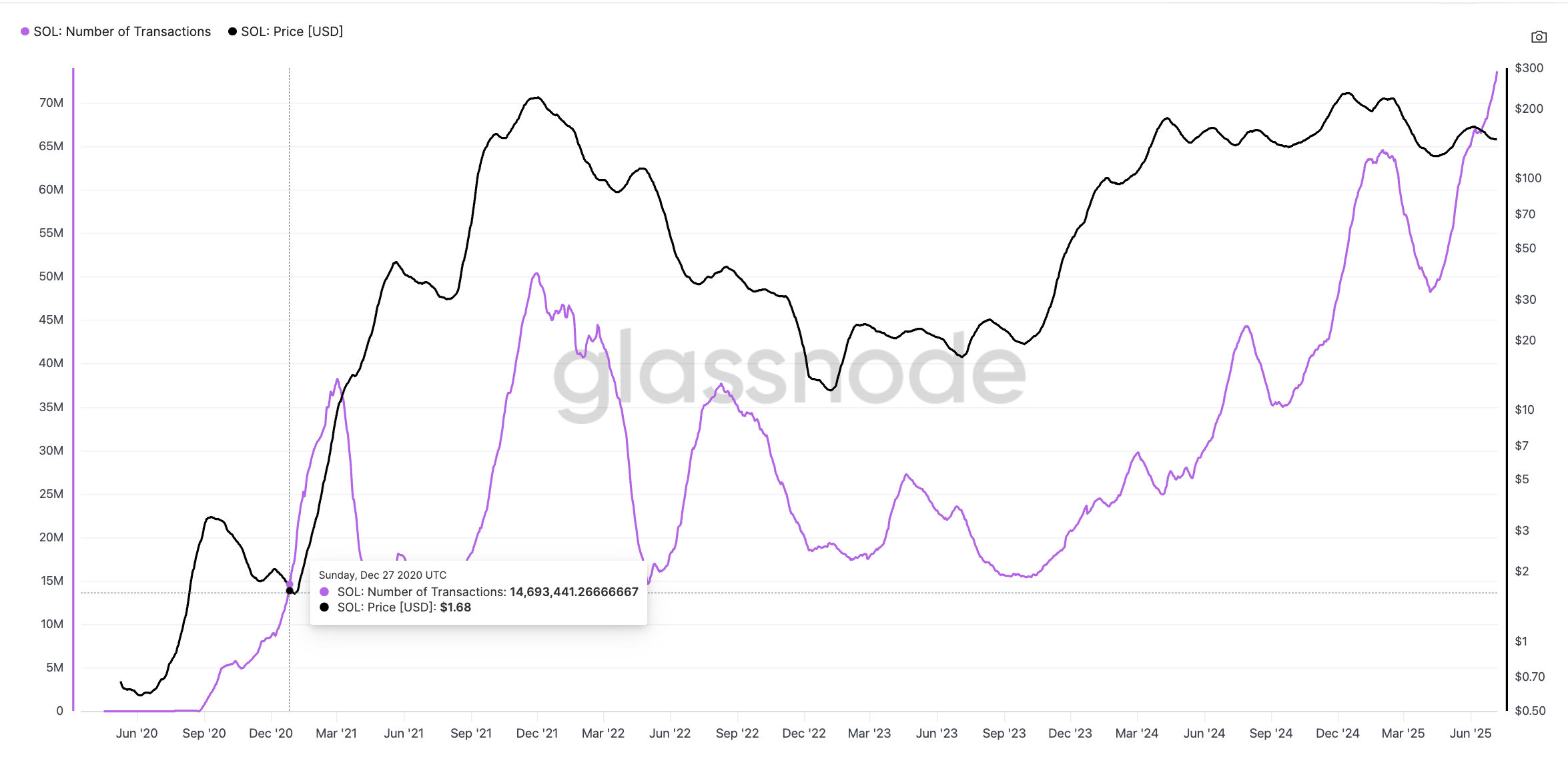

Solana simply printed a uncommon crossover between a key community metric and SOL worth, one thing that hasn’t occurred because the early days of its first bull run in 2020. However this time, the worth is lagging behind, even because the community reveals renewed power.

May this be the sign that lights the following leg up?

Transaction Depend Hits 5-12 months Excessive, However SOL Value Isn’t Following But

Solana’s variety of transactions has surged previous 70 million. But, that’s not the most effective half.

In accordance with the chart, the final time the transaction depend line crossed above the worth line, a multi-year SOL worth rally occurred. This time, in July 2025, the worth stays sluggish, round $151, and the same crossover has occurred.

