In accordance with a brand new chart evaluation from Alphractal, the variety of lively cryptocurrencies has declined considerably whilst Bitcoin’s worth continues to climb.

This market pattern, primarily based on CoinMarketCap information, reveals a culling of weaker initiatives—over 1,400 altcoins are not lively because of delistings, low buying and selling quantity, lack of group curiosity, or publicity as rip-off ventures.

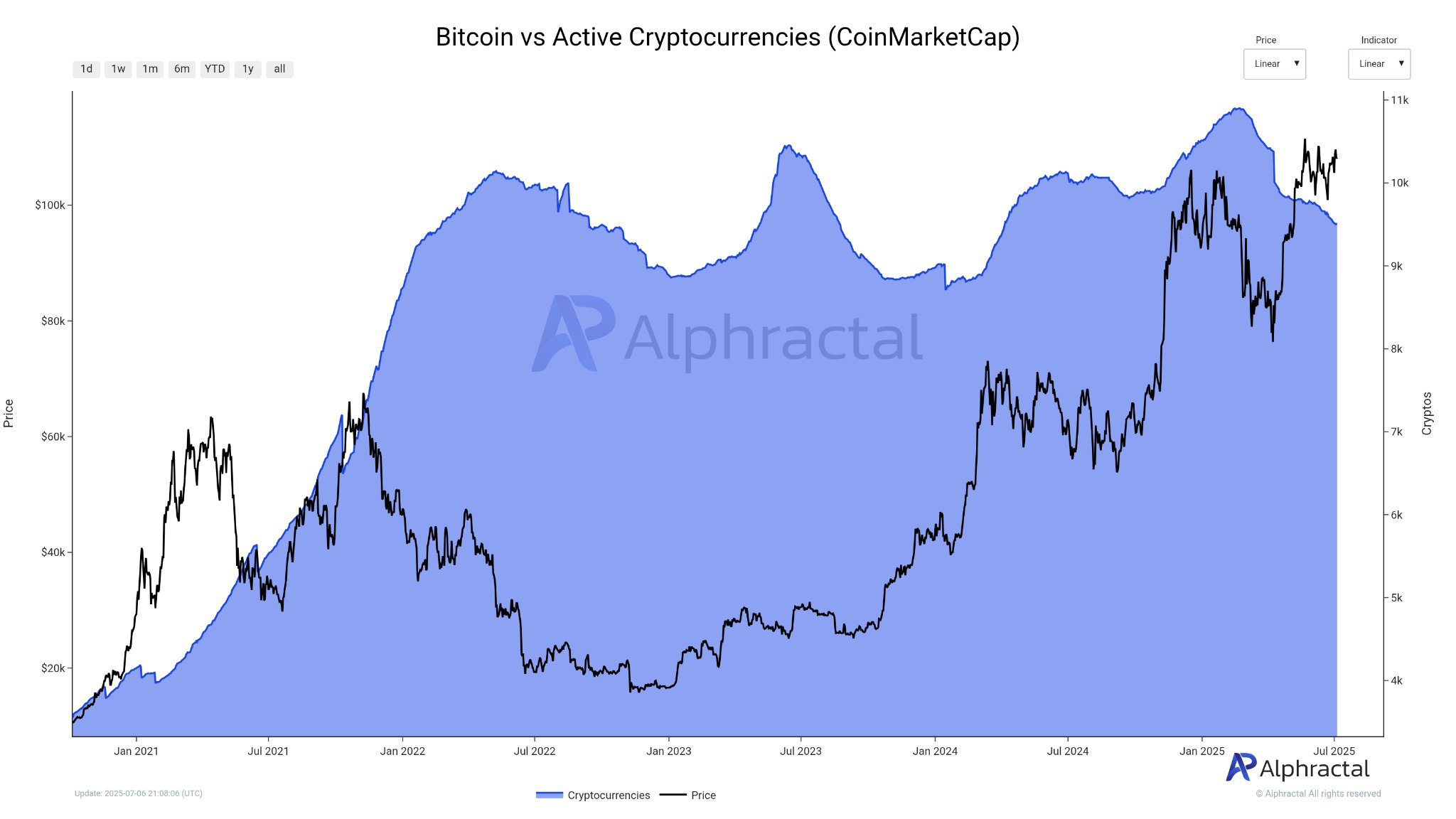

The chart exhibits two overlapping metrics: Bitcoin’s worth in black and the variety of lively cryptocurrencies in blue.

Since early 2024, there was a pointy drop within the variety of listed initiatives, coinciding with Bitcoin’s regular rise again above $100,000. As of July 2025, the variety of tracked lively tokens has fallen to round 10,000, down from over 11,400 on the cycle’s peak.

Alphractal’s interpretation of this divergence is broadly optimistic. The exit of underperforming or fraudulent initiatives is seen as a type of market cleaning—eradicating noise and making room for high quality. In earlier cycles, comparable drops in token rely have signaled a return to fundamentals and renewed investor give attention to core belongings like Bitcoin and Ethereum.

Analysts say this shrinking mission pool is bullish for crypto. With fewer “zombie” tokens competing for consideration and liquidity, capital more and more flows towards high-conviction performs. Bitcoin’s resilience in opposition to the backdrop of widespread mission failures helps the narrative that it stays the digital asset market’s anchor.

The delisting of 1,400+ cash may assist restore belief in crypto markets. Most of the defunct tokens had been launched throughout speculative hype phases and did not ship actual use instances or improvement exercise. Their removing reduces confusion for brand new buyers and highlights the significance of due diligence.

In brief, Alphractal’s report presents a wholesome signal: fewer tokens, stronger conviction. As Bitcoin rises and the altcoin panorama thins out, the market seems to be getting into a extra mature, selective development section.