Because the starting of June, Solana has traded sideways, consolidating inside a slender vary. The altcoin has confronted sturdy resistance at $158.80 and located assist at $141.97, making a number of unsuccessful makes an attempt to interrupt out in both path.

Nevertheless, this era of value stagnation has introduced a shopping for alternative for long-term holders (LTHs), who’re taking full benefit.

Solana Lengthy-Time period Holders Shrug Off Weak Value Motion

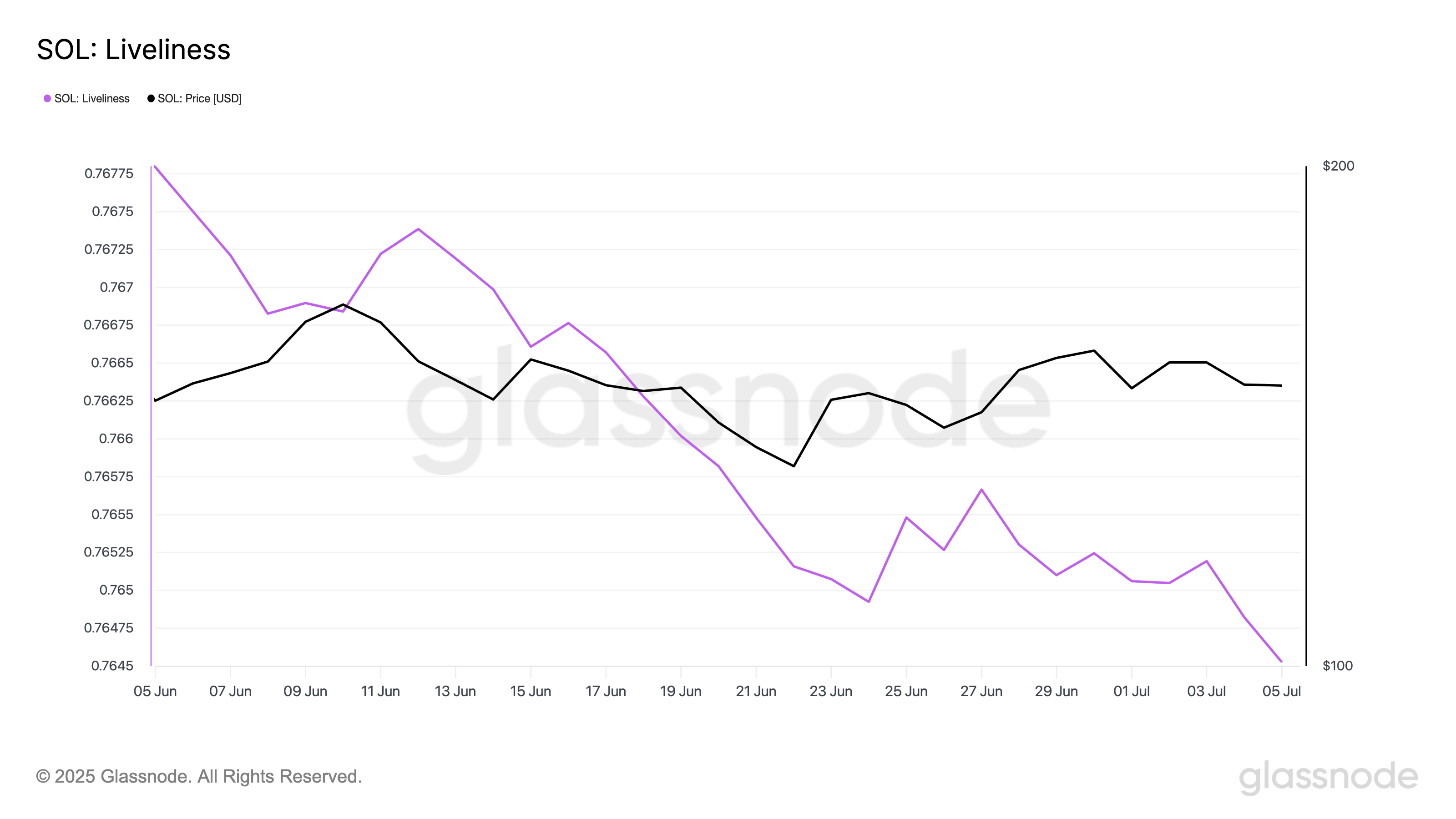

Glassnode’s knowledge exhibits that SOL’s Liveliness has trended downward since climbing to a 90-day excessive on June 4. This metric, which tracks the motion of beforehand dormant tokens, fell to a 30-day low of 0.764 yesterday, indicating a notable decline in sell-offs amongst SOL’s LTHs.

Liveliness measures the motion of long-held tokens by calculating the ratio of coin days destroyed to the whole coin days gathered. When it climbs, it means that extra dormant tokens are being moved or offered, typically signaling profit-taking by long-term holders.

Converesly, when Liveliness declines, it signifies that LTHs are shifting their belongings off exchanges and opting to carry.

For SOL, this pattern means that long-term holders stay assured within the prospect of a near-term rally and present little concern over the coin’s present lackluster efficiency.

Continued accumulation from these traders may construct the inspiration for a bullish breakout as soon as market sentiment shifts in a extra favorable path.