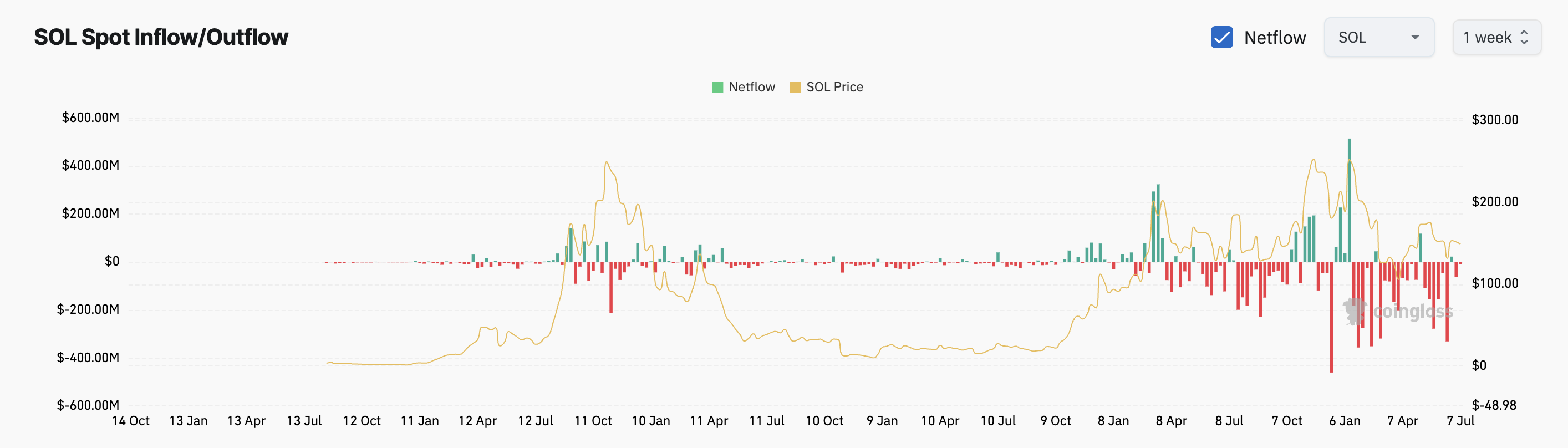

Netflows Tilt Bearish, Regardless of Trade Exits

Information from Coinglass reveals Solana has seen regular outflows by way of early July. That normally factors to accumulation. However the outflows have slowed down in current days, and there’s no spike in inflows both.

Briefly, nobody’s dumping SOL, however nobody’s dashing to purchase both.

This stability could clarify why the SOL worth hasn’t damaged out but. Merchants appear to be ready for a stronger sign earlier than taking a aspect.

SOPR Flips Beneath 1; Signal of Panic?

Solana’s Spent Output Revenue Ratio (SOPR), which tracks whether or not cash are being offered at a revenue or loss, has hovered just under 1.0 since late June. That sometimes means holders are promoting at a loss or break-even, usually seen throughout market bottoms.

When SOPR drops under 1, it reveals capitulation; merchants are exiting positions at a loss. However when SOPR begins to rise once more towards 1, it suggests most panic sellers are gone, and solely long-term or break-even holders stay.

On this case, SOPR rising from 0.95 again towards 1.0 signifies that compelled promoting could also be cooling off. Mixed with the slowing trade outflows, it suggests Solana is stabilizing, or slightly, the underside for this cycle is likely to be forming.

SOL Value Construction: Falling Wedge Nonetheless in Play, However Momentum Lags

The Solana worth has stayed locked inside a broad falling wedge since early January 2025. The construction continues to be intact, however SOL has examined the higher trendline a number of instances with no breakout. That line now sits slightly below $155, and the worth has been hovering shut with out clearing it.

A confirmed transfer above $155 may shift the momentum. If that occurs, upside targets sit at $169 and $180, each performing as main resistance zones from prior highs.

But when bulls fail to interrupt the wedge, there’s a threat of sliding again into the outdated sideways band. This help zone between $140 and $125 has trapped the SOL worth earlier than. Dropping that zone would weaken your complete construction and probably result in deeper losses. The wedge is vast sufficient that even smaller dips received’t break the setup, but when SOL drops under $125, the sample could now not maintain weight.

Supporting the sample is the Shifting Common Convergence Divergence (MACD), attempting to show bullish. The MACD line (blue) has flipped above the sign line (orange), a basic early momentum indicator. The flip occurred close to a swing low, confirming bullish power and a bottoming try, additionally indicated by SOPR.

However right here’s the catch: the histogram bars, which symbolize the gap between the 2 strains, are fading. That alerts a weakening upside momentum.

MACD is a momentum indicator that helps spot early pattern reversals primarily based on two transferring strains and a histogram.

Solana is buying and selling close to $151. Until it decisively breaks the $155, the falling wedge stays in management.

The publish Solana (SOL) Simply Flashed a 5-12 months Bullish Sign; May a Breakout Be Subsequent? appeared first on BeInCrypto.