- BONK surged over 52% this week amid rumors of a 2x leveraged ETF and a looming 1 trillion token burn.

- Solana ETF buzz and nearing 1 million holders have added to bullish sentiment.

- A market correction is feasible as hypothesis cools and buyers eye profit-taking.

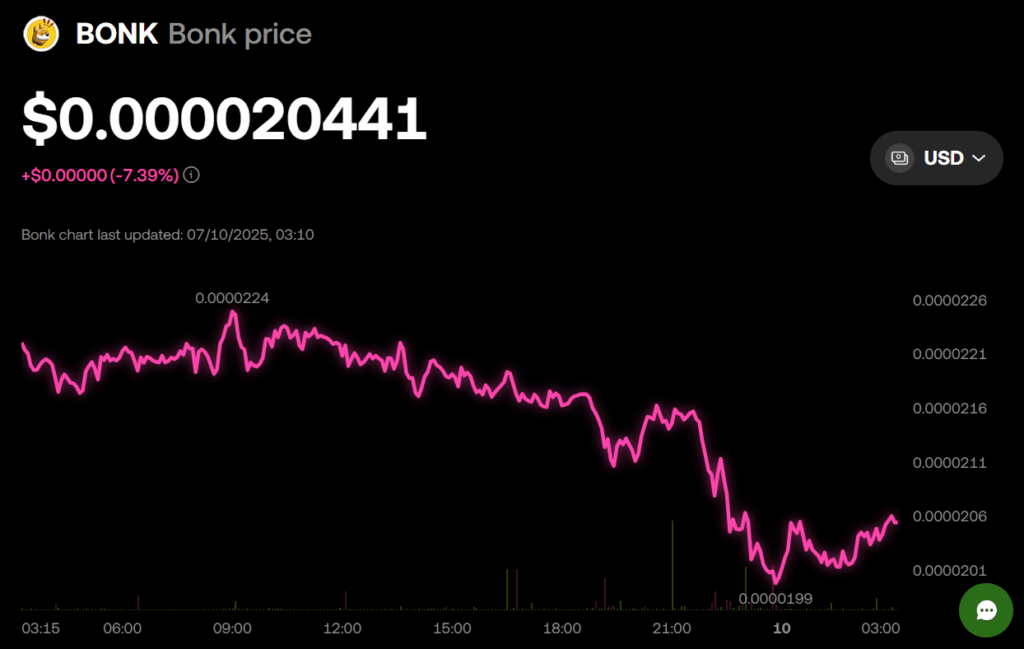

Solana-based memecoin Bonk (BONK) is having a standout week, topping efficiency charts with a 52.1% acquire within the weekly window among the many high 100 cryptocurrencies by market cap. It’s additionally up 52.5% over the previous two weeks and 38.4% during the last month. Regardless of this bullish streak, the every day chart reveals a slight 4.9% pullback, with the token nonetheless down 17.5% since July started, pointing to some underlying volatility.

Why BONK Is Pumping Proper Now

The current BONK rally seems to be pushed by a mixture of hypothesis and strategic updates. Rumors counsel that Tuttle Capital could file for a 2x leveraged ETF monitoring BONK — a transfer that would open the door to vital institutional capital inflows. Though no official submitting has been made, anticipation alone is drawing investor consideration. Concurrently, the undertaking is approaching the 1 million holder milestone, which might set off a 1 trillion token burn, lowering provide and additional stoking bullish expectations.

Moreover, BONK is probably going benefitting from spillover optimism round a possible Solana ETF, which continues to be beneath SEC overview. This broader pleasure surrounding SOL could also be lifting related tasks like BONK in its wake.

Warning: A Market Cool-Off Might Be Looming

Whereas momentum is clearly in BONK’s favor proper now, a correction appears doubtless as soon as present speculative catalysts subside. The broader crypto rally seems to be pushed by institutional ETF inflows, with retail participation nonetheless lukewarm. If enthusiasm round BONK’s burn or ETF rumors fades, or if bigger holders start to take earnings, we may see a pointy retracement in worth.

ETF inflows into Bitcoin and Ethereum have continued regardless of geopolitical tensions just like the Israel-Iran battle. Nonetheless, BONK stays a high-risk asset, and its future trajectory will doubtless be influenced by macroeconomic choices, reminiscent of rate of interest insurance policies from the U.S. Federal Reserve — which, for now, stay on maintain.