Ethereum’s worth has climbed steadily over the previous week, rising practically 10% as institutional gamers proceed to pour capital into the main altcoin.

This rising momentum comes amid broader optimism within the crypto market and a strengthening correlation with Bitcoin, which is itself edging nearer to a brand new all-time excessive. Collectively, these developments recommend Ethereum could also be poised for a major breakout, however a well-known roadblock nonetheless stands in the way in which.

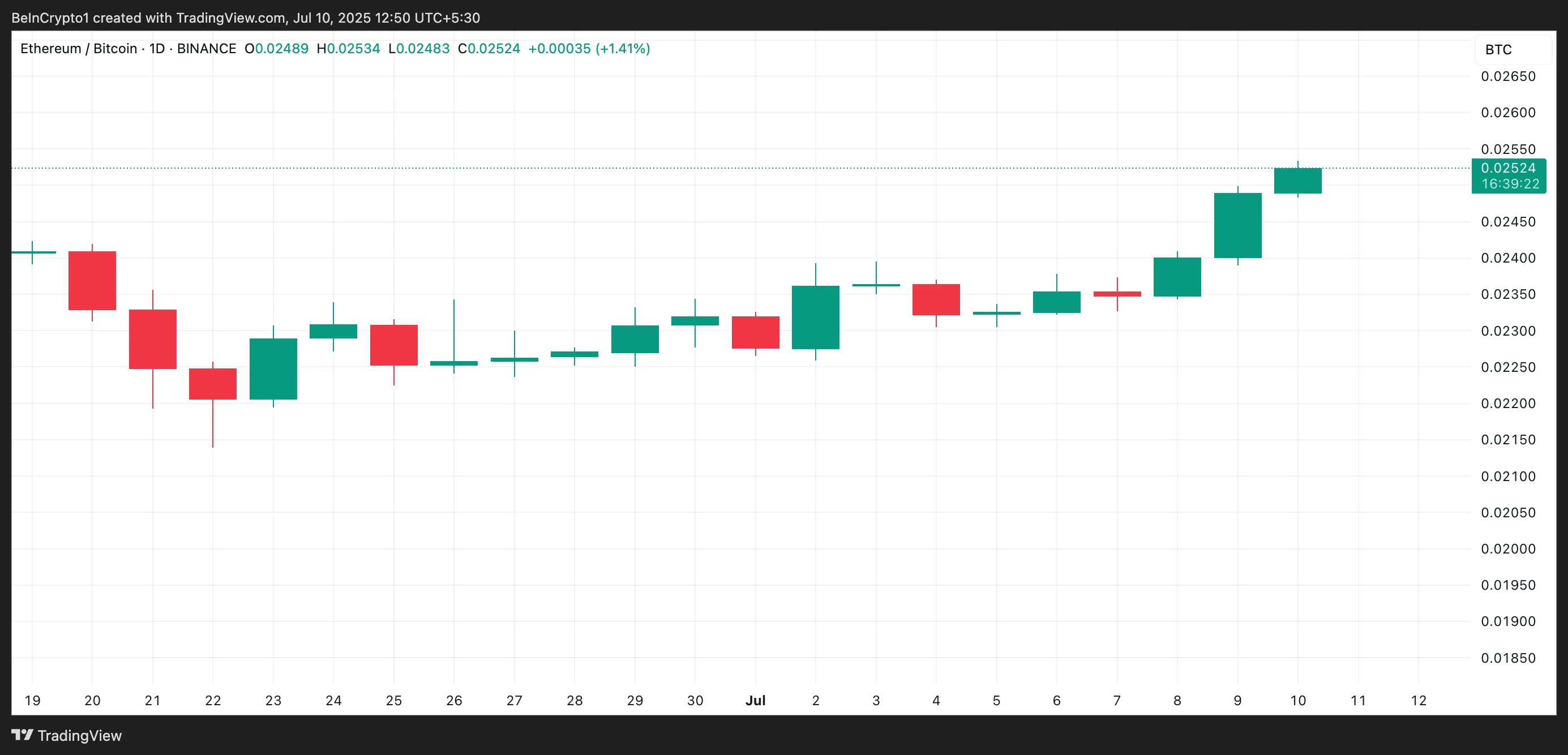

ETH/BTC Correlation Climbs

Ethereum’s correlation with Bitcoin has climbed sharply since late June. The ETH/BTC correlation coefficient, which measures how intently ETH’s worth actions monitor these of BTC over a given interval, now sits at 0.02.

