- Merchants are closely shorting LINK, with over $8.6M in shorts and a 0.935 lengthy/brief ratio.

- Worth is caught below resistance, quantity is fading, and it’s buying and selling beneath the 200-day EMA.

- A break beneath $12.70 might set off a 17% drop—until bulls reclaim the trendline and $16 stage.

Chainlink (LINK) simply can’t appear to catch a break. With tariff tensions effervescent up once more, the token’s already shaky momentum took one other hit—and the market’s temper isn’t serving to. Sentiment is sliding quick, and merchants are eyeing shorts greater than ever.

Merchants Lean Bearish—Arduous

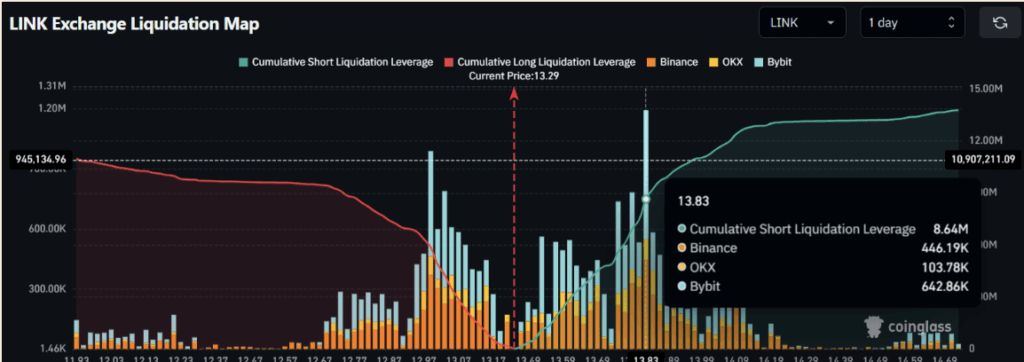

On July eighth, bearish vibes dominated the LINK market. In accordance with CoinGlass, merchants have began piling into brief positions, establishing for potential draw back. A whole lot of motion is clumped across the $12.99 assist and $13.83 resistance ranges—two zones that are actually drawing heavy consideration.

Knowledge’s portray a fairly clear image: $8.64 million in shorts vs. $5.87 million in longs. That imbalance? Not nice for the bulls. The lengthy/brief ratio is sitting at 0.935, which suggests greater than half the market (round 51.68%) is betting LINK’s going decrease. Solely 48.32% are nonetheless holding out hope on the lengthy aspect.

Worth Slides, Quantity Fades

As of now, LINK’s hovering round $13.49—a 0.55% dip up to now 24 hours. Doesn’t sound like a lot, however given the context, it’s not reassuring. The continued tariff chatter appears to be zapping confidence, not simply in LINK however within the broader crypto sentiment too.

Quantity’s taken a success as nicely. Per CoinMarketCap, buying and selling exercise has dropped about 12% in comparison with the day earlier than. Fewer members, extra indecision. Not one of the best combo should you’re hoping for a rebound.

Make-or-Break Territory Forward

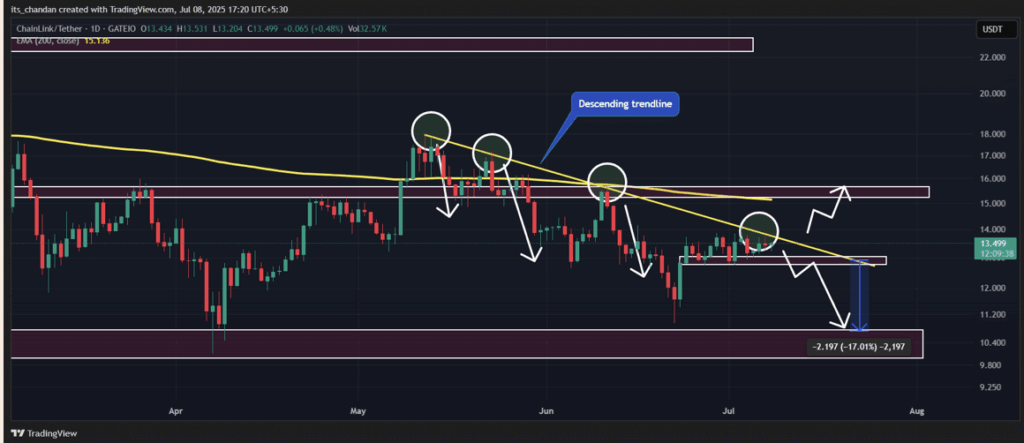

Technically talking, LINK is sitting on a essential ledge. The worth has been locked in a good consolidation vary for weeks—and it’s now brushing up towards a descending trendline that’s acted as resistance a number of instances earlier than. That is the fourth time it’s testing that line, and historical past says… not nice odds.

If LINK breaks beneath the $12.70 zone, issues might spiral rapidly. We’re speaking a couple of potential 17% drop if sentiment doesn’t flip. However—and it’s a giant however—if the bulls handle to rally and push worth above that trendline, we would simply see a reversal. Key factor to look at for? A clear day by day shut above that resistance.

Closing Phrase: Warning Guidelines for Now

Because it stands, LINK continues to be below its 200-day EMA on the day by day chart. Till that’s reclaimed—and worth breaks by way of $16—that is nonetheless very a lot a downtrend. There’s potential for a breakout, positive, however provided that momentum returns and the broader market performs alongside.

Proper now, merchants are cautious. Shorters have the higher hand. And until one thing shakes issues up quickly, LINK may very well be heading for one more leg down.