Bitcoin has been exhibiting notable correlation to the inventory equities lately, however information reveals Ethereum is charting a extra impartial path.

Bitcoin & Ethereum Displaying Completely different Levels Of Correlation To Different Belongings

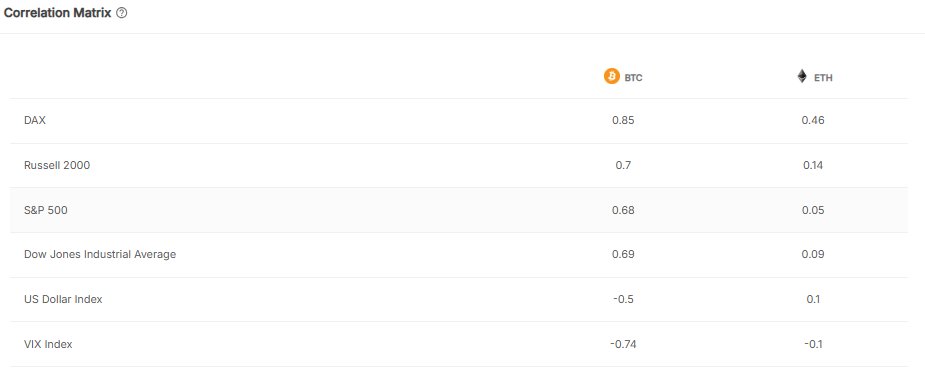

In a put up on X, the institutional DeFi options supplier Sentora (beforehand IntoTheBlock) has talked about how the most recent Correlation Matrix has seemed between the 2 largest cryptocurrencies, Bitcoin and Ethereum, and conventional markets. The “Correlation Matrix” right here refers to an indicator that tells us how intently tied collectively the costs of two given belongings presently are.

When the worth of this metric is constructive, it means the belongings are reacting to strikes in one another by shifting in the identical course to a point. The nearer the metric is to 1, the stronger the connection.

Associated Studying

However, the indicator being below the zero mark implies there’s a destructive correlation between the 2 costs. That’s, they’re shifting in reverse instructions. For this facet of the size, the acute level is -1.

Naturally, the Correlation Matrix exhibiting a price precisely equal to zero suggests there isn’t a correlation by any means between the belongings. In statistics, the 2 variables are mentioned to be ‘impartial’ on this case.

Now, right here is the desk shared by Sentora that reveals how the Correlation Matrix of Bitcoin and Ethereum stands with respect to some conventional markets:

As is seen above, the index that Bitcoin and Ethereum have the strongest constructive correlation to is DAX. That mentioned, the Correlation Matrix stands at 0.46 for ETH, which means that whereas some correlation does exist, it’s not too intense. This isn’t the case for Bitcoin, which has the indicator sitting at 0.85, indicating its value is fairly in tandem with DAX.

Likewise, BTC has a notable correlation to different inventory market indices, with a metric worth of 0.7, 0.68, and 0.69 for the Russel 2000, S&P 500, and Dow Jones Industrial Common, respectively. In distinction, Ethereum is nearly absolutely impartial from these indices, with the indicator standing fairly near zero for every of them.

For US Greenback Index and VIX Index, the final two markets listed within the desk, the Correlation Matrix is contained in the destructive zone for Bitcoin. Which means that the digital asset has actively been shifting in opposition to these indices.

Associated Studying

“Proper now, the highlight is on the U.S. Greenback Index (DXY): if geopolitical and macro tensions drag the greenback decrease, that backdrop might create room for one more leg increased in BTC,” notes the analytics agency.

Identical to with the shares, Ethereum is displaying little correlation to DXY and VIX, additional reinforcing that the cryptocurrency has been following a trajectory of its personal lately.

BTC Value

Bitcoin is mounting one other bullish push as its value surges to $109,400, nevertheless it stays to be seen whether or not its destiny can be any totally different from the weekend transfer.

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com