Bitcoin may very well be on the verge of one other main breakout as institutional inflows return to ranges that traditionally set off speedy value acceleration.

Based on a brand new evaluation by Ecoinometrics, 30-day rolling inflows into Bitcoin exchange-traded funds (ETFs) are nearing 50,000 BTC — a threshold that has beforehand signaled the beginning of highly effective bull strikes.

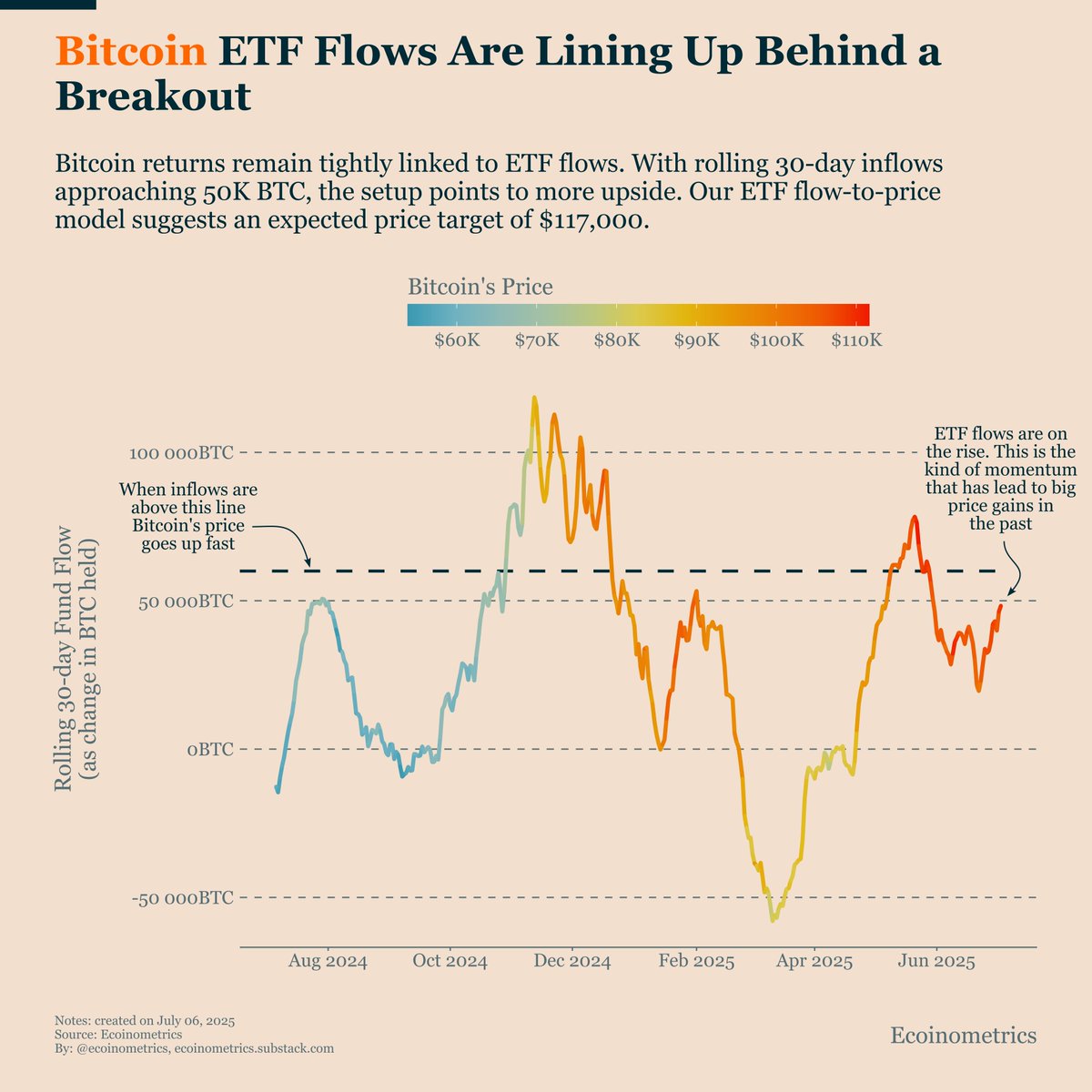

The report highlights a powerful correlation between ETF fund flows and Bitcoin’s value course. When rolling ETF inflows exceed the 50,000 BTC mark, previous information reveals Bitcoin’s value tends to surge considerably, as seen in This autumn 2024 and early 2025. Throughout these durations, BTC climbed quickly towards new highs, pushed largely by institutional demand mirrored in spot ETF purchases.

Ecoinometrics’ ETF flow-to-price mannequin now factors to a possible goal of $117,000, assuming inflows proceed to rise. The mannequin makes use of previous influx surges to estimate truthful worth, and present momentum suggests BTC could quickly revisit the higher value bands that traditionally align with robust fund accumulation.

The accompanying chart reveals color-coded bands similar to BTC’s value vary ($60K–$110K) and compares them with the 30-day fund movement trajectory. During times of excessive inflows — significantly above 50K BTC — the value has persistently trended larger, getting into warmer-colored zones on the chart.

ETF inflows are as soon as once more rising in July, an indication that institutional confidence stays strong regardless of current consolidation. This return of constructive fund momentum reinforces the $117K projection and means that Bitcoin could quickly enter its subsequent breakout part — so long as the influx sample continues.

With fund flows performing as a number one indicator of institutional demand, all eyes at the moment are on whether or not the 50K BTC influx stage might be decisively breached. In that case, Bitcoin’s path towards six-figure territory may develop into more and more doubtless within the months forward.