypto, detailing the addresses, dates and quantities.

Prime Journal Tales of The Week

Bitcoin vs stablecoins showdown looms as GENIUS Act nears

Stablecoins will cement the US greenback’s dominance as a world reserve forex, however Bitcoin goals to interchange it. Which one will win?

Faux JD stablecoins, scammers impersonate Solana devs: Asia Specific

JD says it hasn’t launched a stablecoin, crypto specialists be a part of investigation into South Korea’s former first woman, and extra.

Rising numbers of customers are taking LSD with ChatGPT: AI Eye

Amid experiences of bizarre individuals turning into delusional utilizing AI, is it a very good concept to take acid with ChatGPT as your Shaman?

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Employees

Cointelegraph Journal writers and reporters contributed to this text.