Bitcoin surged to an all-time excessive of $116,000 on July 10, simply six days after Donald Trump signed the Large Lovely Invoice into legislation. The flagship cryptocurrency has gained 6% because the invoice’s signing, with Ethereum and different altcoins following shut behind.

The rally comes amid a wave of macroeconomic shifts, rising US debt, tightening bond markets, and historic ETF inflows.

Fiscal Surge Triggers Flight to Onerous Property

Trump’s $3.3 trillion Large Lovely Invoice, signed on July 4, triggered an instantaneous $410 billion rise in US debt. The invoice lifts the debt ceiling by $5 trillion and completely extends key tax cuts.

Markets see this as inflationary. Buyers are rotating out of bonds and into scarce property like Bitcoin. The invoice’s measurement and velocity of implementation have amplified fears over fiscal self-discipline.

Bitcoin, with its fastened provide, is rising once more as a hedge in opposition to fiat debasement.

BlackRock’s spot Bitcoin ETF (IBIT) has reached $76 billion in property below administration. That’s triple what it held simply 200 buying and selling days in the past.

By comparability, it took the biggest gold ETF over 15 years to achieve the identical milestone. Institutional flows at the moment are a robust driver of worth motion, pushing Bitcoin deeper into mainstream portfolios.

Fed Stability Sheet Shrinkage Tightens Liquidity

In June, the Federal Reserve diminished its steadiness sheet by $13 billion, bringing it to $6.66 trillion—the bottom since April 2020. The Fed has now lower over $2.3 trillion in property during the last three years.

In the meantime, Treasury holdings are down $1.56 trillion in that very same interval. With fewer patrons within the bond market and extra debt being issued, buyers are transferring into various shops of worth.

Bitcoin has develop into the highest candidate.

Additionally, Ethereum is buying and selling close to $3,000, up 14% because the Large Lovely Invoice grew to become legislation. Solana, Avalanche, and different altcoins are additionally rallying.

Retail and institutional capital are returning. Meme cash and DeFi tokens are gaining traction as speculative sentiment returns. Crypto is as soon as once more main the risk-on cycle.

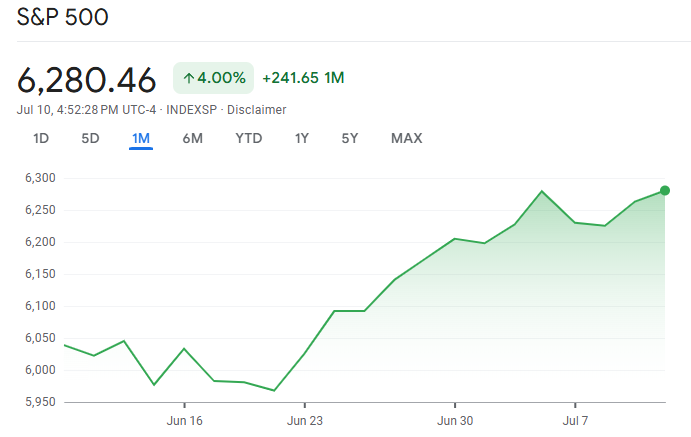

S&P 500 All-Time Excessive: Threat-On Throughout the Board

The S&P 500 has surged 30% since its April 2025 low, hitting a brand new all-time excessive this week. This alerts sturdy investor confidence in high-growth, high-risk property.

Bitcoin advantages immediately from this surroundings. As equities rally, crypto tends to comply with. The market sees the Large Lovely Invoice as oblique stimulus—and it’s responding accordingly.

Backside Line

Bitcoin’s newest all-time excessive is a response to structural modifications—not hype. The Large Lovely Invoice expanded the deficit and shook confidence in US debt markets.

With inflation fears rising and institutional entry rising, Bitcoin is changing into the macro hedge of alternative. As crypto enters a brand new bull market, all eyes now flip to the Federal Reserve and charge lower selections.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.