Japan’s long-dormant bond market has jolted international traders awake, surging above 3% for the primary time since 2000.

Whereas this may increasingly appear to be a localized shift on the floor, analysts warn it might mark the start of a broader liquidity squeeze that reverberates throughout danger property, together with Bitcoin.

Japan’s Bond Shock Sends World Markets a Warning

Japan’s long-term rates of interest crossed a important threshold, sending ripples by means of international markets. For the primary time since 2000, Japan’s 30-year authorities bond yield surged 10 foundation factors (bps) to three.065%.

A number of analysts flagged this improvement, decoding it as a possible first sign of a broader liquidity squeeze. This spike represents a major reversal for an economic system that has lengthy symbolized ultra-loose financial coverage and near-zero rates of interest.

Analysts warn that this could possibly be an early warning for international markets, particularly for danger property like Bitcoin (BTC).

Japan stored rates of interest tremendous low for years, a transfer that helped international markets keep liquid and risk-on. Notably, that low-cost capital fueled all the things, together with crypto.

“Japan 30yr yield breaks 3%, not seen since 2000. World’s most indebted, most aged, most chronically low-inflation economic system is main international bond markets down. Open your eyes, USA will not be far behind. Possibly it’s not Japan reacting to the world, however the world is about to observe Japan,” market analyst Fernando Pertini wrote.

Towards this backdrop, the tone throughout monetary social media has turned from curiosity to concern, with Barchart expressing a collective market unease.

The implications are particularly unsettling for the crypto market. BitBull, a famend market analyst, prompt that the event could mark a turning level for your entire cycle.

“Japan’s 30-year bond yield simply crossed 3% for the primary time in many years. It may not sound dramatic… nevertheless it’s an enormous sign…Now that charges are rising, it means cash might begin tightening throughout the board. Much less cash flowing = extra stress on danger property like BTC and alts. This could possibly be the Black Swan Occasion of this cycle,” BitBull expressed.

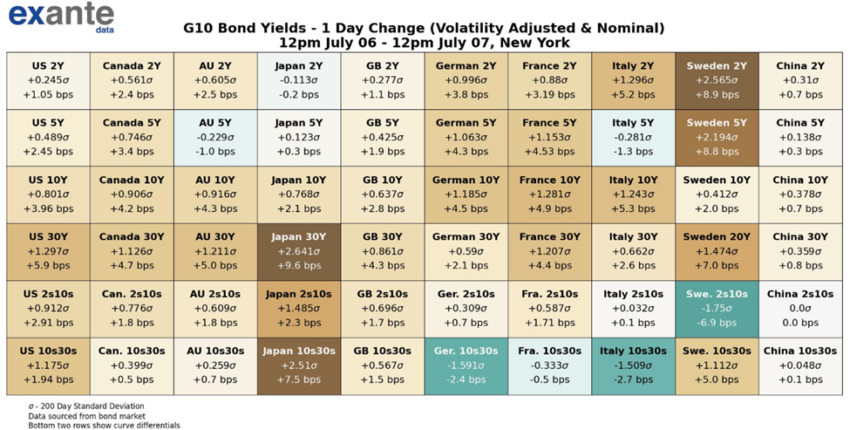

Exante Information confirmed the Japan 30Y yield as probably the most statistically important transfer amongst G10 bond markets during the last 24 hours, supporting that view.

“The most important transfer within the final 24 hours was: Japan 30Y. G10 bond yields that had 2 commonplace deviation strikes throughout the interval embody: Japan 30Y, Sweden 2Y, Japan 10s30s, Sweden 5Y,” the agency famous.

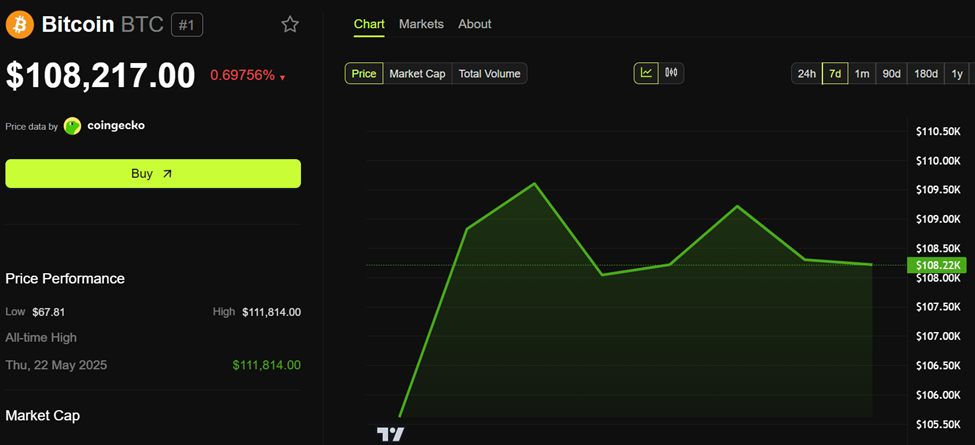

But regardless of the macro tremors, Bitcoin stays unusually steady. As of this writing, BTC is buying and selling at $108,217, firmly inside a good vary.

“… regardless of the slowing spot momentum, Bitcoin’s broader technical and bullish market place has remained structurally intact. BTC continues to carry above the important thing $100,000 psychological help degree, after bouncing off $98,000 throughout the war-driven dip and has fashioned robust help ranges on the $106,500 vary,” Shawn Younger, Chief Analyst of MEXC Analysis instructed BeInCrypto.

Bitcoin’s Uncommon Stability May Entice Threat-Averse Buyers

David Puell, an analyst with Ark Make investments, identified this uncommon calm amid broader volatility, noting that it might appeal to the risk-averse investor cohort.

“Beginning Might and October 2023, respectively, the 6m and 1y skews of each broad volatility and excessive tails have been constructive with no interruption, in contrast to prior bull markets….We imagine that is precisely what would attraction to a risk-averse investor,” wrote Puell.

In the meantime, company accumulation continues. Genius Group, a public agency positioning itself as a “Bitcoin-first” schooling firm, raised its treasury goal tenfold. CEO Roger Hamilton emphasised the corporate’s conviction in an X (Twitter) put up.

“We’re at present seeing a worth appreciation of the Bitcoin now we have bought for our Bitcoin Treasury, and we’re happy to be saying this substantial improve in our Bitcoin Treasury goal to 10,000 Bitcoin,” Hamilton revealed.

With international bond markets flashing warnings and institutional gamers doubling down on Bitcoin, Japan’s yield shock could also be greater than a neighborhood occasion.

Primarily based on shared sentiment amongst analysts, it might mark the beginning of a brand new macro actuality.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.