Solana Holders Stay “Hopeful”

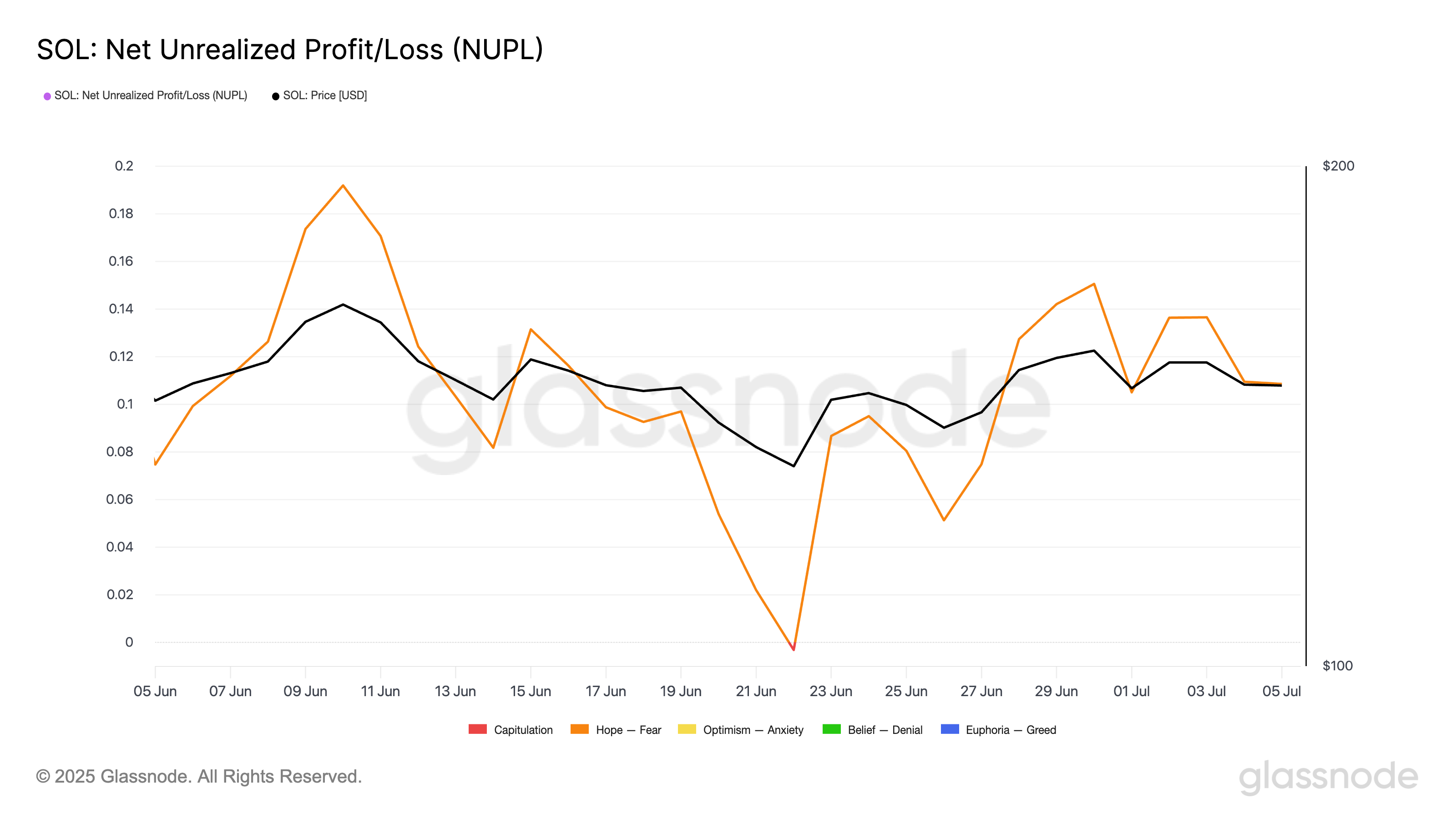

Furthermore, readings from SOL’s Internet Unrealized Revenue/Loss (NUPL) affirm the probability of a bullish breakout. Based on Glassnode, the metric has remained throughout the “hope” zone over the previous 30 days. At press time, it’s at 0.108.

The NUPL tracks the distinction between the whole unrealized good points and losses of traders primarily based on the worth at which cash had been final moved. It signifies whether or not holders are, on common, in revenue or loss and the way possible they’re to promote.

The “Hope” zone means that whereas many traders are again in revenue, they haven’t but begun taking income aggressively. As a substitute, they’re holding with the expectation of additional upward momentum.

This pattern indicators cautious optimism amongst SOL coin holders and sometimes marks the early phases of a possible bullish pattern.

SOL Bulls Eye $170 as Lengthy-Time period Holders Tighten Their Grip

At press time, SOL trades at $148.06. If the coin’s LTHs double down on their accumulation and historic patterns maintain, this might propel SOL’s value above the resistance at $158.80.

A succesful breach of this long-term resistance zone may lay the groundwork for a rally towards $170.

Nevertheless, if selloffs strengthen, SOL eyes a break under the assist flooring at $141.97. On this case, its value may fall to $123.49.

Disclaimer

In step with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.