- Bitcoin, Ethereum, Solana, and XRP posted modest features as crypto markets largely shrugged off Trump’s newest tariff threats.

- Analysts attribute investor calm to repeated tariff delays and rising conviction in crypto as a macro hedge.

- Institutional use of choices — notably with Bitcoin ETFs like IBIT — helps easy volatility and encourage rangebound buying and selling.

Main cryptocurrencies — Bitcoin, Ethereum, Solana, and XRP — managed to submit features on Wednesday, at the same time as information broke that the U.S. is reopening commerce negotiations with a number of nations. The constructive value motion, whereas modest, underscores a rising resilience within the crypto market, notably amid geopolitical volatility and macroeconomic headwinds.

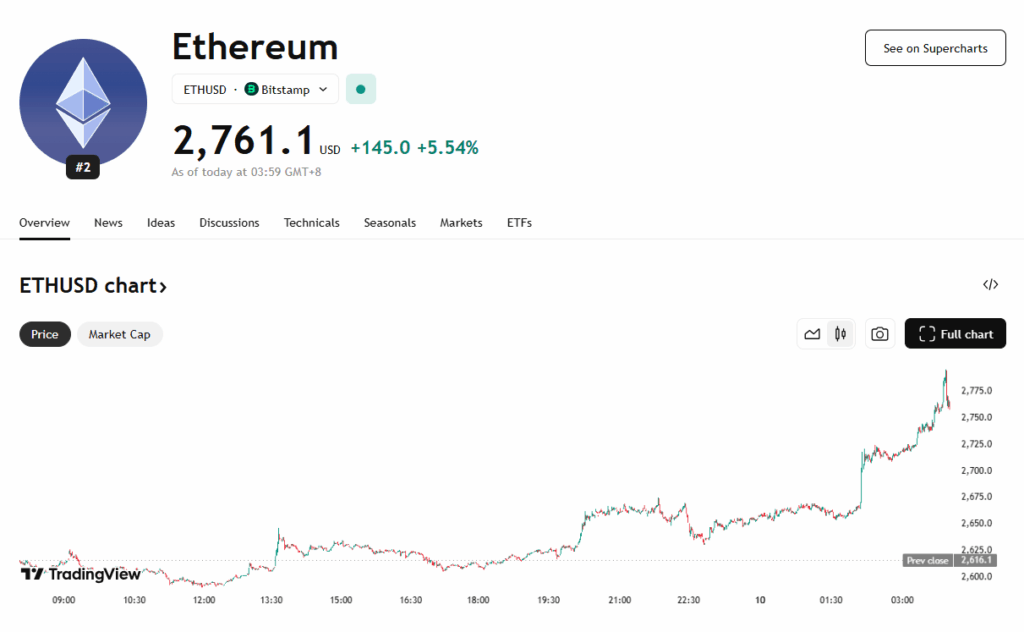

Bitcoin (BTC) climbed to $109,659, marking a 0.7% every day acquire, with a slender 30-day buying and selling vary between $107,000 and $110,000. Ethereum has hovered close to $2,500, whereas Solana has remained regular at $150, reflecting a market that seems “rangebound” however quietly bullish. Within the final 24 hours, Ethereum, Solana, and XRP gained between 2% and 4%, signaling renewed optimism regardless of latest tariff headlines from President Trump.

Market Sentiment: Calm Amid Coverage Turbulence

Wednesday’s uptick got here shortly after President Trump issued new tariff letters to 14 nations, together with Japan, South Korea, and Thailand, with steep import taxes set to start August 1. Curiously, the crypto market barely flinched. Analysts recommend this is because of dealer confidence that the August deadline will once more be postponed, feeding right into a rising meme that “Trump All the time Chickens Out,” additionally dubbed TACO in crypto circles.

eToro’s Bret Kenwell famous that repeated delays in Trump’s tariff actions have desensitized traders. “If there’s confidence that negotiations will proceed or deadlines can be prolonged, markets could proceed to shake off the headlines,” he stated. In consequence, many see any dip in crypto costs as a shopping for alternative, serving to preserve the present buying and selling vary.

Choices Hedging and Institutional Calm

A extra mature crypto market can be enjoying a job. In line with Amberdata’s Greg Magadini, institutional traders are more and more turning to choices methods to hedge macroeconomic uncertainty. As an example, many are shopping for shares in BlackRock’s IBIT Bitcoin ETF, writing lined requires yield, and concurrently buying protecting places to handle draw back threat.

This hedging method has decreased the influence of knee-jerk selloffs, at the same time as tariffs and different risk-off triggers emerge. Magadini additionally highlighted that the market’s rising dimension requires considerably extra quantity to set off massive value swings, providing pure dampening in opposition to volatility.

Tariff Discuss Fatigue?

Crypto traders appear to be taking Trump’s newest tariff warnings in stride — not as a result of they don’t matter, however as a result of they’ve seen this film earlier than. Whereas the general crypto market cap dropped 3% in 24 hours, it’s nonetheless up 35% since April, displaying how sustained demand and robust positioning are outweighing short-term fears.

With the S&P 500, gold, and even Bitcoin more and more considered as hedges in opposition to poor fiscal administration or inflationary dangers, analysts consider crypto will proceed to learn from its “different asset” standing as coverage uncertainty lingers into the second half of 2025.