- TRX every day transactions doubled since Sept 2023, whereas whales and holders hold accumulating under $0.28.

- Value is probably going heading towards the $0.295–$0.3 zone, the place a excessive cluster of liquidations sit—count on volatility.

- Merchants can purpose for profit-taking at $0.3 or look forward to a breakout and retest earlier than leaping again in.

TRON’s been quietly choosing up steam, and it’s not simply hype. Every day transaction numbers have doubled since final September, climbing from beneath 5 million to 9 million. That form of visitors’s no small feat—and yeah, the community’s raking in additional income due to it. Add in whales quietly stacking and a few chatter choosing up on social media? Looks like one thing’s brewing beneath the floor.

The place the Sensible Cash Purchased (and Nonetheless Holds)

In response to IntoTheBlock, a whopping 98% of TRX holders are “within the cash.” That’s not a typo. Many of the heavy shopping for? Occurred within the $0.243–$0.28 vary—about 28.39 billion TRX, price over $7.4 billion, was scooped up there. In the meantime, solely 4.48 billion TRX was purchased up between $0.288 and $0.455. That’s a reasonably weak zone as compared.

Translation: that decrease zone is a powerful demand pocket, and there’s not a mountain of promoting stress up above simply but. Certain, some people will lock in income, however consumers nonetheless appear to be calling the photographs.

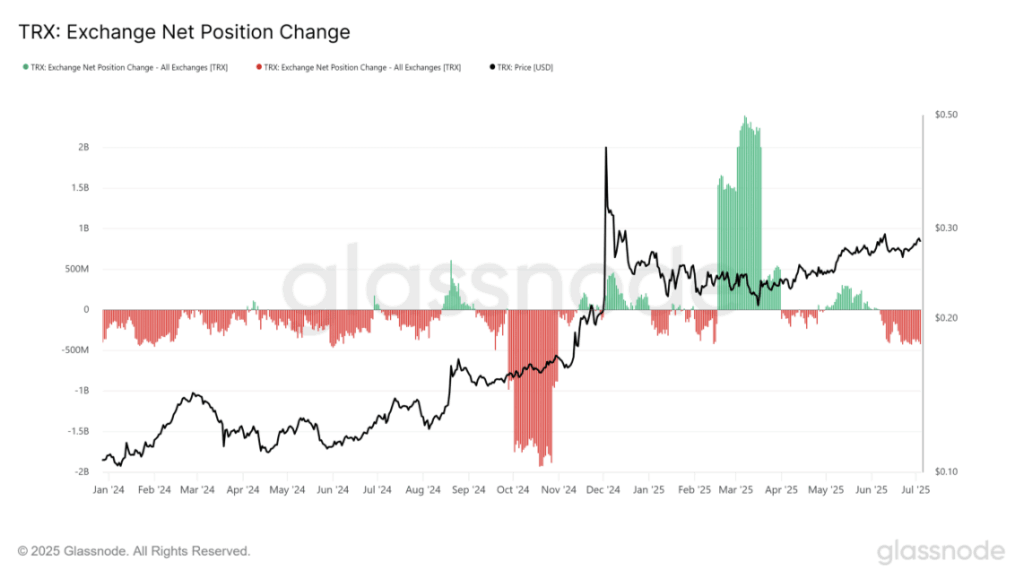

Alternate Outflows = Quiet Accumulation

Over on Glassnode, the Alternate Internet Place Change metric is flashing one thing fascinating. When the quantity’s inexperienced, it often means extra TRX is being despatched to exchanges—aka, folks may be trying to promote. However recently? It’s gone purple. TRX is getting pulled off exchanges, hinting that buyers are holding tight and accumulating.

That traces up with the current, gradual grind upward in value. And right here’s the kicker—this very same sample performed out final October, simply earlier than TRON ripped greater in November and December. That doesn’t assure a repeat, however hey, markets like to rhyme.

However That $0.30 Zone? It’s Loaded With Traps

Now, don’t get too cozy. In response to CoinGlass’s heatmap, there’s a variety of liquidity sitting simply overhead—particularly round $0.29 and particularly within the $0.295–$0.3 vary. These zones are like magnets, filled with stop-losses and leverage. So, chances are high excessive that TRX will attempt to attain up there quickly, looking that liquidity.

As soon as it does, don’t be stunned if issues flip rapidly. Longs will pile in in the course of the run-up, after which bam—value may reverse laborious to squeeze them out. Basic.

That’s why merchants may wanna take income round $0.295–$0.3. If there’s a clear break above $0.3 and a stable retest as assist? That’s your inexperienced gentle to lengthy once more. In any other case, a rejection there may arrange a sneaky brief.