- Hyperliquid DEX quantity dropped from June highs, however token buying and selling nonetheless climbed previous $1.93B YTD.

- Derivatives-fueled progress slowed after liquidations, whereas PancakeSwap and spot DEXes gained steam.

- HYPE surged 390% in Q2, however indicators now level to doable pullback—although excessive community exercise would possibly soften the autumn.

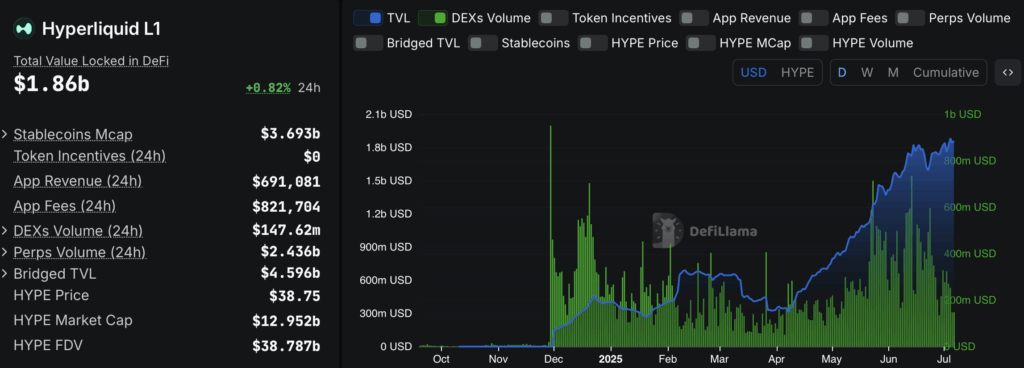

Hyperliquid actually made waves earlier this 12 months. Little doubt. Its DEX volumes in Could and June had been off the charts. However recently? Issues have cooled down a bit—and never in a refined method both.

At the same time as DeFi appeared to bounce again throughout the board, Hyperliquid’s DEX volumes slipped. In keeping with DeFiLlama, the platform noticed highs above $714M in Could and even managed to push previous $735M mid-June. Quick-forward to the top of June and—increase—day by day quantity tumbled down to simply $134.8M.

Yeah, that’s a steep drop.

Quantity over the past two days has been hovering round $270M, which, whereas nonetheless first rate, is a far cry from these document numbers. That’s a couple of third off its peak, if you happen to’re counting. In the meantime, legacy DEXes like PancakeSwap began choosing up steam once more, pulling extra merchants again their method. It’s like Hyperliquid misplaced a little bit of its edge within the shuffle.

Token Quantity’s Nonetheless Flexing

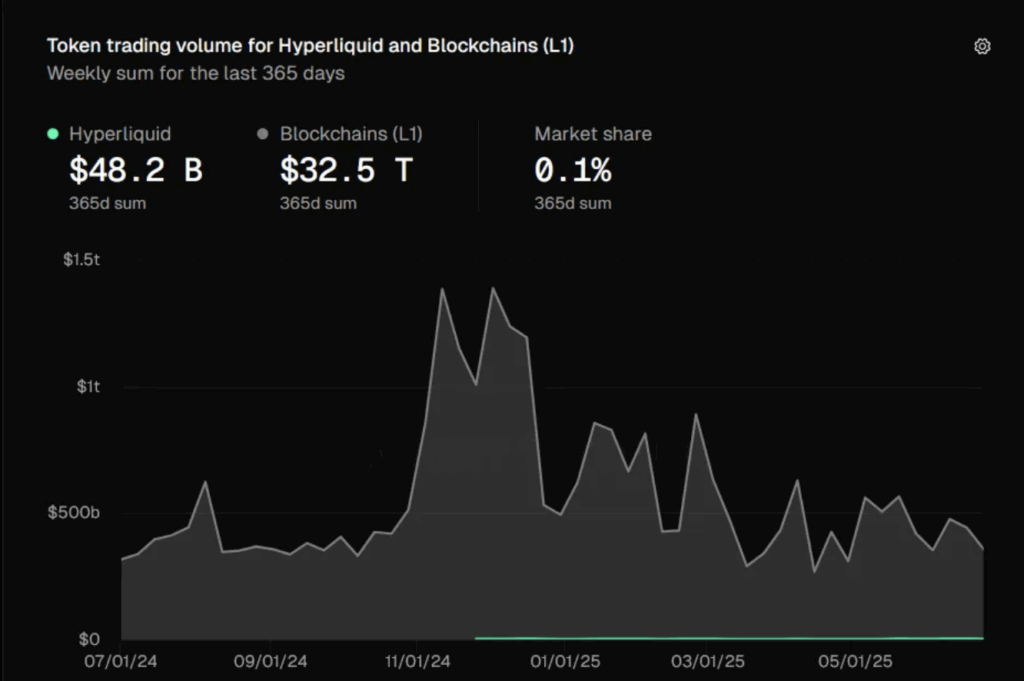

Regardless of the drop in DEX visitors, the Hyperliquid token itself is telling a unique story. TokenTerminal knowledge exhibits buying and selling quantity climbed from $1.5B in Dec 2024 to just about $1.93B—in order that’s a $430M soar year-to-date. Not dangerous, proper?

This progress in token quantity mirrors the community’s broader pattern since December. However right here’s the twist: the current slowdown? It truly kinda is smart.

Seems, Hyperliquid’s volumes have been closely tied to derivatives buying and selling—significantly when whales had been feeling spicy with leveraged bets. However that urge for food for danger took successful recently, due to wild worth swings and liquidations (yeah, even whales like James Wynn felt the sting).

And with extra customers chasing spot trades over on PancakeSwap and different OG DEXes, it appears to be like like some people are shifting focus towards long-term holds as an alternative of high-stakes leverage performs.

Nonetheless, even with all this, Hyperliquid holds simply 0.1% of the overall DeFi pie. That places it thirty first within the rankings by token quantity. Not tiny—however not precisely dominating both.

Is HYPE Set for a Nasty Pullback?

HYPE, the native token, had a killer run in Q2. From backside to high, it pumped 390%—which is kinda insane. However since mid-June, that rocket gasoline’s been working low. The RSI is sagging, hinting that possibly the bulls are working on fumes.

That stated, there’s a plot twist. The Cash Stream Index (MFI) simply ticked up over the previous few days—suggesting contemporary liquidity is coming in. Might be a second wind? Or simply hopeful consumers catching falling knives, we’ll see.

Now, it’s additionally price noting: lots of HYPE holders are deep in revenue. So yeah, a few of them would possibly begin cashing out. However quantity’s nonetheless robust, and that community exercise? It’s not simply hypothesis—it’s legit demand. That might put a little bit of a ground below the value, even when a pullback begins to kind.

In fact, July’s filled with unknowns. Market sentiment, macro stuff, you title it. Nonetheless, HYPE looks as if a kind of property the place what’s taking place on-chain may make or break what occurs subsequent.