The crypto market has been on a tear in 2025, and the most recent 99Bitcoins Q2 State of Crypto Market Report, authored by Manisha Mishra and sponsored by KCEX, lays all of it out. The quarter noticed institutional demand surge, Bitcoin ($BTC) hit a then-ATH of $111,980, and crypto hiring spike 753%.

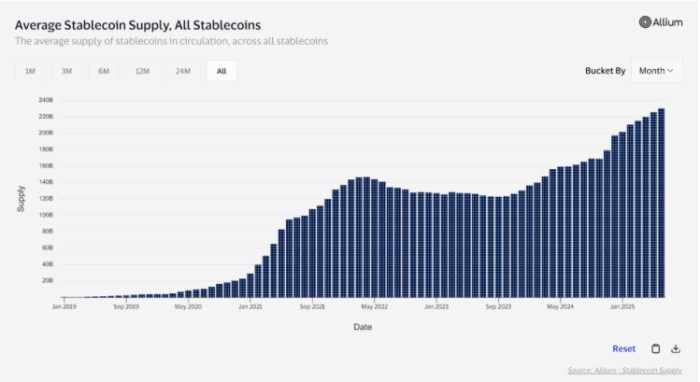

Regardless of the rally, the whole market cap was nonetheless 12% under its $3.7 trillion peak, hinting at room to run. With stablecoin adoption booming and long-term holders stacking, Q2 could have been the true begin of this cycle’s breakout.

Learn the total report right here: State of Crypto Q2 2025 – 99Bitcoins

A Report-Breaking Quarter for Bitcoin

Bitcoin lit up Q2 with a 25.66% acquire, smashing previous resistance to hit a then-record $111,980 on Might 22. That put it nicely forward of gold’s 7.21% rise and most fairness indices, marking a pointy reversal from Q1’s pullback.

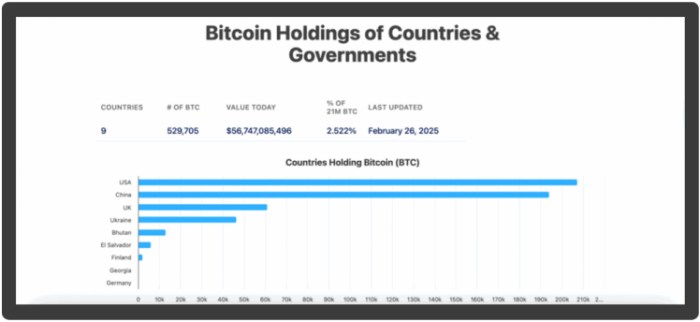

In accordance with 99Bitcoins’ Q2 report, the rally was pushed by institutional inflows, ETF demand, and rising sovereign curiosity, with governments now holding 2.5% of Bitcoin’s whole provide. In the meantime, spot ETF flows persistently outpaced miner issuance, tightening provide simply as demand surged.

Chris Wright of 21Shares summed it up:

“We imagine that Bitcoin ETFs will appeal to 50% extra inflows this yr in comparison with final yr. This may lead to internet inflows of roughly $55 billion in 2025, representing a rise of round $20 billion year-over-year.”

A golden cross in late Might confirmed the uptrend, following a clear breakout from months of consolidation. It’s a textbook bullish construction.

With value motion and fundamentals in sync, Q2 marked the clearest shift but: Bitcoin is again, however powered by establishments, not retail.

Establishments Took the Wheel, Retail Turned to Altcoins

In accordance with the 99Bitcoins report, this bull run has a distinct driver behind the wheel. And it’s not Reddit. 9 out of 10 specialists interviewed within the Q2 report stated retail merchants have shifted their focus to the perfect altcoins, chasing sooner features whereas establishments quietly amassed Bitcoin.

The on-chain information backs it up. Glassnode reveals that 30% of $BTC’s provide is now held by centralized entities, with giant gamers dominating inflows. In the meantime, Google Developments reveals that retail curiosity in “Bitcoin” searches stayed surprisingly low all through Q2, whilst $BTC hit new highs.

