Key Insights:

- Bitcoin not too long ago registered a brand new all-time excessive, dragging the market up and inflicting $1 billion in liquidations.

- Based on analysts, costs can trek additional upwards to $130k earlier than any robust revenue taking happens.

- Bitcoin is treading on skinny ice, and any macroeconomic shocks can flip the script fully.

The crypto market is ablaze as soon as once more and this time, it’s the bears who’re feeling the warmth.

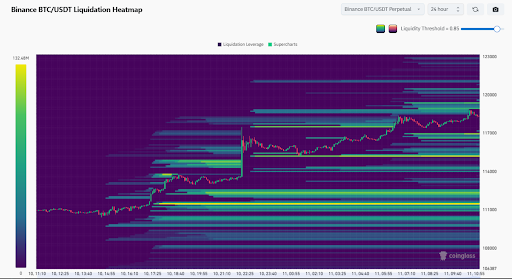

Over $1 billion price of brief positions have been worn out in simply 24 hours as Bitcoin surged previous a number of all-time highs. This transfer has triggered a large brief squeeze and is now sending ripples by the market.

Right here’s a breakdown of what occurred, what’s driving this rally and the place Bitcoin could be headed subsequent.

Shorts Get Crushed as Bitcoin Rockets Previous $116K

The market not too long ago recorded one of many largest liquidation occasions this 12 months, the place roughly $1.01 billion in crypto brief positions have been liquidated as Bitcoin and Ethereum costs exploded.

Based on information from CoinGlass, over 232,000 merchants have been affected by the surge. That is with Bitcoin brief positions accounting for round $570 million of that complete and Ethereum shorts taking a success of $206.9 million.

To place it merely, merchants who wager available on the market taking place have been caught off-guard. In distinction, lengthy positions barely flinched, with solely about $20 million liquidated throughout the identical time.

Bitcoin particularly, recorded two back-to-back document highs and climbed from $112,000 on Wednesday to $116,500 on Thursday. Ethereum however, rose to $2,990 with the market’s momentum pushing complete crypto market capitalization up by 4.4% to $3.63 trillion.

Will Bitcoin Hold Climbing?

Earlier within the week, not everybody was satisfied that Bitcoin might break its earlier highs.

Bitfinex analysts initially confirmed concern over Bitcoin’s “lack of follow-through power”. In addition they famous that bulls may battle to push costs additional with out robust indicators on the macroeconomic entrance.

At the moment, Bitcoin was buying and selling round $108,500, and warning was within the air. Nevertheless, not all analysts have been hesitant. Michaël van de Poppe, founding father of MN Buying and selling Capital was one of many first to foretell a breakout to new all-time highs by early July.

The inevitable breakout to an ATH on #Bitcoin may even occur in the course of the upcoming week.

Such a bullish setup. pic.twitter.com/VQfT2A2GSR

— Michaël van de Poppe (@CryptoMichNL) June 28, 2025

He turned out to be proper, because the market is now virtually fully inexperienced. The query now’s: How a lot increased can Bitcoin go?

All Eyes on $130K

Market analysts imagine Bitcoin nonetheless has room to run earlier than a significant pullback. Based mostly on on-chain information from CryptoQuant, “accumulator” addresses, or wallets that constantly add BTC over time, have ramped up their shopping for these days.

These addresses now maintain over 248,000 BTC, up 71% from only a few weeks in the past. This isn’t simply speculative exercise.

A bounce of $4.4 billion in Bitcoin’s realized cap has additionally confirmed that actual capital is flowing into the asset.

Much more telling is the Market Worth to Realized Worth (MVRV) ratio, which in keeping with Axel Adler Jr., is but to hit the two.75 sell-off zone. At present ranges, this implies Bitcoin could proceed rising till it reaches round $130,900.

What Might Derail the Bitcoin Rally?

Even with the bulls in management, it’s essential to contemplate the dangers. Over $2.1 billion in lengthy positions are presently weak if Bitcoin retraces again to the $112,000 degree.

Because of this any sudden macroeconomic shock, regulatory growth or sudden market downturn might set off one other spherical of liquidations. This time, the bulls may undergo probably the most.

Total, the previous 24 hours have reminded the market simply how rapidly sentiment can shift. What began as an try to interrupt all-time highs has was a robust rally, which is now leaving short-sellers reeling.