In a landmark breakthrough, Bitcoin (BTC) has entered into worth discovery, registering contemporary information close to $118,000 for the primary time in historical past.

BTC’s push above the $2.4 trillion market cap stage is now sparking a bullish wave throughout most main altcoins. The historic rally coincided with greater than $1.18 billion of web inflows into spot Bitcoin ETFs in only one buying and selling day on July 10 – a transparent signal that institutional demand is accelerating forward of an anticipated rate of interest reduce by the US Federal Reserve.

That bullish backdrop has introduced renewed consideration to initiatives constructing world wide’s largest cryptocurrency. That is why Bitcoin Hyper (HYPER), the native token for a brand new Bitcoin Layer 2 community, has secured over $2.3 million in its presale.

Trying forward, market commentators argue that if Bitcoin is to maintain its dominance in its subsequent development chapter, it wants the sort of scalable and Web3‑prepared infrastructure that Bitcoin Hyper guarantees to ship.

You should buy HYPER for simply $0.012225 within the present presale stage earlier than the worth will increase within the subsequent spherical.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

Bitcoin Hits New ATH as Digital Gold Narrative Takes Maintain

Bitcoin’s newest rally has reaffirmed the highest crypto’s standing as digital gold – a macro hedge and long-term retailer of worth in an unsure financial period. Asset managers and even state treasuries are stockpiling BTC not as a funds instrument, however as a hedge towards inflation and geopolitical uncertainty.

Robust demand from establishments has turn out to be a major driver of Bitcoin’s worth motion, pushing it into blue skies as soon as once more. BlackRock’s spot Bitcoin ETF (IBIT), which started buying and selling in January 2024, now holds greater than $80 billion in web property – and the fund has almost tripled its Bitcoin place in lower than a yr, setting a tempo that took the most important gold ETF over a decade to realize.

Actually, spot Bitcoin ETFs collectively simply crossed the $51 billion cumulative web influx milestone, with spectacular one-day inflows (together with over $448 million into IBIT alone on July 10) as Bitcoin hit file highs.

On July 10 (ET), Bitcoin spot ETFs recorded a complete web influx of $1.179 billion, marking the second-highest in historical past. Ethereum spot ETFs noticed a complete web influx of $383 million, additionally the second-highest on file.https://t.co/ueXcZjuIVU

— Wu Blockchain (@WuBlockchain) July 11, 2025

One of many greatest catalysts behind the rising institutional participation is a clearer regulatory panorama. The “Crypto Week” occasions happening on Capitol Hill subsequent week will advance long-awaited tax and regulatory measures, including to optimism that extra express guidelines will additional strengthen crypto’s place on Wall Road.

But for all its success as digital gold, Bitcoin’s on-chain utility stays restricted. The bottom Bitcoin community can course of solely a handful of transactions per second, has comparatively excessive charges, and lacks native help for sensible contracts.

This implies most BTC immediately sits in wallets as static capital – wonderful for preserving wealth, however largely inactive in the case of DeFi or different Web3 functions. Layer 2 options have lengthy been seen as one of the simplest ways to activate Bitcoin’s worth, however current makes an attempt have fallen brief.

Bitcoin Hyper is positioning itself to fill that hole. It goals to offer Bitcoin with the pace and programmability of a contemporary sensible contract platform, with out compromising on BTC’s safety.