A worth near 1 signifies that each property transfer in the identical course, whereas a worth close to -1 means they transfer in reverse instructions.

With BTC nearing its all-time excessive, ETH’s worth might comply with swimsuit and rally. It is because, traditionally, excessive correlation in bull phases has preceded joint rallies for each property.

ETH Targets $3,000 as Establishments Load Up

Ethereum’s institutional traders look like locking in positions as they reap the benefits of the climbing ETH/BTC correlation. With each property traditionally rallying in tandem throughout bullish phases, this group is positioning for a possible breakout above $3,000.

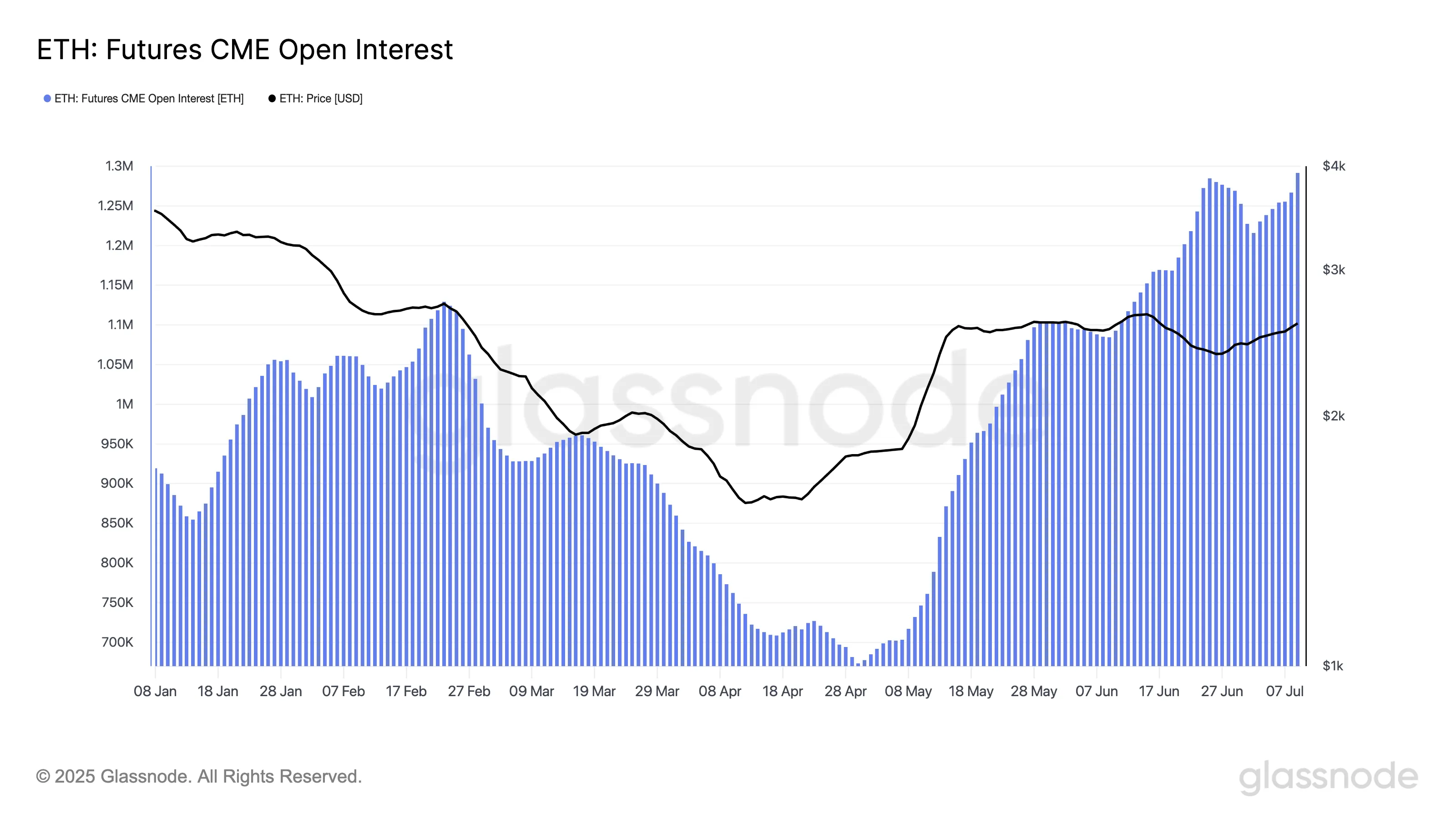

