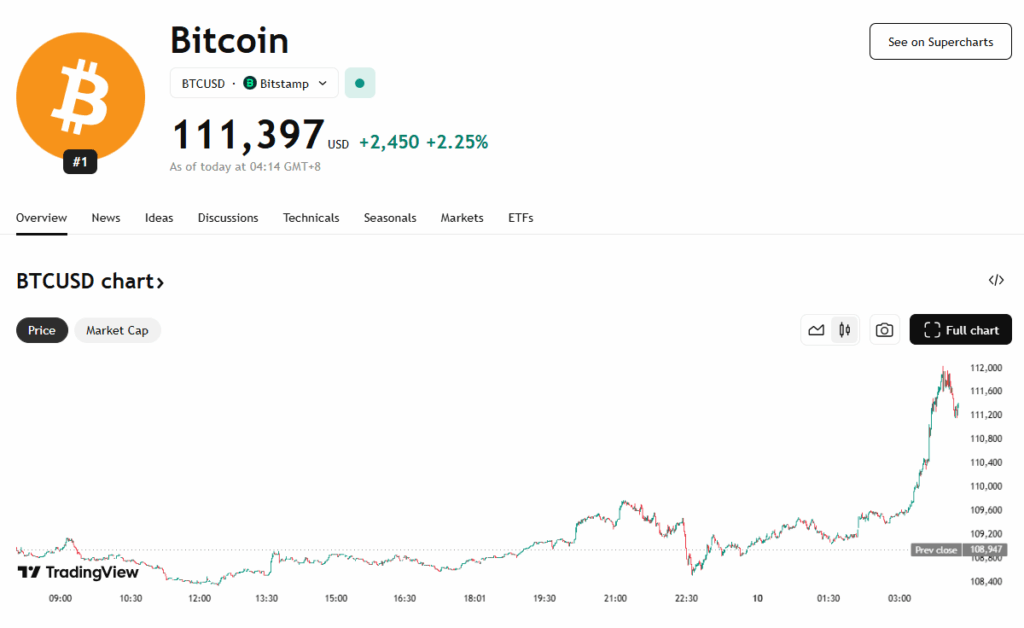

- Bitcoin surged to $111,400, approaching its all-time excessive of $112,000, amid a broader crypto rally led by Ethereum’s 6% rise to $2,760.

- Analysts spotlight low volatility and quiet accumulation as sturdy bullish indicators, suggesting a serious transfer could also be imminent.

- Ethereum’s breakout is attributed to rising institutional curiosity in its position in settlement infrastructure and asset tokenization, with Bitwise calling ETH a prime play within the development.

Bitcoin surged to $111,400 on Wednesday afternoon, marking its highest degree since Might and bringing it inside hanging distance of its all-time excessive of $112,000. The transfer broke weeks of tight rangebound buying and selling and injected renewed vitality into the broader crypto market. Ethereum additionally noticed a powerful breakout, leaping 6% to $2,760, its highest worth in almost a month.

The most recent rally unfolded throughout U.S. market hours and coincided with a raise in crypto-related equities. Notably, MicroStrategy (MSTR) rose 4.4%, approaching its 2025 highs, whereas Coinbase (COIN) superior 5%, and bitcoin miners like MARA Holdings and Riot Platforms (RIOT) gained about 6% every.

Quiet Earlier than the Surge?

The rally has caught consideration not only for its worth motion, however for its quiet, low-volatility buildup. Charlie Morris, CIO at ByteTree, famous in a report that Bitcoin’s 90-day and 360-day volatility has been steadily declining, a technical sign that always precedes sharp upward strikes.

“The setup for the subsequent one is wanting good,” Morris wrote. “As I carry on saying, the quiet bulls are one of the best.” With volatility compressed and momentum constructing underneath the floor, Bitcoin seems poised for a possible breakout past its earlier report.

Ethereum’s Surge and Institutional Confidence

Ethereum’s ETH additionally carried out strongly, pushing via resistance and exhibiting bullish technical power. Based on Joel Kruger from LMAX Group, ETH’s rise displays growing institutional curiosity, significantly from long-only asset managers betting on Ethereum’s future position in settlement infrastructure and tokenized asset ecosystems.

Analysts from Bitwise echoed that sentiment, describing ETH as one of many “cleanest” performs to achieve publicity to the fast-growing tokenization development, which has change into one of the vital hyped narratives of 2025.

Macro and Market Outlook

Bitcoin’s sustained transfer above $110,000 might sign the beginning of a contemporary bullish leg. For now, resistance round $112,000 — the Might excessive — stays the ultimate main barrier. In the meantime, crypto equities are rallying in parallel, suggesting broader market confidence.

With each Bitcoin and Ethereum flirting with breakout territory, analysts are watching carefully for affirmation in buying and selling quantity, continuation patterns, and potential ETF-driven flows that would amplify upside strikes.