Inside Bitcoin Hyper’s Revolutionary Layer 2 Scaling Answer

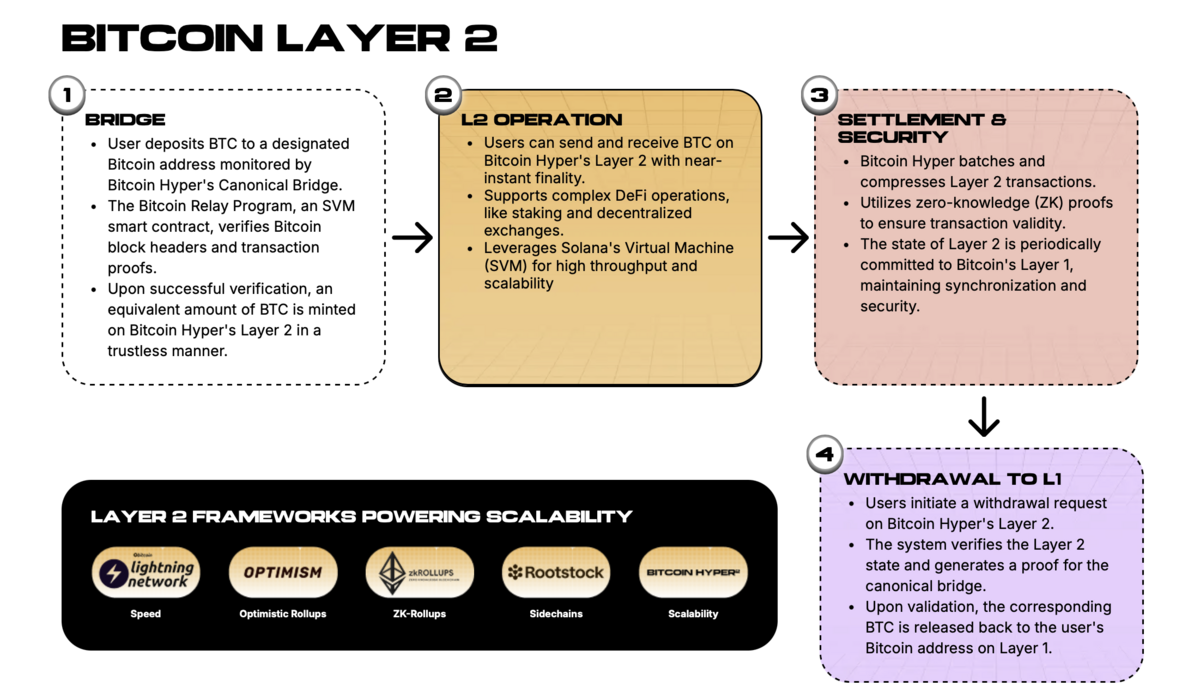

Bitcoin Hyper’s method to scaling Bitcoin is each revolutionary and elegantly easy. It should create a Layer 2 blockchain that operates in tandem with Bitcoin’s important chain, leveraging the Solana Digital Machine (SVM) for ultra-fast throughput.

To unlock Bitcoin’s potential on this community, Bitcoin Hyper will use a decentralized canonical bridge that seamlessly transfers BTC between the bottom layer and the Layer 2.

Customers ship actual BTC to a bridge contract on Bitcoin’s Layer 1 (L1), and that transaction will get validated by way of zero‑data proofs and locked on‑chain. Concurrently, an equal quantity of wrapped BTC might be minted on the Bitcoin Hyper community.

Your entire course of is trustless and non-custodial – and zero-knowledge proofs make sure that the Layer 2 solely mints tokens when provably backed 1:1 by BTC on the L1, thereby preserving safety.

From that time, the deposited Bitcoin will exist in Bitcoin Hyper’s high-speed atmosphere, and transactions utilizing the wrapped BTC will settle in seconds and value solely fractions of a cent in charges. Customers can ship funds, commerce property, deploy sensible contracts, or interact in yield farming and lending capabilities which might be not possible on Bitcoin’s base layer alone.

Extra importantly, all exercise on Bitcoin Hyper remains to be anchored to Bitcoin’s ledger. Each batch of Layer 2 transactions might be usually dedicated to Bitcoin’s blockchain, sustaining decentralization and integrity.

Why Analysts See Bitcoin Hyper because the Subsequent Huge Layer 2 Success Story

Every thing on the Bitcoin Hyper community will revolve across the HYPER token. Past serving because the gasoline token for each transaction on the Layer 2 community, HYPER can even present excessive staking rewards and governance rights.

In different phrases, HYPER captures the financial upside of bringing new utility to Bitcoin. If Bitcoin Hyper succeeds in attracting customers and builders, demand for HYPER may scale in tandem with on-chain exercise.

Historical past has already confirmed that Layer 2 tokens can seize vital upside when a scaling answer features traction. For instance, Polygon’s MATIC and Arbitrum’s ARB (two of the preferred Ethereum Layer 2 cryptos) each rallied with rising adoption of their very own networks, in addition to Ethereum itself.

A well-liked analyst from 99Bitcoins believes that HYPER may comply with an analogous path – however with the added benefit of supporting a a lot bigger retailer of worth, and benefiting from Bitcoin’s world model recognition.

To purchase HYPER, traders can go to the official Bitcoin Hyper presale web page and join a crypto pockets to buy HYPER utilizing ETH, USDT, BNB, or perhaps a conventional card. Consumers may also stake their tokens for an annual reward of as much as 350%.

Go to Bitcoin Hyper Presale

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, instantly or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to use of or reliance on any content material, items or providers talked about.