Based on on-chain information from Glassnode, open curiosity in ETH futures on the Chicago Mercantile Alternate (CME), measured by the 7-day easy transferring common, has surged to a file excessive of $3.34 billion.

This displays rising institutional positioning as key market gamers accumulate ETH in anticipation of additional upside.

Open curiosity refers back to the whole variety of excellent futures contracts that haven’t been settled. When it surges like this, it signifies rising buying and selling exercise and elevated capital coming into the market.

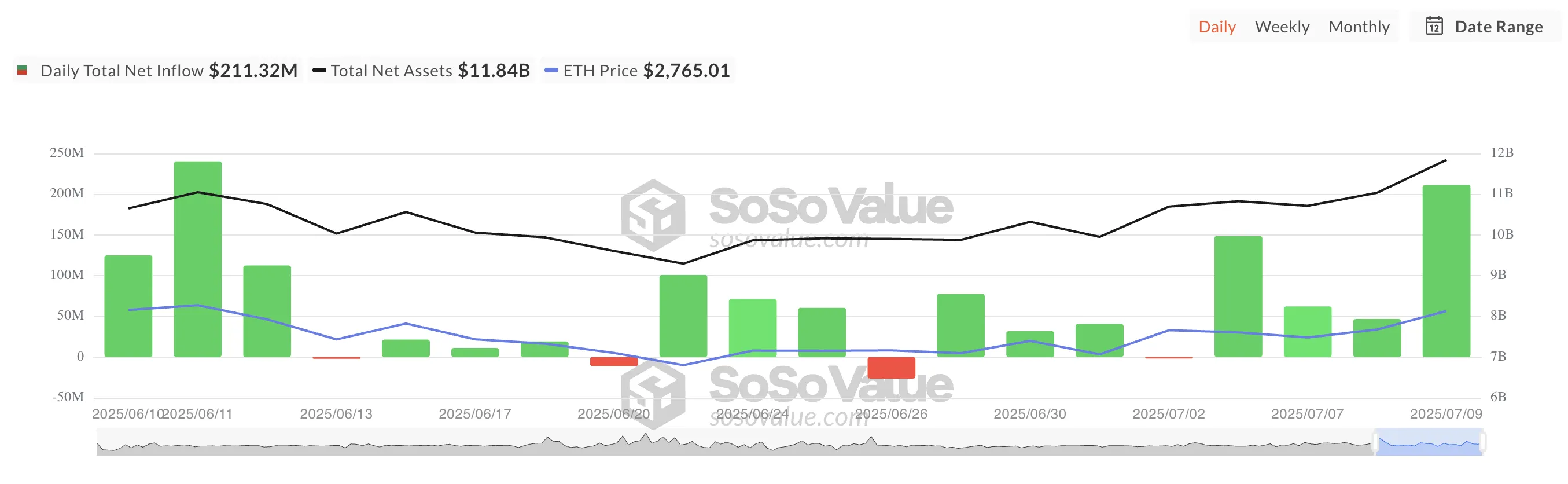

Moreover, the constant weekly inflows into spot ETH ETFs spotlight the strengthening confidence within the altcoin amongst these key traders.

