The latest accumulation of Ethereum by public firms is writing a brand new chapter in Ethereum’s historical past. Specialists and market analysts imagine this accumulation development will develop even stronger sooner or later.

Lately, an organization bought Bitcoin to purchase Ethereum, marking a major shift in long-term expectations for this asset in comparison with the broader market.

Why Establishments Quickly Purchase up All Newly Issued ETH

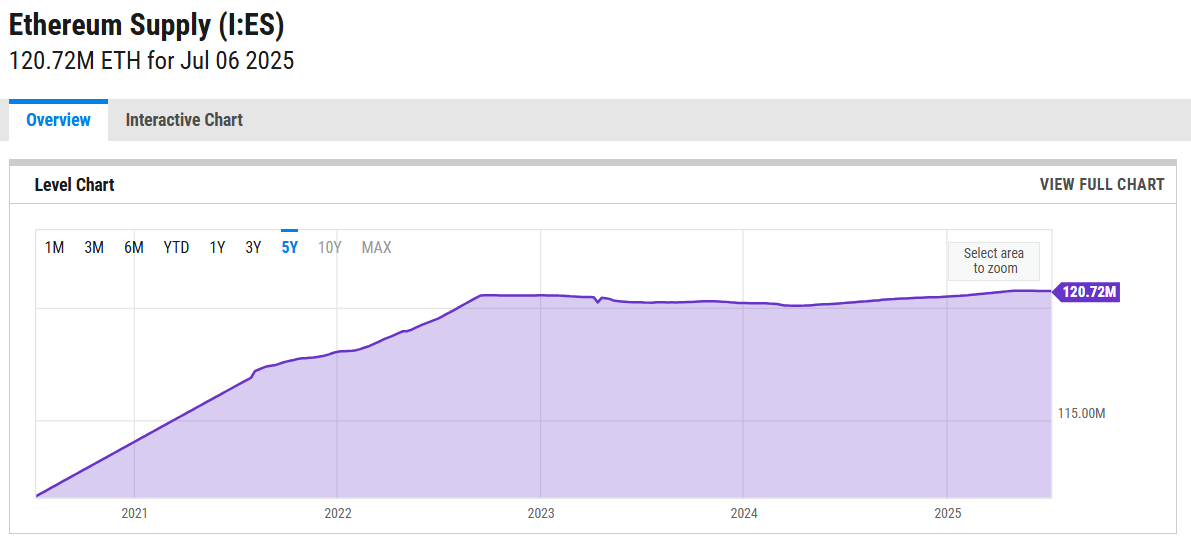

Since Ethereum’s Merge improve in September 2022, the community has sharply lowered ETH issuance. Ycharts knowledge exhibits that issuers solely circulated round 300,000 new ETH after this improve.

Moreover, Ethereum burns a portion of transaction charges eternally, and validators should lock up massive quantities of ETH to safe the community. Corporations and establishments ramping up ETH accumulation in 2025 might additional push the supply-demand imbalance.

Ethereum developer Binji in contrast ETH to an oil discipline that pumps out only one barrel each day, whereas Wall Road consumes six barrels. His level is that new ETH issuance is tiny in comparison with what establishments maintain shopping for and holding.

“SharpLink Gaming and BitDigital have, in only one month, eaten up 82% of all the web new ETH issued because the Merge (298,770). Plus, spot ETFs maintain 4.11 million ETH, which is 11x the web issuance. Mainly, think about an oil mine that yields one barrel a day whereas Wall Road swallows six,” Binji defined.

BeInCrypto reported that Bit Digital bought all its Bitcoin holdings — 280 BTC price round $28 million—and mixed the proceeds with the $172 million raised via a public providing to purchase 100,603 ETH price about $254.8 million. Earlier, SharpLink Gaming raised $425 million particularly to purchase extra Ethereum.

These strikes led well-known crypto analyst Pentoshi to foretell that establishments will quickly soak up all newly issued ETH.

“In lower than one month, public firms may have purchased sufficient ETH to offset all of the ETH that’s been created because the Merge,” Pentoshi predicted.

Pentoshi and Binji each argue that ETH accumulation remains to be early. They imagine ETH might rework right into a mainstream deflationary asset.

Nevertheless, some critics problem this view. They argue that firms would possibly maintain ETH of their treasuries primarily to draw “exit liquidity” — so massive buyers can promote at increased costs.

These critics declare narratives that when fueled ETH’s worth — like ICOs, DeFi, and NFTs — have misplaced power. They are saying stablecoins now drive ETH demand. Nevertheless, Ethereum might lose its main place as extra blockchains compete to host stablecoins.

“All ETH has for a story at the moment is stablecoins. However do we actually want a $300 billion decentralized blockchain simply to commerce IOUs? No. Many stablecoin chains will launch to compete with ETH. As for the ETH treasury firms, that’s simply to draw exit liquidity,” investor John Galt mentioned.

On the time of writing, ETH trades round $2,550. ETH’s worth remains to be half of its all-time excessive from 2021.

The put up Specialists Predict Public Corporations Might Quickly Purchase Up All Newly Issued ETH Since The Merge appeared first on BeInCrypto.