GMX suffered a serious hack as we speak, as a pockets drained roughly $42 million from its GLP liquidity supplier. It’s unclear how this occurred, however the staff supplied the attackers a ten% bounty in the event that they returned 90% of the funds.

Hackers have already bridged round $9.6 million from Arbitrum to Ethereum utilizing Circle’s CCTP, resulting in controversy. That is GMX’s second main breach this 12 months, and its token fell over 25% in response.

How Was GMX Hacked?

The crypto group has suffered quite a lot of outstanding hacks recently, and it doesn’t appear to be the development is slowing down. Earlier this morning, safety watchdogs observed a suspicious transaction on GMX, which now appears to be a hack.

By means of unknown strategies, a Twister Money-funded pockets managed to empty round $42 million from GMX’s liquidity supplier (GLP).

GMX, the favored decentralized alternate, rapidly responded to this main hack. Particularly, it disabled a number of person options associated to buying and selling, minting, and redeeming tokens.

The agency additionally encoded an on-chain message to the hackers, claiming that it will not pursue authorized motion in the event that they returned 90% of the stolen funds inside 48 hours. The opposite 10% could be a kind of bug bounty.

Moreover, GMX is investigating the precise reason for this hack, however the outcomes are presently inconclusive. The agency claimed that the harm was remoted to the GMX V1 alternate, and that V2, markets, different liquidity swimming pools, and the GMX token itself are working as regular.

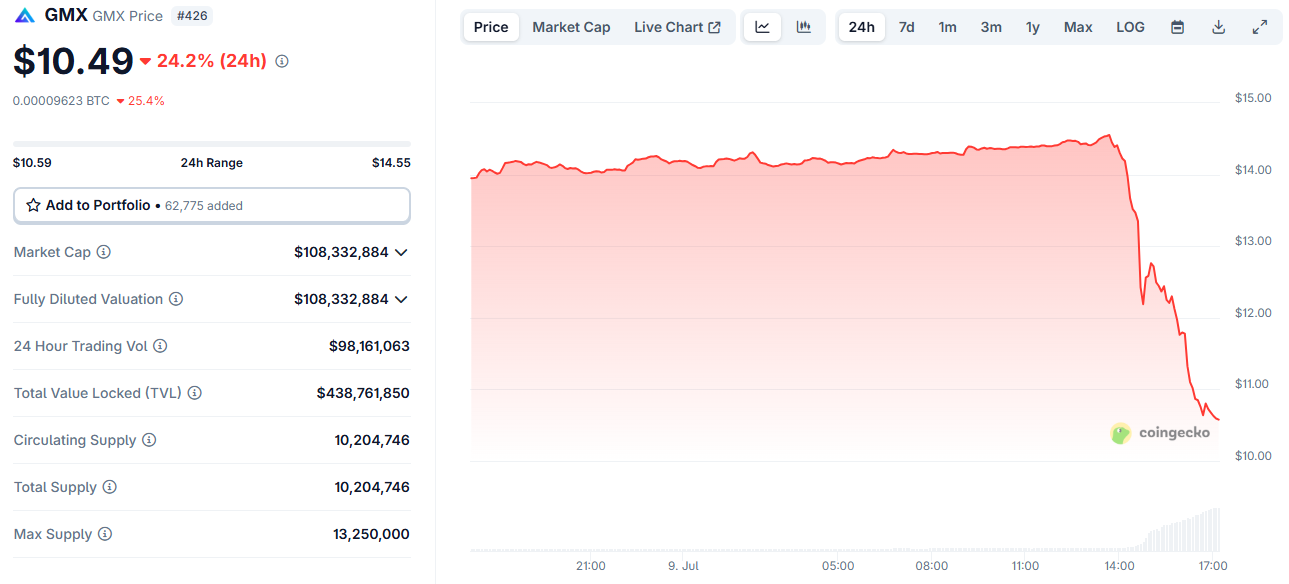

Nonetheless, this token dropped greater than 35% and has been falling because the hack occurred:

Sadly, that is GMX’s second main hack in 2025. Earlier this March, the agency misplaced $13 million to an assault that additionally brought on GMX to plummet 10%. If extra critical breaches like this proceed, it may harm the agency’s popularity.

ZachXBT, a outstanding crypto sleuth, has already pointed out one other weak spot within the GMX hack. He claimed that $9.6 million in stolen funds sat on the USDC blockchain for almost two hours earlier than the attacker used CCTP to bridge the funds to Ethereum.

He personally tried to flag the transaction and accused Circle of negligence in failing to freeze these property.

Apart from this profitable ETH bridging, the opposite ~$33 million stays on Arbitrum. It’s unclear if the attackers will handle to launder the remaining proceeds from the GMX hack.

The put up GMX Crashes 25% After $42 Million DeFi Hack appeared first on BeInCrypto.

ALERT

ALERT