Based on SosoValue, ETH-backed funds have recorded uninterrupted weekly inflows since Might 9. Final week alone, over $219 million in capital flowed into ETH spot ETFs regardless of the coin’s largely sideways worth motion.

This sustained funding confirms the rising confidence in ETH’s long-term worth as subtle traders place forward of an anticipated breakout above $3,000.

Nevertheless, there’s a catch.

ETH Bulls Stall Under $3,000 as Retail Merchants Faucet Out

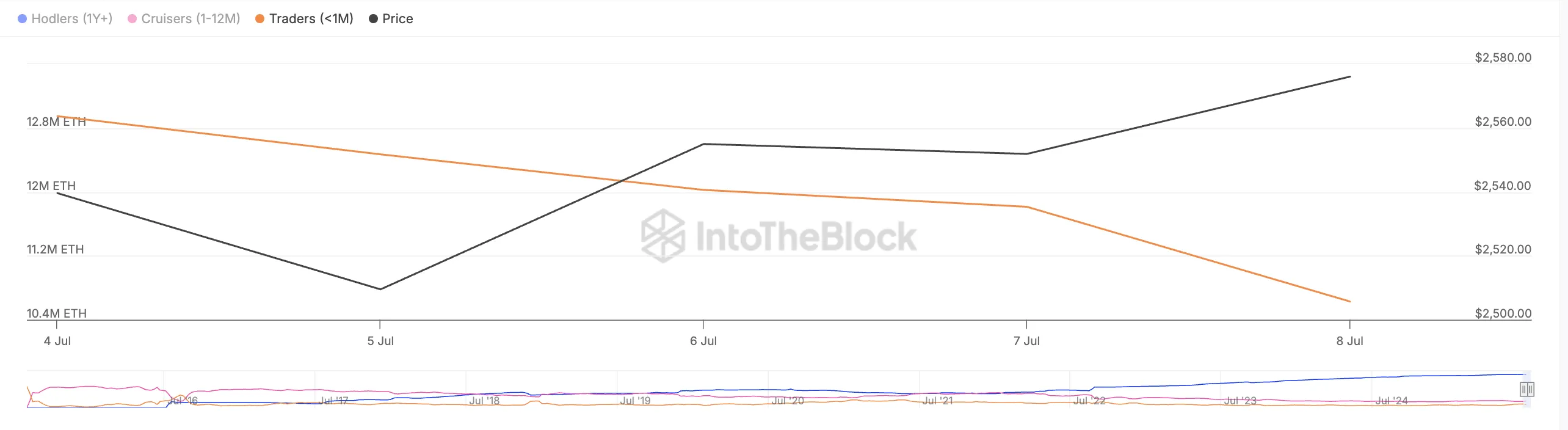

As key holders chase a rally above $3,000, ETH’s short-term worth motion continues to be weighed down by “paper palms.” These retail merchants have held the coin for lower than 30 days and are promoting into its latest power.

IntoTheBlock’s information exhibits that this group’s stability has dropped by 16% since July 4, slowing down the coin’s worth development amid robust institutional assist.

Retail merchants drive an asset’s short-term worth efficiency by means of frequent, emotion-driven shopping for and promoting. In contrast to institutional traders who have a tendency to carry by means of fluctuations, retail individuals are extra reactive to information, sentiment, and short-term worth strikes.

After they start to promote, downward strain will increase, stalling rallies or triggering corrections.

Though institutional curiosity in ETH is an efficient signal of long-term confidence, retail merchants are wanted to catalyze a rally above $3,000 within the quick time period. If they continue to be aloof and demand falls, the coin might lose a few of its latest beneficial properties and fall beneath $2,745.

Nevertheless, a resurgence in new demand might push ETH’s worth above $2,851 and towards $3,067.

Disclaimer

Consistent with the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.