Confidence amongst long-term holders additionally climbed. UTXO exercise dropped, and the quantity of BTC in long-term storage stored rising. An indication that severe capital isn’t trying to promote anytime quickly.

Stablecoins and DeFi Picked Up Steam

If Q2 proved something, it’s that stablecoins aren’t simply secure, they’re additionally scaling. The Circle IPO popped 168% on day one, marking the primary stablecoin issuer to go public and signaling TradFi’s rising urge for food for crypto publicity with out the volatility.

In accordance with 99Bitcoins, 81% of crypto-aware SMBs now need to use stablecoins for day by day ops, and the variety of Fortune 500s planning to combine them has tripled since final yr.

On the DeFi aspect, Ethereum ($ETH) held L1 dominance, Chainlink ($LINK) led dev exercise, and $HYPE – the native token of Hyperliquid – noticed severe traction, fueled by the DEX’s rise to 70%+ of all perp DEX quantity.

Whereas others chased memes, HYPE rallied on precise utility.

Briefly: DeFi’s nonetheless cooking, and stablecoins are fueling the fireplace.

Memecoin Mayhem

After tanking in Q1, the memecoin market bounced again barely in Q2, although volatility stayed excessive and value motion remained erratic.

Q2 noticed the meme cash hit new heights, with over 5.9 million new tokens launched and most of them churned out by way of pump.enjoyable. It was chaotic, noisy, and pure degen power. Whereas most pale immediately, tokens like $FARTCOIN and $SPX stored using the wave.

That stated, the surge in token exercise got here with a darkish aspect: phishing and wallet-targeted hacks climbed, particularly amongst memecoin holders.

Regulatory Wins and Macro Shifts Driving Confidence

If Q2 had a theme, it was reduction on each the coverage and financial fronts. The U.S. pulled again on crypto enforcement, scrapped IRS reporting guidelines for DeFi, and signaled a extra constructive stance general.

In the meantime, the Fed held charges regular for the fourth straight time, hinting at a potential lower in July. With unemployment flat and development slowing, capital began flowing into safe-haven belongings, and this time, Bitcoin was firmly on that record.

The outcome? Confidence surged. Bitcoin ETF inflows accelerated, volatility dropped, and $BTC’s macro narrative strengthened. It’s not only a danger asset; it’s turning into a part of the defensive playbook.

Elsewhere, $XRP lastly closed its long-running authorized battle with the SEC, doubtlessly clearing the runway for a brand new ATH later this yr.

What’s Subsequent for Q3?

Again in Q2, 99Bitcoins forecasted that if BTC may flip $111K–$112K resistance, the trail to $120K would open, with $135K as a stretch goal. Quick ahead to now, and that prediction is ageing nicely: Bitcoin is already buying and selling at above $118K, edging towards that psychological milestone.

The report additionally famous $BTC was holding agency above $103K help, forming a bullish construction backed by rising miner pockets balances, shrinking alternate reserves, and rising illiquid provide – all indicators of confidence from long-term holders.

Nonetheless, Q3 isn’t with out danger. ETF inflows may sluggish, and macro headwinds, from international battle to sudden charge hikes, stay on the radar.

But when institutional flows keep scorching and the Fed delivers a charge lower, $135K not appears like a moonshot. It’s simply a part of the following leg up.

Remaining Ideas: A Bull Market With Depth

The 99Bitcoins Q2 report by Manisha Mishra paints a transparent image: this bull market isn’t constructed on retail hype.

Establishments, regulatory tailwinds, and actual product traction are powering it. From ETF inflows to stablecoin adoption and supply-side tightening, the alerts all level towards a extra mature, resilient crypto cycle.

And with Bitcoin already pushing in direction of $120K, lots of the Q2 projections are already enjoying out. If momentum holds, and macro situations don’t throw a curveball, This autumn could possibly be the true breakout.

Learn the total report right here: State of Crypto Q2 2025 – 99Bitcoins

This text is for informational functions solely and doesn’t represent monetary recommendation. Please all the time do your individual analysis (DYOR) earlier than investing in crypto.