In line with the newest Santiment report, the crypto market is coming into a important section, with a mixture of bullish on-chain alerts and cautionary sentiment indicators.

Whereas Bitcoin stays close to $109,000, Santiment notes that Ethereum, Solana, and XRP are displaying indicators of renewed energy amid whale accumulation and shifting investor habits.

The report, introduced throughout Santiment’s weekly livestream with Tony Edward (Pondering Crypto), breaks down the state of the market utilizing key metrics resembling MVRV ratios, whale holdings, social sentiment, and funding charges.

Santiment: Steady Begin to July, However Divergence Beneath

Santiment highlights that July started with modest good points for Bitcoin (+2.5%), whereas altcoins like Ethereum (+6%), Uniswap, Pepe, and Arbitrum posted stronger returns. The agency suggests this displays continued capital rotation into danger belongings as world liquidity situations enhance.

Santiment advises monitoring conventional markets just like the S&P 500 and gold for alerts which will spill over into crypto, particularly when these markets are additionally rallying.

Bitcoin’s MVRV Ratio Suggests Revenue-Taking Threat

Santiment’s MVRV knowledge reveals that Bitcoin merchants are, on common, in revenue, inserting the asset in what the agency calls “slight hazard territory.” Lengthy-term holders are up 18%, and short-term holders are up 2.8%. Though not but excessive, Santiment warns that if the ratio strikes towards the +30% vary, danger of a pullback will increase.

The report recommends aligning commerce horizons with MVRV ranges—short-term merchants nonetheless have room to function, whereas long-term buyers could wish to look ahead to higher entry factors.

Whales Accumulate Regardless of ETF Outflows

One among Santiment’s most bullish findings is the continued accumulation by Bitcoin whales. Over the previous week, wallets holding 10 to 10,000 BTC added greater than 25,000 BTC, and over the past three months, that determine rises to 160,000 BTC.

This accumulation has occurred whilst spot Bitcoin ETFs recorded their first web outflow in 14 days, totaling $342.2 million. Regardless of the streak break, Santiment emphasizes that 85% of buying and selling days since mid-April nonetheless noticed web inflows, underscoring sustained institutional demand.

Ethereum vs. Bitcoin: Indicators of a Lengthy-Awaited Breakout?

Santiment highlights a notable transfer on the ETH/BTC buying and selling pair, the place Ethereum gained 3.5% in only a few hours. This energy, hardly ever seen in recent times, may mark the start of a capital rotation towards ETH.

Their MVRV knowledge additionally suggests Ethereum is much less overheated than Bitcoin. Quick-term ETH holders are barely in revenue (+1.2%), and long-term holders stay underwater. This provides Ethereum extra upside potential earlier than coming into speculative danger zones.

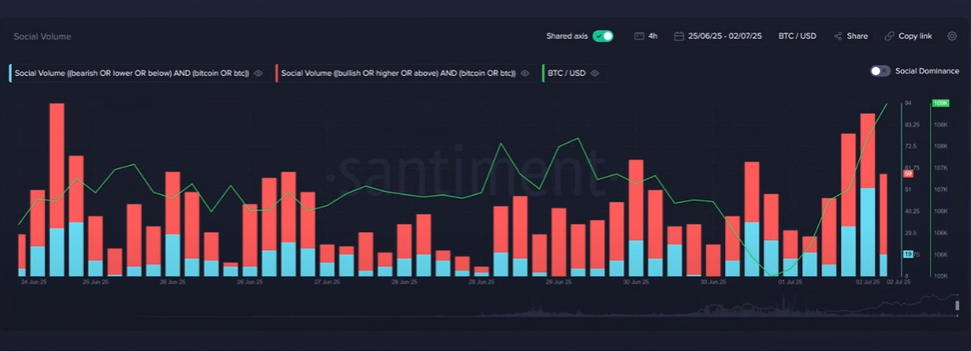

Sentiment Watch: Bitcoin and XRP Close to Euphoria

Santiment flags rising social sentiment for Bitcoin and XRP as a possible crimson flag. These belongings are presently experiencing the best ranges of crowd pleasure in weeks, which traditionally precedes short-term corrections. In contrast, Ethereum and Solana stay in impartial sentiment territory, signaling extra balanced risk-reward dynamics.

Santiment encourages utilizing sentiment divergence to regulate portfolio publicity—trimming overly euphoric belongings whereas rotating into undervalued ones with quieter narratives.

Solana, Improvement Developments, and Quick-Squeeze Setups

The report names Solana as a “sneaky decide” on account of its stable fundamentals and comparatively muted social buzz, which may prime it for a low-expectation rally.

Moreover, Santiment lists Ethereum, Chainlink, Cardano, and Web Laptop among the many most actively developed initiatives, primarily based on GitHub exercise. Excessive improvement alerts continued technical progress and long-term viability.

On derivatives markets, unfavorable Bitcoin funding charges recommend merchants are closely shorting BTC. Santiment views this as a bullish contrarian sign, as extended bearish positioning typically units the stage for brief squeezes.

Conclusion: Santiment Sees Room for Rotation

Santiment concludes that whereas Bitcoin reveals energy, its rising MVRV and euphoric sentiment pose near-term dangers. In the meantime, Ethereum and Solana supply more healthy on-chain setups, whale assist, and decrease social hype—situations that always precede outperformance.

The agency recommends a data-first strategy: monitoring MVRV, sentiment scores, ETF flows, and whale habits to information selections in a market filled with noise.