- LTC struggles underneath three main shifting averages, with bearish momentum rising and RSI drifting beneath impartial.

- Quantity and liquidations level to vendor dominance, with lengthy merchants absorbing many of the losses previously 24 hours.

- $86.85 and $84 are key ranges; a breakout or breakdown from this vary may set the tone for Litecoin’s subsequent transfer.

Litecoin’s kinda caught proper now — not crashing, however not flying both. As of Tuesday, LTC is buying and selling round $86.18 after slipping 1.86% during the last 4 hours. Not an enormous transfer, but it surely’s protecting everybody on edge, principally as a result of the worth has been hovering beneath some fairly cussed shifting averages.

Proper now, you’ve bought the 50-period SMA sitting at $85.51. Then there’s the 100-day proper behind it at $86.15, and capping all of it off is the 200-day resistance at $86.85. Three straight periods now and Litecoin nonetheless hasn’t managed to shut above any of them. Every failed try chips away at no matter bullish vitality is left — if there’s a lot left in any respect.

Bears Nonetheless Holding the Steering Wheel

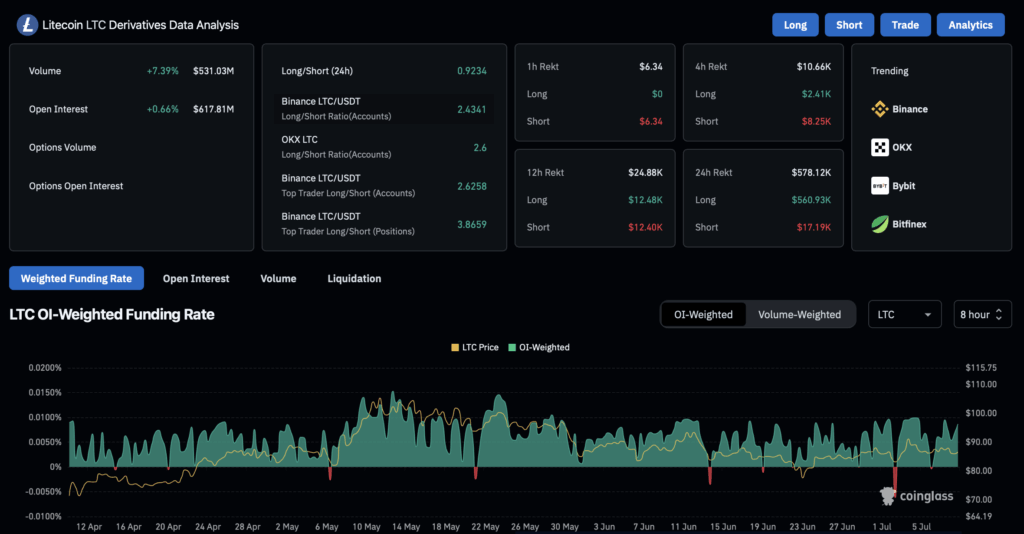

Momentum indicators aren’t giving a lot consolation both. The RSI is chilling round 44.98, sliding underneath the sign line at 48.68. That kinda setup leans bearish — like, there’s curiosity from patrons, however not sufficient to flip the vibe. In line with CoinGlass, buying and selling quantity has picked up 9.46% to hit $540.97 million, which may imply individuals are simply profiting from short-term worth swings.

Open curiosity crept up 0.11% to hit $609.19 million, with most of that coming from perpetual futures. That’s a refined lengthy bias, with the funding price simply at 0.008%, so nobody’s actually going full degen but. Previously 24 hours, $631,950 price of LTC positions bought liquidated — and almost all of that ($623,010) got here from longs. Shorts solely took an $8,940 hit, which… yeah, kinda tells you who’s in cost right here.

Technicals Set the Stage — However Which Means?

Proper now, merchants are laser-focused on some key ranges. Resistance remains to be proper up on the 200-period MA at $86.85. If Litecoin can bust via that with some quantity, we may be speaking a fast dash to $90 and even final month’s highs round $92. However that’s a giant “if.” No person needs to get caught in one other bull lure with no follow-through.

If the worth heads south, fast assist is sitting at $84 — that’s the place patrons stepped in late final week. Under that, there’s a downward-sloping trendline that meets the $82 zone. Break beneath that and, effectively, we may very well be heading again to $80 and even Might’s low close to $77. Not superb.

Since peaking simply above $90 on July 3, LTC’s been making decrease highs and decrease lows. Traditional descending channel stuff on the 4-hour chart. Bears appear to be urgent their benefit for now, and except one thing shifts, they’ll most likely hold urgent.

Macro Drag and Vary Stress Mounting

There’s a broader story at play too. Bitcoin dominance is rising once more, pulling capital out of altcoins like Litecoin. It’s arduous for LTC to maneuver independently proper now with out some form of main catalyst. Headlines or macro occasions may change the script — however till then, we’re kinda grinding sideways.

LTC is in a little bit of a strain cooker. A strong break above $86.85 may be the spark bulls want. A dip underneath $84? That most likely arms the reins again to the bears. Quantity’s creeping up, and the squeeze is getting tighter, so one thing’s gotta give. Everybody’s expecting that first actual transfer.