- Ethereum is consolidating close to $2,560, with a breakout sample forming and bullish indicators constructing beneath the floor.

- ETF inflows, institutional adoption, and Ethereum’s increasing Layer 2 ecosystem are pushing long-term development potential.

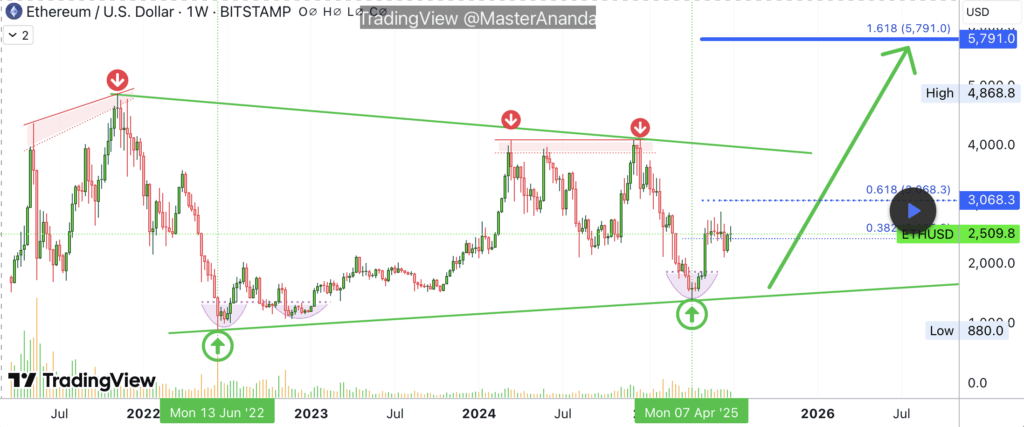

- Analysts see $5,791 as the following main cease—and presumably $8,500 if momentum continues into late 2025.

Ethereum’s holding its floor round $2,560, however beneath that calm exterior, there’s one thing brewing. With ETFs pulling in severe cash and long-term buyers exhibiting no indicators of letting up, ETH might be gearing up for one in all its largest strikes but—possibly even towards $8,500 by the tip of 2025.

ETH Coiling Up Inside a Symmetrical Triangle

Proper now, Ethereum’s simply kinda chilling—hovering round $2,559 as of July 7. It dipped a bit earlier this week however rapidly bounced off $2,450 and climbed proper again over its key transferring averages. Nothing flashy but, however that’s typically how large strikes begin.

On the 4-hour chart, ETH is boxed inside a good symmetrical triangle, with resistance close to $2,560 and assist at $2,478. All the main EMAs (20, 50, 100, 200) are jammed collectively between $2,486 and $2,525, which often means one thing’s about to offer.

The RSI’s sitting round 49—neither too scorching nor too chilly. A break above $2,560 with strong quantity may open doorways to $2,639, even $2,723. But when ETH slips under $2,478, effectively, $2,388 or worse—$2,320—may be subsequent.

Ethereum ETFs: Not Simply Hype—Massive Cash’s Coming

Right here’s the place it will get spicy. Matt Hougan from Bitwise thinks ETH ETFs may usher in $10 billion by yr’s finish. That’s not a typo. We’re speaking severe institutional firepower. Simply in June alone, ETFs pulled $1.17 billion into Ethereum.

Why the frenzy? Ethereum’s transferring into the driving force’s seat for tokenizing real-world stuff—shares, bonds, stablecoins, you title it. Hougan says TradFi’s waking as much as Ethereum because the settlement layer of the long run. Is sensible.

And get this: the SEC lately made a transfer that just about greenlights staking with out calling it a safety. That might result in staking-enabled ETFs, which might be one other large draw for buyers chasing passive yield.

Massive Image: $8,500 Isn’t That Loopy

Zooming out, Ethereum’s been caught in consolidation mode for some time, holding tight above $2,425 since April. However there’s a rounded backside forming—basic bottoming sample in case you’re into that stuff.

One technical mannequin pegs $5,791 as the following large resistance. After that? A stretch to $8,500 doesn’t appear so far-fetched. Larger lows preserve stacking up, and no new highs since March 2024? That smells like strain constructing for a breakout, not a breakdown.

Don’t Overlook Layer 2 and Staking

Positive, ETFs are attractive, however there’s extra below the hood. Ethereum’s Layer 2s—like Arbitrum, Optimism, zkSync—are buzzing. Transactions are up. TVL’s rising. Charges? Nonetheless manageable.

Extra importantly, staking’s paying off. Rewards are rising. And extra staked ETH means much less circulating provide—which, as we all know, often means costs head north. That deflationary push might be what actually lights the fireplace.

So… Can ETH Actually Hit $8.5K?

With so many stars lining up—ETF inflows, staking features, L2 development, bullish chart setups—it’s onerous to disregard what Ethereum’s constructing towards. It must bust by means of $2,560 first, however as soon as that occurs? $5,791 is the primary main checkpoint. And if the momentum holds, don’t be shocked if $8,500 comes into play earlier than this cycle’s out.