Veteran dealer Peter Brandt has weighed in on Bitcoin’s latest worth construction, providing a nuanced take that blends cautious skepticism with long-term conviction.

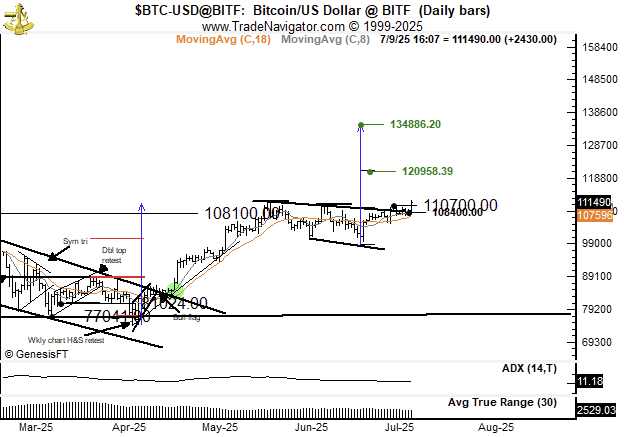

In a put up shared on July 10, Brandt famous that the present chart sample—a broadening inverted triangle—is just not inherently bullish and sometimes reveals instability. He remarked, “An increasing inverted triangle has a better fee of morphing or mortality than a sample resembling a horizontal pennant.” Regardless of that, Brandt confirmed he stays lengthy BTC, suggesting confidence in Bitcoin’s bigger development.

Key degree: $107,000 as structural help

Brandt highlighted the $107,000 degree as an important help zone. A breakdown beneath this threshold would, in his view, “recommend morphology”—a time period he makes use of to explain sample breakdowns or evolving market constructions. For now, BTC is buying and selling close to $111,490, simply above the $110,700 resistance-turned-support line.

Worth targets: $120K to $135K nonetheless in sight

Regardless of his reservations in regards to the sample’s reliability, Brandt’s chart outlines potential bullish targets. The following main upward projections are $120,958 and $134,886.20—ranges that align with the measured transfer from the earlier breakout zone round $108,100.

Brandt’s place: Lengthy however alert

Identified for his no-nonsense method to technical evaluation, Brandt’s newest commentary indicators a mixture of optimism and warning. Whereas he maintains an extended place in Bitcoin, he warns merchants to not place blind religion in chart patterns, particularly these with a excessive fee of failure. His broader message appears clear: bullish continuation is feasible, however worth construction integrity stays key.

As Bitcoin navigates the mid-$110K vary, merchants and analysts alike are watching intently to see whether or not this triangle resolves upward or confirms Brandt’s warnings with a deeper correction.