- Ethereum’s institutional accumulation and ETF inflows sign rising confidence, as whales add 200K ETH and on-chain provide hits multi-year lows.

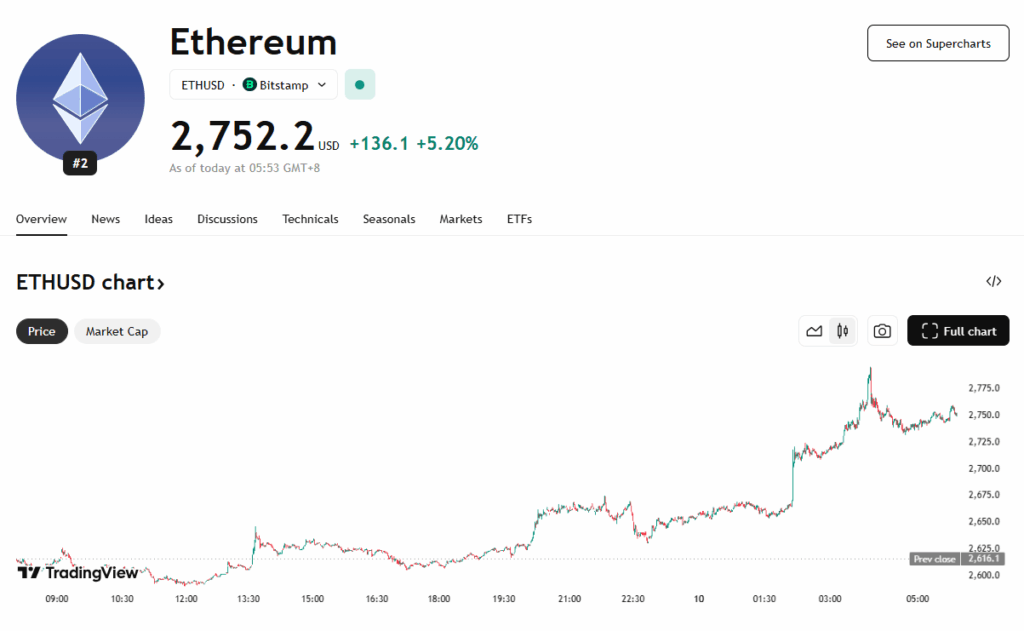

- ETH stays range-bound between $2,400 and $2,700, with a decisive breakout above $2,800 wanted to verify a brand new bull section.

- Failure to carry $2,500 might set off a drop towards $2,200, whereas a transfer previous $2,800 might pave the way in which for a rally to $3,000 and past.

Ethereum has lately crossed the $2,700 threshold, sparking renewed bullish optimism all through the crypto neighborhood. This push greater is fueled by a mixture of components: growing institutional curiosity, declining alternate provide, and technical power in ETH/BTC that hints at Bitcoin dominance fading. Giant ETH wallets holding between 10,000 and 100,000 cash have accrued over 200,000 ETH, pushing centralized alternate reserves to a multi-year low of 18 million. These on-chain actions counsel rising investor conviction and a shift in long-term positioning.

Ethereum’s Core Fundamentals Stay Sturdy

The basics additionally stay sturdy. Ethereum nonetheless instructions the lead in DeFi and tokenized property, with a $65 billion TVL and a $126 billion stablecoin market cap. Its proof-of-stake mechanism is seeing continued traction, with greater than 35.5 million ETH staked by over 100,000 validators. Institutional inflows are additionally reinforcing this bullish case—U.S. spot Ether ETFs have drawn in almost $2 billion since April. Analysts see these flows as a key sign of rising confidence in Ethereum’s position as a settlement layer for monetary property.

Technical Indicators Level to Vital Resistance Forward

Technically, Ethereum has been consolidating in a spread between $2,400 and $2,700 since early Could. The MACD has turned constructive, and the worth lately moved above each the 50- and 100-day SMAs. However the true take a look at lies close to $2,800, the place Ethereum faces heavy resistance from its 200-day SMA and a key liquidity zone. A clear break above that stage might verify a breakout from the multi-month vary, with potential upside towards $3,000. Nonetheless, a rejection at these ranges might pull the worth again to $2,400 and even $2,200, particularly if macro pressures reemerge.

Closing Ideas: Make-or-Break Second for ETH

Regardless of the bullish setup, warning lingers. Analysts like Carl Runefelt level to Ethereum’s present rising wedge sample—a probably bearish construction. Ethereum should decisively break above $2,700–$2,800 to flee the chance of a pullback. In any other case, this surge might find yourself being only a short-term aid rally. In the end, Ethereum’s capability to reclaim $2,800 and flip it into assist will doubtless decide the following massive transfer—not only for ETH, however for the broader altcoin market.